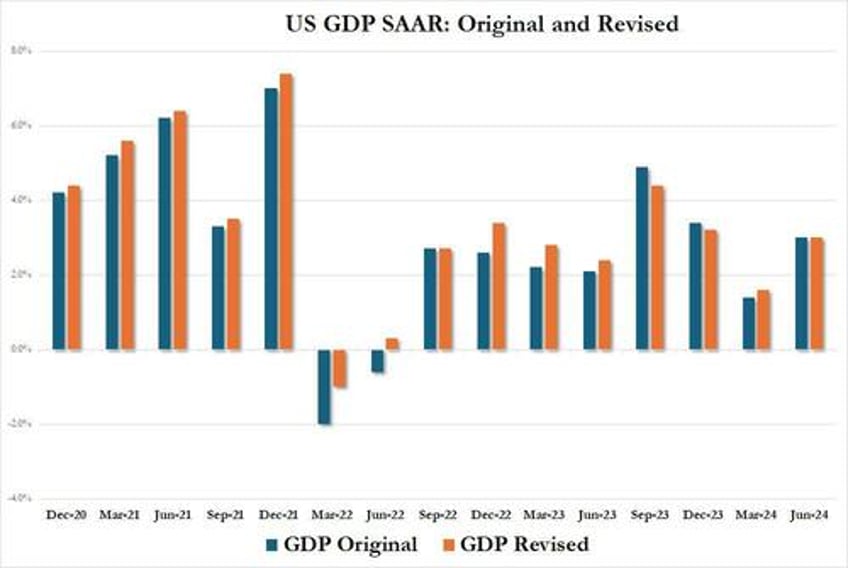

Something strange happened yesterday when the Bureau of Economic Analysis released the final estimate of Q2 GDP data: as part of the release, Biden's Dept of Commerce run by Gina Raimondo, which runs the BEA, reported that GDP in since 2020 had been revised not net markedly higher (with the exception of H2 2023) ...

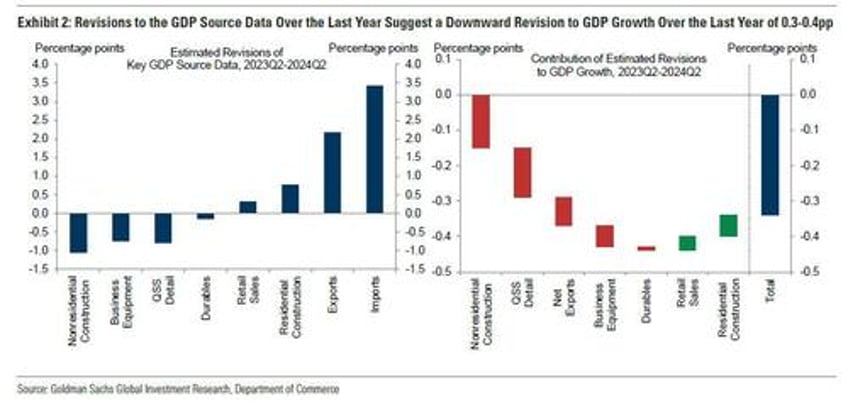

... even though banks such as Goldman warned of, and expected, a significantly negative revision to historical GDP numbers.

So what happened?

