Is this just a correction after a strong bullish advance from November, or is the bull market ending? If you read some of the headlines, you would suspect the latter. As noted by MarketWatch last week:

“For the first time since early November 2023, less than 30% of S&P 500 stocks are trading above their 50-day moving average — a clear indicator of the current poor market’s breadth. This significant drop from the 85% observed in late March and 92% at the beginning of January highlights a dramatic reversal in market dynamics.

The 50-day moving average is often seen as a barometer for the short-term health of stocks. Falling below this level en masse suggests that a broad swath of the market is facing downward pressure. This shift comes amid escalating geopolitical tensions in the Middle East and renewed concerns over inflation, which have collectively nudged traders towards a more guarded stance in April.”

Of course, there are many “reasons” lately for the drop in stock prices. Geopolitical stress between Israel and Iran and hotter-than-expected inflation data that paused Fed rate cuts brought sellers into the market. However, none of this is shocking, as we previously noted in “Blackout Of Buybacks:”

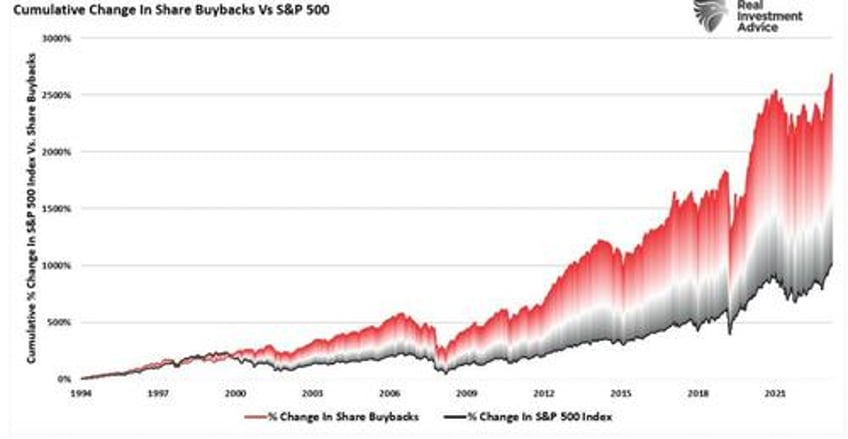

“Notably, since 2009, and accelerating starting in 2012, the percentage change in buybacks has far outstripped the increase in asset prices. As we will discuss, it is more than just a casual correlation, and the upcoming blackout window may be more critical to the rally than many think.” – March 19, 2024

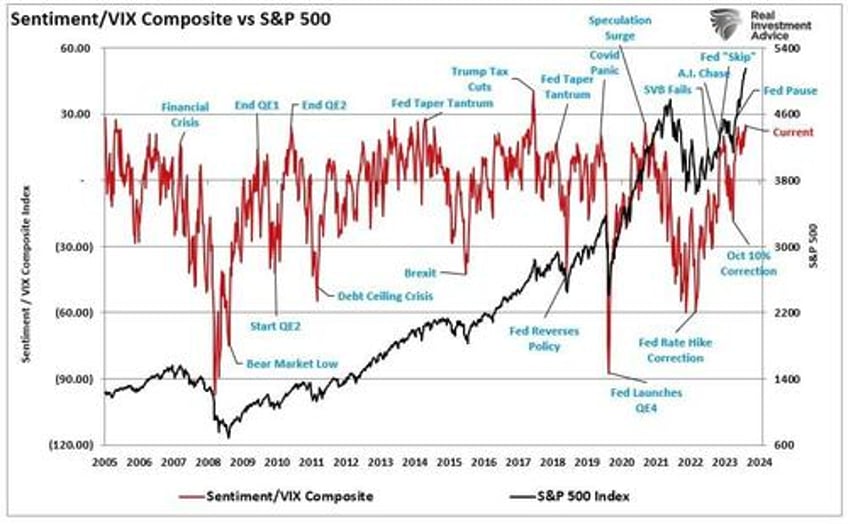

Furthermore, the “blackout” of corporate buybacks coincided with an aggressively bullish investor sentiment. As we noted in that same article:

