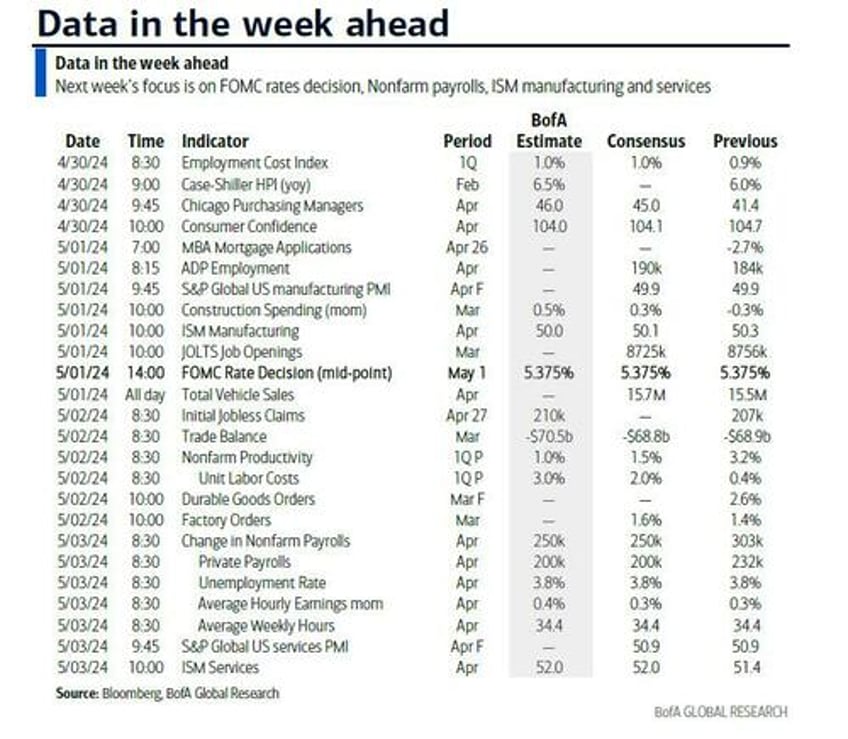

As DB's Jim Reid notes, with just two days left in a rollercoaster April for markets - and FX - last week actually saw the best week for the S&P 500 (+2.67%) and NASDAQ (+4.23%) since November, following several weeks of declines, as earnings gave markets a boost even if the US inflation data was on net worrying. And while the month is almost over, the new week is just starting and as Reid notes, it's shaping up an exceptionally busy week of important events.

The FOMC on Wednesday is the obvious highlight of the week, but we also have payrolls on Friday to look forward to. DB expect a more hawkish-leaning Fed this week. While our economists expect the Committee will maintain an easing bias, they do expect the statement and press conference to echo Chair Powell’s view that firmer inflation prints suggest it will take longer to gain confidence about disinflation. The press conference will be fascinating to see the nuances in Powell’s responses as he justifies a likely unchanged easing bias, even if the rhetoric is more hawkish, in the face of rising inflation.

In terms of the jobs report on Friday, our US economists see payrolls gaining +240k in April (consensus +250k), down from +303k in March. The consensus expects the unemployment rate and the hourly earnings growth rate to stay at 3.8% and +0.3% MoM, respectively, although DB expects the former to tick up a tenth. Overall the market sees a solid report.

Other key data in the US includes consumer confidence tomorrow, the manufacturing ISM, JOLTS, and ADP on Wednesday, and the services ISM on Friday. We also see the latest US Treasury quarterly refunding announcement on Wednesday, after the borrowing estimate is due today. This was a big pivot point for global markets back in August (negative) and October (positive) but since then a commitment not to increase auction sizes has reduced its importance.

Finally in the US, earnings season maintains its peak pace as 174 report in the S&P versus 180 last week with Amazon (Tuesday) and Apple (Thursday) the obvious highlights. Meanwhile, 66 Stoxx 600 companies will report this week.

In Europe, preliminary CPI reports for Germany and Spain today, and the Eurozone tomorrow will have a lot of significance for the June ECB meeting and whether we will see the first cut. Our European economists preview the release here. For the Eurozone, they expect the headline HICP to fall one-tenth to 2.31% yoy, its lowest value since August 2021 and see core inflation slowing further to 2.45% yoy, 0.50pp lower than in March 2024. Staying in Europe the latest GDP data for Germany, France, Italy and the Eurozone are due tomorrow. In Asia, various China PMIs (tomorrow) will be a big focus and in Japan, several key economic indicators are also due, including industrial production and labour market data tomorrow.