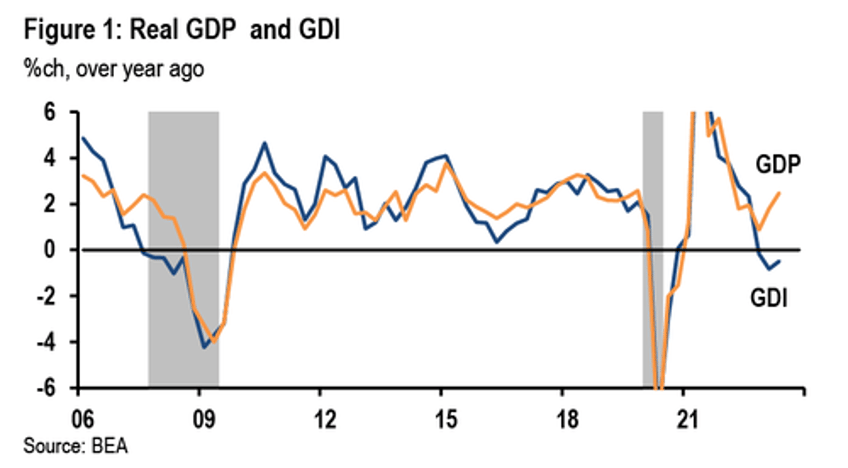

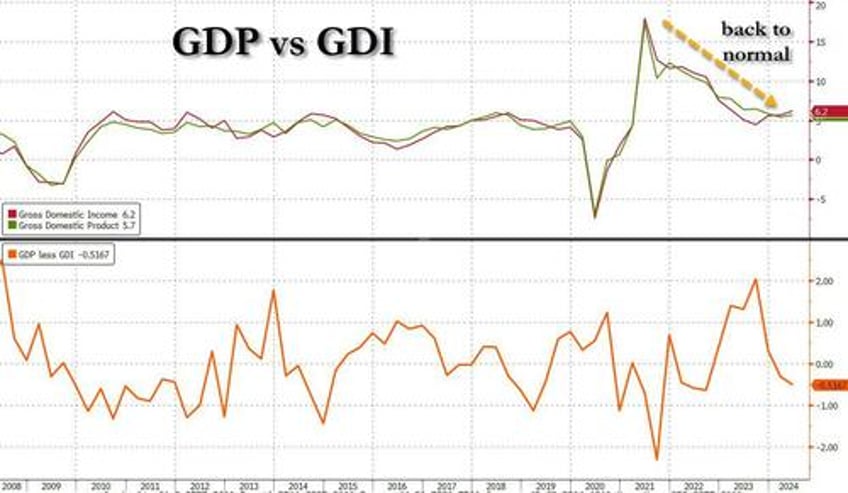

Recall that about a year ago, questions started to swirl around the record divergence between Gross Domestic Product (GDP, or also known as Gross Domestic Output) and Gross Domestic Income (GDI), which unlike GDP also captures various interest payments, mostly to and from the Federal Reserve.

Ironically, back in September 2023, JPMorgan expected that GDP would catch down to GDI, resulting in a much weaker GDP print. That did not happen, because the Biden admin came up with a last minute sticksave that revised historical data to make it seem the US was stronger than previously thought.

Fast forward to this week, when Goldman was looking at the same gap, and also at the divergence between various GDP components as reported and their revisions, and also expected that historical GDP would be revised much lower (also catching down to GDI). That too did not happen, because the BIden admin... did pretty much the same thing.

Instead, what did happen, is that not only was GDI revised sharply higher, effectively closing the record divergence between the two series by boosting various interest income assumptions of GDI.

There's more: after the release of today's Personal Income and Spending data, we found just why Goldman was so wrong in its (correct) assumption that US GDP should be revised lower based on historical data.

The reason for Goldman's erroneous forecast and the unexpected "boost" in US economic growth is because Dept of Commerce head Gina Raimondo, the same person who one month ago told ABC that she was unfamiliar with the Bureau of Labor (which had just slashed historical US jobs by over 800K) and one of the most political operatives of the Biden admin, decided to drastically revise the two most important data sets propping up the US economy: personal income and personal spending.

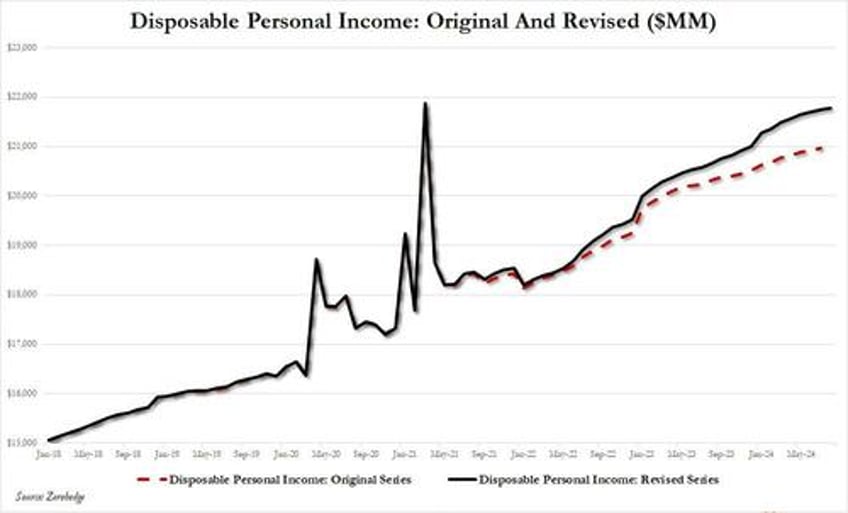

First, as shown in the chart below, personal income was unexpectedly revised about $800 billion higher, as a result of not just an increase in what the government believes was interest and dividend income, but also government handouts (i.e., personal current transfer receipts rising by over $200 billion) and also a $293 billion cumulative increase in wages and salaries. In total, Disposable personal income was revised from just under $21 trillion (annualized) to $21.8 trillion.

