HSBC Holdings Plc has restricted employees from sending text messages on their company-issued smartphones, a move stemming from regulatory probes into the financial industry's use of unofficial communications like WhatsApp, personal texts, or email to conduct business. This comes five months after HSBC paid tens of millions of dollars to settle a Commodity Futures Trading Commission and Securities and Exchange Commission probe over unauthorized WhatsApp use among employees.

Bloomberg spoke with people in the know who said HSBC is disabling the texting function on work phones for all employees. They said employees have already been barred from using WhatsApp.

"Banks use a wide range of approved channels to communicate in compliance with regulatory obligations," a spokesperson for the bank said.

The spokesperson continued, "HSBC, like many other banks, reviews and adjusts functionality on its corporate devices as needed."

However, according to another person, not all employees will be banned from texting on work phones. They said a small pool of workers in regulated roles will still be able to text where activity is archived.

In mid-May, HSBC paid CFTC $30 million and the SEC another $15 million over its failure to monitor employees' communications on unauthorized messaging apps.

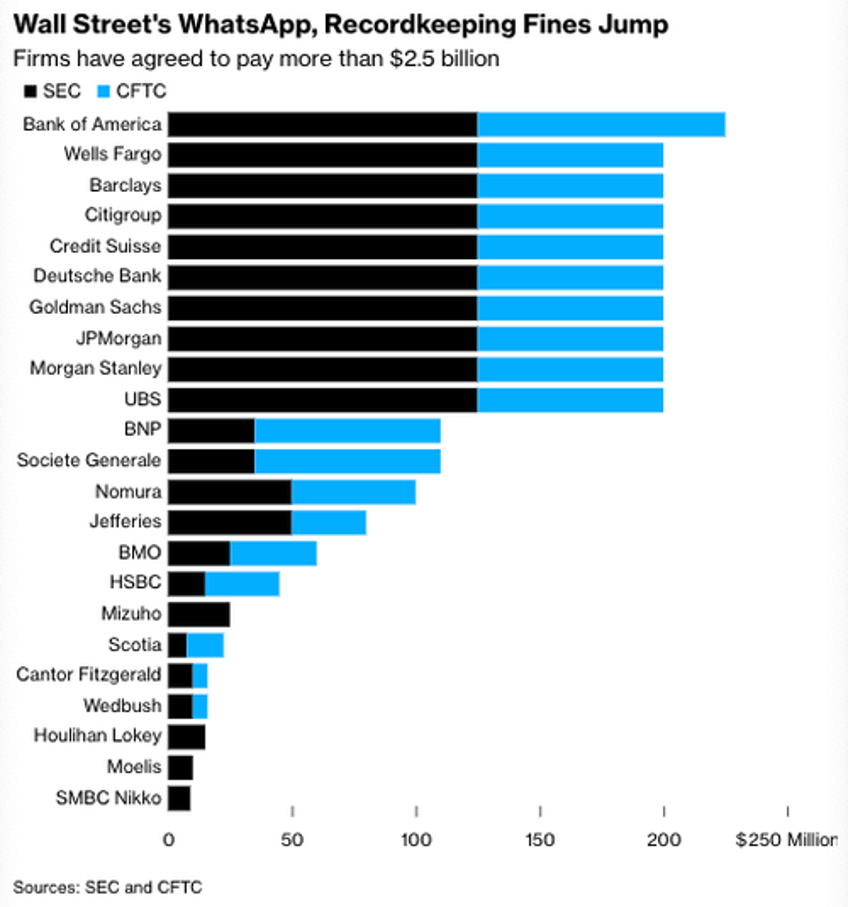

Data from Bloomberg shows Bank of America, Wells Fargo, Barclays, Citigroup, Credit Suisse, and 18 other banks have shelled out $2.5 billion to the SEC and CFTC for violating recordkeeping rules

In recent months, the SEC fined Wells Fargo, BNP Paribas, Societe General, and Mizuho for "widespread and longstanding failures by the firms and their employees to maintain and preserve electronic communications."

Reuters said in a separate report that the latest probe into Wall Street's private messages is focused on a dozen investment companies:

The firms include Carlyle Group, Apollo Global Management, KKR & Co., TPG, and Blackstone, according to three people with direct knowledge of the matter, as well as some hedge funds, including Citadel, said a different person with direct knowledge.

The executives gave their personal phones and other devices to their employers or lawyers to be copied, and messages discussing business have been handed to the SEC, three people said.

That is in contrast to the broker-dealer probes. In those cases, the SEC asked companies to review staff messages and report to the agency how many discussed work. SEC staff reviewed only a sample of messages themselves, according to three sources with knowledge of the previous investigations.

The sources spoke on the condition of anonymity because SEC investigations are confidential.

At least 16 firms including Carlyle, Apollo, KKR, TPG, and Blackstone, have disclosed that the SEC is probing their communications. The firms did not provide further details and did not comment for this story. A spokesperson for Citadel declined to comment.

Monitoring employee communications has been challenging for Wall Street's compliance departments for years because of the proliferation of mobile-messaging apps and remote work.