Day-by-day calendar of events:

Monday April 29

- Data : US April Dallas Fed manufacturing activity, Germany April CPI, Eurozone April services, industrial and economic confidence

- Earnings : PetroChina, China Construction Bank, BYD, NXP Semiconductors, Domino's Pizza, Paramount Global

- Auctions : US Treasury borrowing estimates

Tuesday April 30

- Data : US Q1 employment cost index, February FHFA house price index, April MNI Chicago PMI, Dallas Fed services activity, Conference Board consumer confidence, UK March net consumer credit, mortgage approvals, M4, April Lloyds business barometer, China April official PMIs, Caixin manufacturing PMI, Japan March retail sales, job-to-applicant ratio, jobless rate, industrial production, housing starts, Italy Q1 GDP, March hourly wages, April CPI, Germany Q1 GDP, April unemployment claims rate, France Q1 GDP, March PPI, consumer spending, April CPI, Eurozone Q1 GDP, April CPI, Canada February GDP, New Zealand Q1 jobs report , Denmark March unemployment rate

- Central banks : BoE's APF report

- Earnings : Amazon, Eli Lilly & Co, Samsung, Coca-Cola, AMD, McDonald's, Stryker, Starbucks, Mondelez, Mercedes-Benz Group, Volkswagen, PayPal, adidas, Diamondback Energy, Restaurant Brands, Pinterest, Vonovia, Covestro, Caesars Entertainment

Wednesday May 1

- Data : US March JOLTS report, construction spending, April total vehicle sales, ISM index, ADP report, Canada April manufacturing PMI

- Central banks : Fed's decision

- Earnings : Mastercard, Qualcomm, Pfizer, KKR, GSK, Marriott, Estee Lauder, DoorDash, Corteva, Haleon, Devon Energy, Barrick Gold, eBay, Albemarle, Etsy

- Auctions : US quarterly refunding announcement

Thursday May 2

- Data : US Q1 unit labor costs, nonfarm productivity, March trade balance, factory orders, initial jobless claims, Japan April monetary base, consumer confidence index, Italy March PPI, April manufacturing PMI, new car registrations, budget balance, Canada March international merchandise trade, Switzerland April CPI

- Central banks : BoJ minutes of the March meeting

- Earnings : Apple, Novo Nordisk, Shell, Linde, ConocoPhillips, Booking, Cigna, Regeneron, Apollo, Pioneer, Universal Music Group, Block, Ares, Moderna, Blue Owl, Vestas, AP Moller - Maersk, Orsted, ArcelorMittal, Live Nation Entertainment, DraftKings

- Other : UK local elections, OECD economic outlook

Friday May 3

- Data : US April jobs report, ISM services, UK April official reserves changes, Italy March unemployment rate, France March industrial production, budget balance, Eurozone March unemployment rate, Canada April services PMI, Norway April unemployment rate

- Earnings : Hershey, Daimler Truck, Cheniere Energy

* * *

Looking at just the US, Goldman writes that the key economic data releases this week are the Employment Cost Index on Tuesday, ISM manufacturing and JOLTS job openings on Wednesday, and the employment report on Friday. The May FOMC meeting is on Wednesday. The post-meeting statement will be released at 2:00 PM ET, followed by Chair Powell’s press conference at 2:30 PM. Treasury will release its Q2 financing estimates on Monday and the Quarterly Refunding Statement on Wednesday.

Monday, April 29

- 10:30 AM Dallas Fed manufacturing activity, April (consensus -11.3, last -14.4)

Tuesday, April 30

- 08:30 AM Employment cost index, Q1 (GS +0.9%, consensus +1.0%, last +0.9%): We estimate the employment cost index rose by 0.9% in Q1 (qoq sa), which would lower the year-on-year rate by two tenths to 4.0% (nsa yoy). Our forecast reflects deceleration in the Atlanta Fed wage tracker and in average hourly earnings of production and nonsupervisory workers. We also expect a slower pace of ECI growth among unionized workers, following the 1.7% spike in Q4 (SA by GS, not annualized). On the positive side, we assume ECI benefit growth picks back up to 0.9% (vs. 0.7% in Q4), reflecting expanded benefit offerings at the start of the year.

- 09:00 AM FHFA house price index, February (consensus +0.1%, last -0.1%)

- 09:00 AM S&P Case-Shiller 20-city home price index, February (GS +0.07%, consensus +0.10%, last +0.14%)

- 09:45 AM Chicago PMI, April (GS 46.4, consensus 45.0, last 41.4): We estimate that the Chicago PMI rose by 5pt to 46.4 in April, reflecting the rebound in global manufacturing activity.

- 10:00 AM Conference Board consumer confidence, April (GS 104.3, consensus 104.0, last 104.7

Wednesday, May 1

- 08:15 AM ADP employment change, April (GS +185k, consensus +180k, last +184k): We estimate a 185k rise in ADP payroll employment in April, reflecting a solid underlying pace of job growth and a possible boost from residual seasonality: the ADP measure has picked up in April relative to Q1 in four of the last six years excluding 2020.

