Bond traders were paying close attention to today's 2Y auction not only because at $69 billion in size, it would once again break the record for biggest 2Y auction issuance on record, but also because it comes at a time when yields are trading just shy of 2024 highs. The results, which were announced moments ago, however were solid and helped push yields to session lows, however briefly.

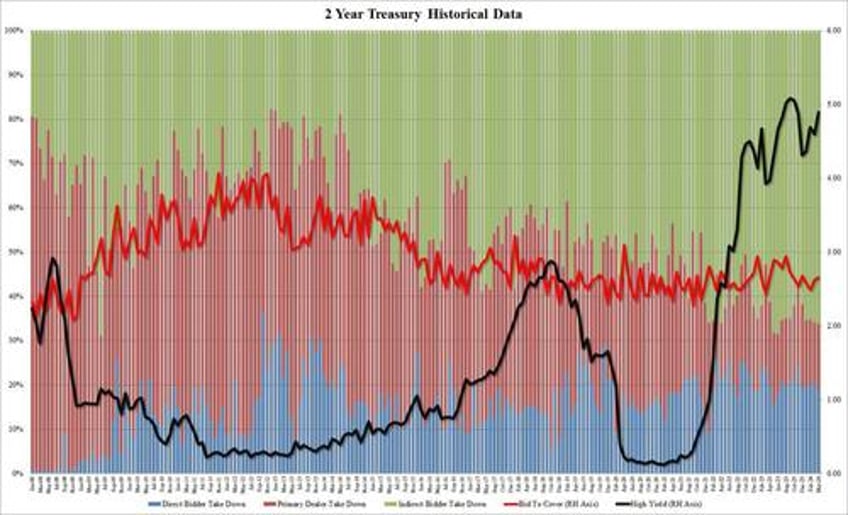

Here are the details: the size of today's 2Y auction was $69 billion, $3 billion more than the March issuance of $66 billion and the biggest on record.

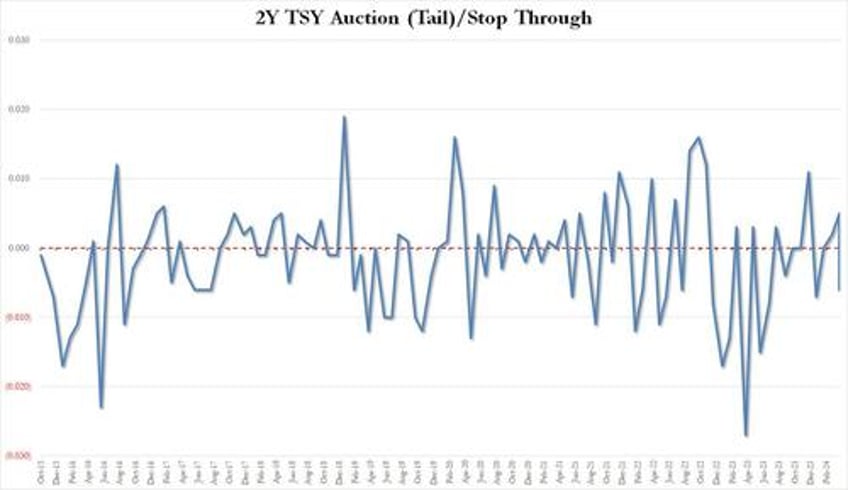

So considering that the high yield of 4.898% (which was well above last month's 4.595% but below the record high of 5.085%) stopped through the When Issued 4.904% was a bit of an achievement.

The bid to cover was also surprisingly strong, rising to 2.659 from 2.619, which was the highest since December and far above the recent average of 2.59.

The internals were also very strong, with Indirects awarded 66.2%, the highest since June 2023, and well above the six-auction average of 62.9%. And with Directs taking down 15.1% (the most since December), Dealers were left holding just 18.7%, the lowest since June.

Overall, this was a stellar auction - as the kneejerk drop in yields after the auction indicated - and clearly suggesting that buyers have quite a ways to go before they reach their breaking point.