By Elwin de Groot, Head of Macro Strategy at Rabobank

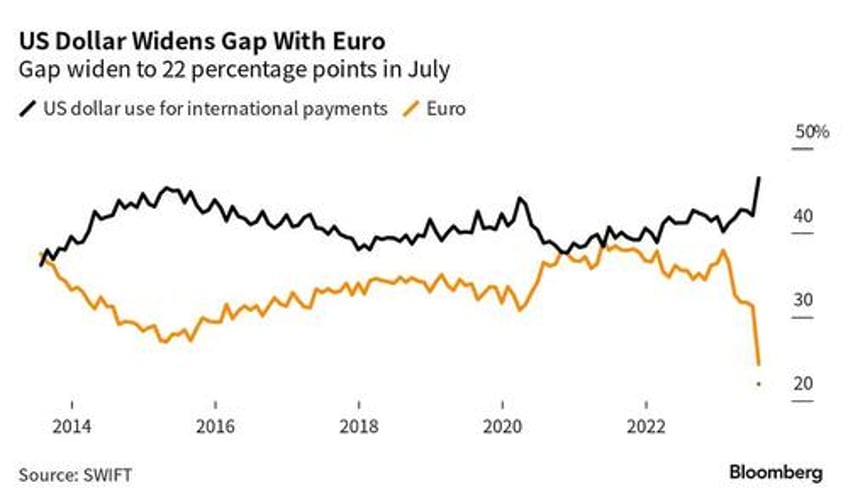

Despite the September ECB hike and warnings by President Lagarde that inflation is still much too high, the market has increasingly turned its focus to the economy, succumbing to the idea that the European economy may already have entered a recession. Nowhere better is that view being reflected in the euro, which has given up all the gains it made against the dollar from December 2022 to July 2023. Since mid-July, the common currency has lost nearly 8% against the dollar. According to data from SWIFT – the global messaging service for cash transactions – the use of the euro has collapsed in the past nine months. It’s share in transactions dropped from 38% in January to 23.2% at the end of August, which is the lowest level recorded in, at least, twelve years.

Our G10 FX analyst Jane Foley believes that EUR weakness is likely to persist. For the dollar leg of the exchange rate our US analyst Philip Marey is of the view that the US could still see a technical recession early in 2024 as the effects of monetary tightening take their toll. This, however, need not trigger a USD sell off, as it appears likely that during the winter the market will have to contend with slow growth in China and cyclical as well as structural weakness in the Eurozone. With investors likely to shun risk assets this could actually favour the dollar.

Meanwhile, as said, the Eurozone is the economy that is losing growth momentum at the most rapid pace, where the US economy has continued to ‘hang in there’. Although the final release of the Eurozone manufacturing PMI saw a slight upward revision in the French index and slightly better-than-expected outcomes for both Spain and Italy (although both remaining firmly in contraction territory), the German index was revised down deeper into recession territory (39.6 in September). Also the Irish PMI, a bellwether for the high-value-added part of industry, slipped back below the 50-mark.

Some snippets from the Eurozone HCOB PMI report highlight the recent weakness. Its headline reads: “Factory job losses intensify amid sinking new orders and deteriorating business confidence.” According to the report, the “[…] volume of new orders placed with eurozone goods producers fell rapidly once again during September. In fact, the rate of decline remained among the steepest seen in the survey’s 26-year history. Considerable weakness was also seen on the export front. The response by manufacturers was to reduce production levels for the fourteenth time in 16 months. The decrease was sharp and slightly faster than in August.” Also employment is moderating, as “[…] further job cuts were made in September, with euro area factory employment falling at the quickest pace in almost three years.” The good news for households, then, is that price pressures are also waning quickly: “With the exception of the great recession in 2008/2009, output prices have never decreased at a pace faster than the current three-month average."

Altogether, this backdrop suggests scope for further downside pressure for the EUR. Having breached our former EUR/USD1.06 target, Jane Foley revised our forecasts lower and now expects EUR/USD to move to 1.02 on a 3-month view and remain lower for longer into 2024. Last but not least, on the margin, rising concerns about the fiscal pledges of Italy’s right-wing government could also become a EUR negative factor, since this has the potential to create tensions with Brussels going forward.

Apart from these cyclical developments, concerns over structural weakness may be playing into bouts of currency weakness as well. We have discussed the woes of the European car sector in several previous editions of this Global Daily. With the EU having launched a probe into illegal state subsidies in the Chinese car sector, this has injected fresh uncertainty over the trade relation between the two economic blocs. At the end of the day, we believe that the most likely scenario is a negotiated settlement that would either result in some protective measures and/or entails an agreement on Chinese investments in Europe in either the car or the battery sector. But the EU may face a bumpy ride. Teeuwe Mevissen and Erik-Jan van Harn explain our thinking on this matter in more detail here.

On this note, today the European Commission and European Parliament debate on the trade relations with China. After several reports on critical raw materials, the European Commission is also launching a report today that looks at critical technologies: “The European Commission will assess the risks of four critical technologies”. Those technologies are said to be i) semiconductors, ii) artificial intelligence, iii) quantum technologies and iv) biotechnologies such as vaccines and genome sequencing. Reuters cites a Commission official saying that the Commission wants to assess the risks of these technologies “being weaponized by countries not aligned with its values”. The deadline for this assessment is set for the end of this year and the next step is to mitigate the risks next year, according to the Reuters article. These developments show that the EU is now following more or less the same path as the US, although it is still in the ‘assessment phase’ rather than the ‘action phase’.

Meanwhile, on the other side of the world, the RBA chose to leave the cash rate unchanged at 4.10%. This was the first meeting under new Governor Michele Bullock. This was despite the August inflation report showing an acceleration in price growth for the first time since April, and substantial gains in energy prices during the month of September.

The Governor's statement notes that uncertainties surrounding the health of the Chinese economy, the speed of monetary policy transmission and the outlook for household consumption, all informed the decision to remain on hold. At the same time, continued brisk growth in services price inflation, tight labour markets and faster than expected GDP growth were noted as arguments for raising rates. The hawkish bias has been maintained (with a caveat). The statement says "Some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable timeframe, but that will continue to depend upon the data and the evolving assessment of risks". This fits with our RBA watcher Ben Picton’s view that the final 25bp hike in this cycle will likely be administered at the November meeting, following the Q3 quarterly inflation report due in late October.