- 09:45 AM S&P Global US manufacturing PMI, April final (consensus 49.9, last 49.9)

- 10:00 AM Construction spending, March (GS +0.8%, consensus +0.3%, last -0.3%)

- 10:00 AM JOLTS job openings, March (GS 8,650k, consensus 8,680k, last 8,756k): We estimate that JOLTS job openings fell by 0.1mn to 8.65mn in March, reflecting the pullback in online job postings.

- 10:00 AM ISM manufacturing index, April (GS 50.8, consensus 50.1, last 50.3): We estimate the ISM manufacturing index rose by 0.5pt to 50.8 in April, reflecting the rebound in global manufacturing activity. Our manufacturing tracker rose 1.5pt to 49.9.

- 02:00 PM FOMC statement, April 30-May 1 meeting: As discussed in our FOMC preview, the upside inflation surprise over the last three months has delayed the first cut and narrowed the path for the FOMC to cut at all this year. We have not changed our big picture inflation view because the surprises look idiosyncratic, the categories that are still hot reflect lagged catch-up rather than current cost pressures, and the key pillars of the disinflation narrative remain intact. We expect the next few inflation reports to be softer and have therefore stuck with our forecast of cuts in July and November, but even moderate upside surprises could delay cuts further.

- 05:00 PM Lightweight motor vehicle sales, April (GS 15.8mn, consensus 15.7mn, last 15.5mn)

Thursday, May 2

- 08:30 AM Trade balance, March (GS -$69.0bn, consensus -$69.2bn, last -$68.9bn)

- 08:30 AM Nonfarm productivity, Q1 preliminary (GS +0.8%, consensus +0.8%, last +3.2%); Unit labor costs, Q1 preliminary (GS +3.5%, consensus +3.3%, last +0.4%): We expect nonfarm productivity growth of +0.8% (qoq saar) in the Q1 preliminary reading. We expect unit labor costs—compensation per hour divided by output per hour—to grow 3.5% in the Q1 preliminary reading, which would increase the year-over-year rate to +4.2%.

- 08:30 AM Initial jobless claims, week ended April 27 (GS 215k, consensus 210k, last 207k): Continuing jobless claims, week ended April 20 (consensus 1,798k, last 1,781k)

- 10:00 AM Factory orders, March (GS +1.6%, consensus +1.6%, last +1.4%); Durable goods orders, March final (consensus +2.6%, last +2.6%); Durable goods orders ex-transportation, March final (last +0.2%); Core capital goods orders, March final (last +0.2%);Core capital goods shipments, March final (last +0.2%)

Friday, May 3

- 08:30 AM Nonfarm payroll employment, April (GS +275k, consensus +250k, last +303k); Private payroll employment, April (GS +225k, consensus +198k, last +232k); Average hourly earnings (mom), April (GS +0.20%, consensus +0.3%, last +0.3%); Average hourly earnings (yoy), April (GS +3.95%, consensus +4.0%, last +4.1%); Unemployment rate, April (GS 3.8%, consensus 3.8%, last 3.8%); Labor force participation rate, April (GS 62.7%, consensus 62.7%, last 62.7%): We estimate nonfarm payrolls rose by 275k in April (mom sa), reflecting a favorable evolution in the April seasonal factors and a continued boost from above-normal immigration. Big Data measures were mixed but generally indicate a solid or strong pace of job gains, and our layoff tracker continues to indicate that the pace of layoffs is low. We estimate that the unemployment rate edged down but was unchanged on a rounded basis at 3.8%, reflecting a rise in household employment and flat-to-up labor force participation (at 62.7%). Foreign-born unemployment normalized in March, falling sharply by 261k (SA by GS) and limiting the scope for further declines in April. We estimate average hourly earnings rose 0.20% (mom sa), which would lower the year-on-year rate from 4.14% to 3.95%. Our forecast reflects waning wage pressures and a nearly 10bp drag from calendar effects (mom sa).

- 09:45 AM S&P Global US services PMI, April final (consensus 50.9, last 50.9)

- 10:00 AM ISM services index, April (GS 52.1, consensus 52.0, last 51.4): We estimate that the ISM services index rose 0.7pt to 52.1 in April. Our non-manufacturing survey tracker edged up 0.3pt to 52.1.

- 07:45 PM Chicago Fed President Goolsbee (FOMC non-voter) speaks: Chicago Fed President Austan Goolsbee will participate in a panel discussion at the Hoover Institution. A Q&A is expected. On April 19, Goolsbee said, "Right now, it makes sense to wait and get more clarity before moving [rates]." He added, "So far in 2024, that progress on inflation has stalled. You never want to make too much of one month’s data, especially inflation, which is a noisy series, but after three months of this, it can’t be dismissed."

- 08:15 PM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will speak in a panel discussion at the Hoover Institution. Speech text and a Q&A are expected. On April 18, Williams said, "I definitely don’t feel urgency to cut interest rates...I think interest rates will need to be lower at some point, but the timing of that is driven by the economy." He added, "We have a strong economy… which means that the rates we have haven’t caused the economy to slow too much."

Source: DB, Goldman