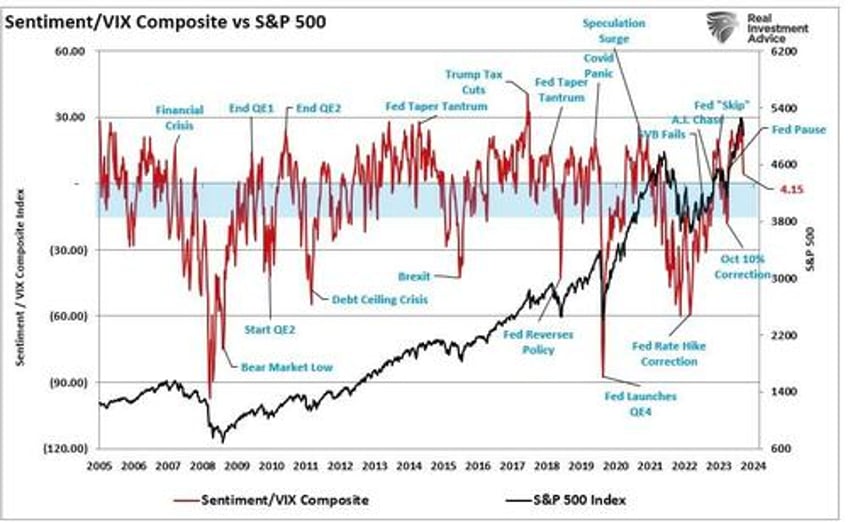

“Investor sentiment is once again very bullish. Historically, when retail investor sentiment is exceedingly bullish combined with low volatility, such has generally corresponded to short-term market peaks.”

We will return to this chart momentarily, but given that corporate share buybacks have accounted for roughly 100% of net equity purchases over the last two decades, the blackout period combined with aggressive bullish sentiment was the recipe for a decline in asset prices.

Here is the math of net flows if you don’t believe the chart:

Pensions and Mutual Funds = (-$2.7 Trillion)

Households and Foreign Investors = +$2.4 Trillion

Sub Total = (-$0.3 T)

Corporations (Buybacks) = $5.5T

Net Total = $5.2 Trillion = Or 100% of all equities purchased

Such is crucial to understand as we head into the rest of the year. It will determine whether this is just a correction within a bullish trend or something more significant.

Buyers Live Lower

In “No Cash On The Sidelines,” we discussed the importance of understanding that “market prices” are set by the demand and supply between buyers and sellers. To wit:

“As noted above, the stock market is always a function of buyers and sellers, each negotiating to make a transaction. While there is a buyer for every seller, the question is always at “what price?”

In the current bull market, few people are willing to sell, so buyers must keep bidding up prices to attract a seller to make a transaction. As long as this remains the case and exuberance exceeds logic, buyers will continue to pay higher prices to get into the positions they want to own.

Such is the very definition of the “greater fool” theory.

However, at some point, for whatever reason, this dynamic will change. Buyers will become more scarce as they refuse to pay a higher price. When sellers realize the change, they will rush to sell to a diminishing pool of buyers. Eventually, sellers will begin to “panic sell” as buyers evaporate and prices plunge.”

In other words, “Sellers live higher. Buyers live lower.“

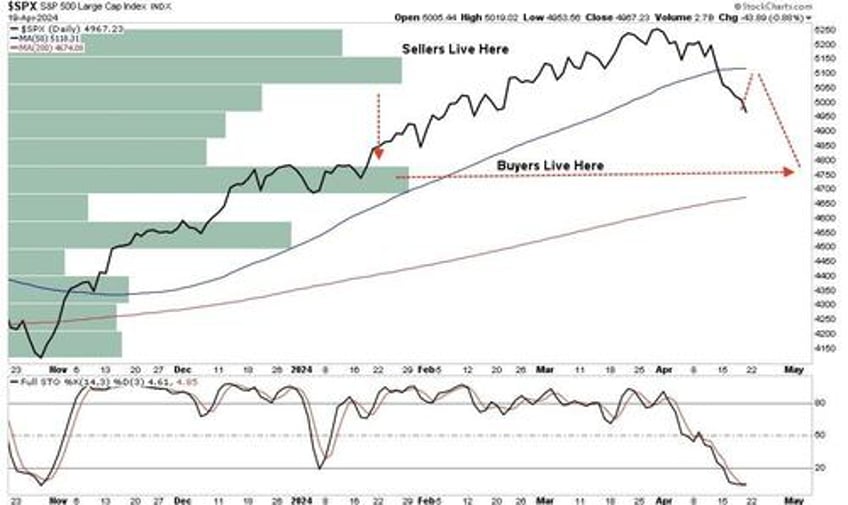

We can see where the buyers and sellers “live” in the following chart, which shows where the highest volume occurred.

