By Michael Msika, Bloomberg Markets Live reporter and strategist

Equities have been moving higher despite warnings of challenges later in the year, leaving underexposed investors with the tough choice of potentially buying near the top or missing out on further gains.

The Stoxx 600 just had its best weekly advance since March as lower-than-expected US inflation stoked bets of an imminent end of Federal Reserve interest-rate hikes. Bears have been wrongfooted so far this year, but many still say markets are currently pricing in too much optimism about the economy.

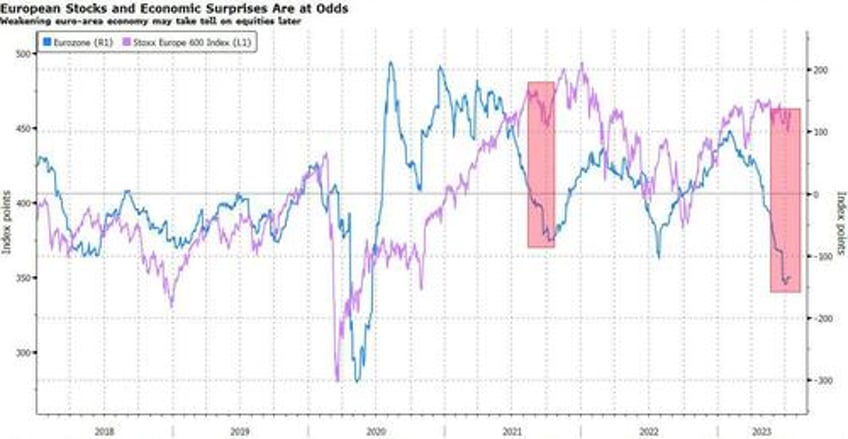

“We remain cautious short term due to tightening credit conditions and macro indicators pointing south,” says Michele Morganti, senior equity strategist at Generali Investments. “A negative yield curve and plunged money aggregates are sending negative cyclical signals.”

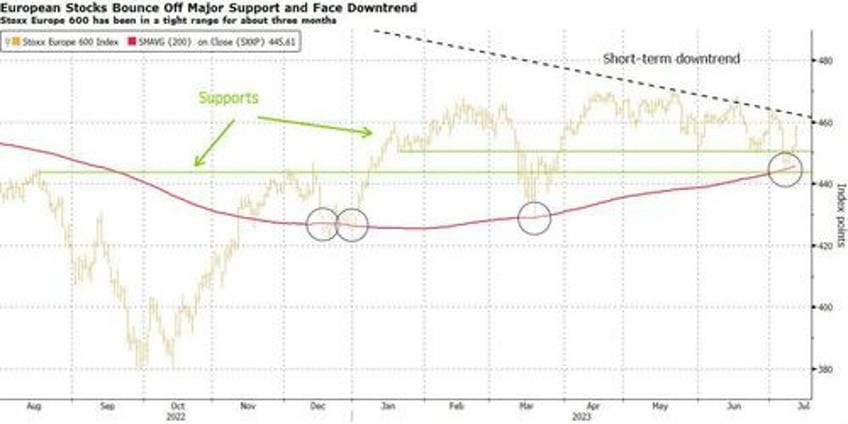

In Europe, the Stoxx 600 has been rangebound for several months, mostly holding onto strong gains made at the start of the year as investors swing between positive and negative catalysts. Still, it’s facing a downward trend in the short-term. The slowing China economy is another issue that could cap gains given the high exposure for some prominent industries in Europe like miners, capital goods, autos or luxury.

“We say 2023 disinflation to prove transitory,” says Bank of America strategist Michael Hartnett, expecting real rates to rise, while adding that US bond yields will not fall below 3% without a “very hard landing.” His European colleague Sebastian Raedler also sees weakening growth momentum and the expansion of risk premia ahead weighing on stocks in the second half.

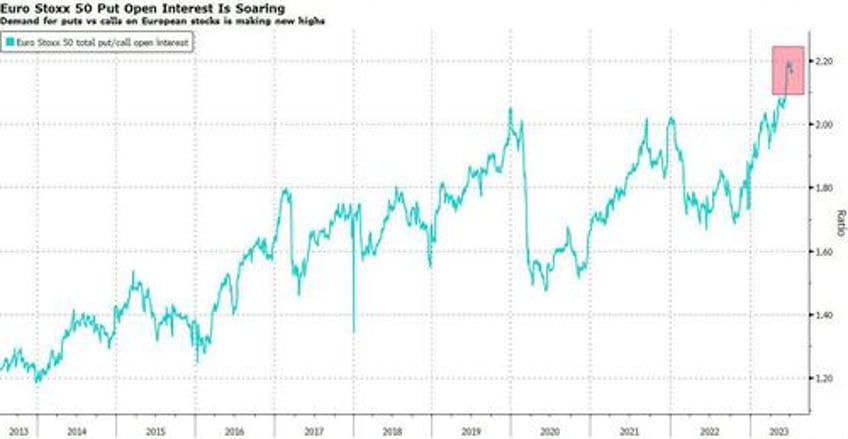

There’s plenty of caution to be found on the derivatives side. Demand for puts on the Euro Stoxx 50 is surging to new highs relative to calls, indicating traders aren’t as sanguine about the outlook as the main market suggests.

“US investors are very bearish on Europe,” say Barclays strategists led by Emmanuel Cau after touring the region last week, meeting hedge funds and long-only clients. “Consistent with the flows data we track, most US clients we met have cut exposure to Europe, on the view that the region is the most vulnerable to central banks-induced recession, will lose from a weaker-for-longer China and has missed the AI train.”

Still, the strategists say peak pessimism might be close and flag that some hedge funds have started trimming their short positions. They also note that the strong performance of cyclicals versus defensives is at odds with inflows to defensives. That indicates the “pain trade” is to the upside for those who are underexposed to cyclicals, they add.

Investors continue to pull money out of European equities. The region’s stock funds have now seen 18 weeks of outflows, according to EPFR Global, making it a $32 billion exit this year.

For UBS Wealth Management CIO Mark Haefele, a lot of optimism about the US economy is already priced in, setting the bar higher for the rest of the year. “In the second half, we expect an environment where inflation continues to fall, but growth also slows, potentially close to zero. That situation is good for bonds, but generally not equities.”