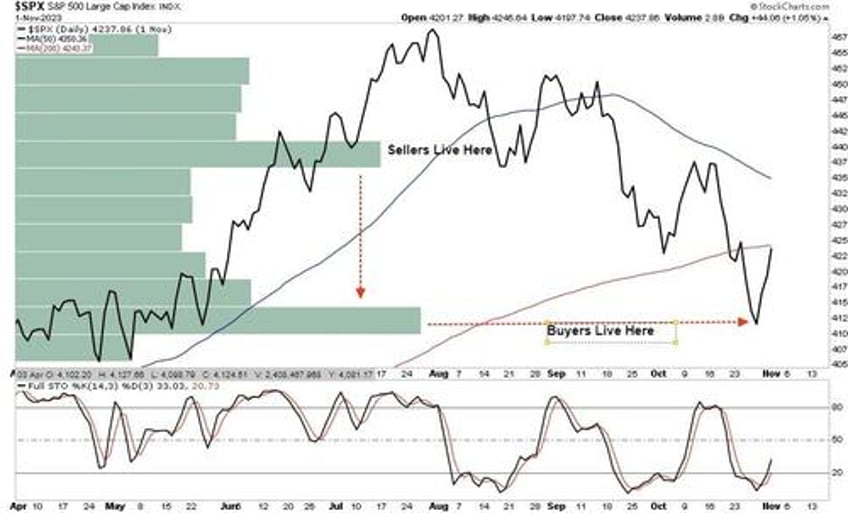

This current correction is becoming increasingly oversold (bottom panel), which suggests a bounce is likely toward the previous support of the 50-DMA. For comparison, we can look at last year’s market correction. As noted, the bullish rally into July peaked late that month. As the market corrected, it bounced from oversold conditions, allowing investors to reduce risk and hedge portfolios. The markets will likely present investors with that opportunity soon.

Then, like today, many investors began to believe it wasn’t just a correction but something much more. However, the reality was that the “buyers lived lower.” Buyers stepped in as prices approached the October lows, coinciding with the return of corporate share buybacks.

Sentiment Is Reversing Quickly

As I said, we need to revisit the sentiment chart above. Investors’ more frothy, bullish sentiment is reversing quickly on many fronts. The chart below, the same as above, is the composite net bullish sentiment index of retail and professional investors divided by the volatility index (VIX). If this is just a market correction, the index tends to bottom between zero (0) and negative (20). With a current reading of 4.15, down from 25.99 just two weeks ago, bullish sentiment has significantly reversed.

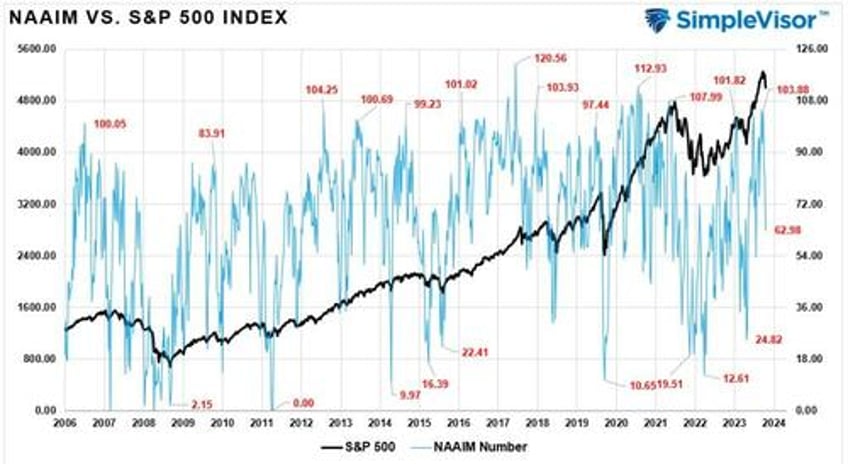

Notably, professional investor allocations to equities recently peaked at 103.88%, which has collapsed in just two weeks to just 62.98% exposure. (Professional investors are notorious for buying market peaks.)

Also, the number of stocks on bullish “buy signals” has dropped from 80.2 to 48.2.

Furthermore, the number of stocks trading above the 50-DMA has fallen from over 80% to 37%, with money flows hitting levels lower than previous market bottom lows. Notably, with just a 5.5% correction from the recent peak (as of last Friday), much of the work of clearing the previous overbought conditions is completed.

Given the significant reversal in sentiment and short-term oversold conditions, we highly suspect the markets will provide a reflexive rally soon. However, with the number of bullish investors who got “trapped” in the selloff, any rallies will likely be met with further selling.

However, despite the current “panic” in the media headlines, this is likely just a correction within an ongoing bullish market. Such is particularly the case given that corporate share buybacks will resume in May, providing critical support for the markets heading into summer.

With that said, this correction, when complete, likely won’t be the last we see this year. Market history suggests we could see another “bumpy ride” heading into what many expect will be a somewhat contentious election.

But that is an article we will write when we get there.