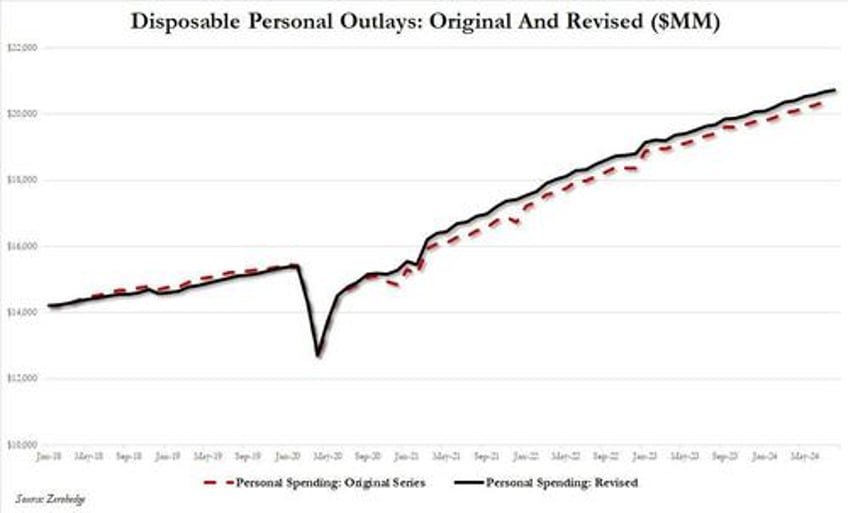

Spending was also revised higher, if to a lesser extent: the August number for Personal outlays was revised higher by about $350 billion, from $20.38 trillion in July to $20.73 trillion in the revised data, reflecting a reduction in spending on goods offset by much higher increase in spending on services.

To summarize: disposable personal income (after tax) was revised 3.8% higher to $21.8 trillion, while personal spending was revised higher by about half that, or 1.7%, to $20.7 trillion.

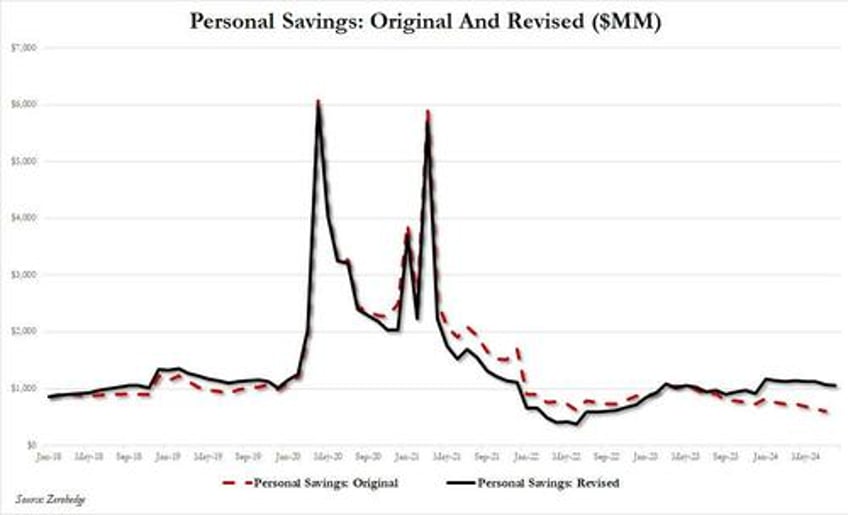

And since the difference between how much you make and how much you spend is also called savings, we can finally get to the bottom of how the US economy magically grew in the past several years instead of shrinking more: it turns out that, when some bureaucrat in Gina Raimondo's Bureau of Economic Analysis decided to click on a mouse button in recent weeks perhaps in (political) response to the dramatic plunge in revised jobs, Americans suddenly became much wealthier... if only in some Dept of Commerce spreadsheet.

You see, when subtracting the revised personal spending from the revised personal income, what you get is the revised savings of US consumers, which as of today's deus ex revision has almost doubled, rising from $600 billion in July to $1.1 trillion in August!

Yes, dear Americans, rejoice for a spreadsheet revision means you are all now half a trillion bucks richer!

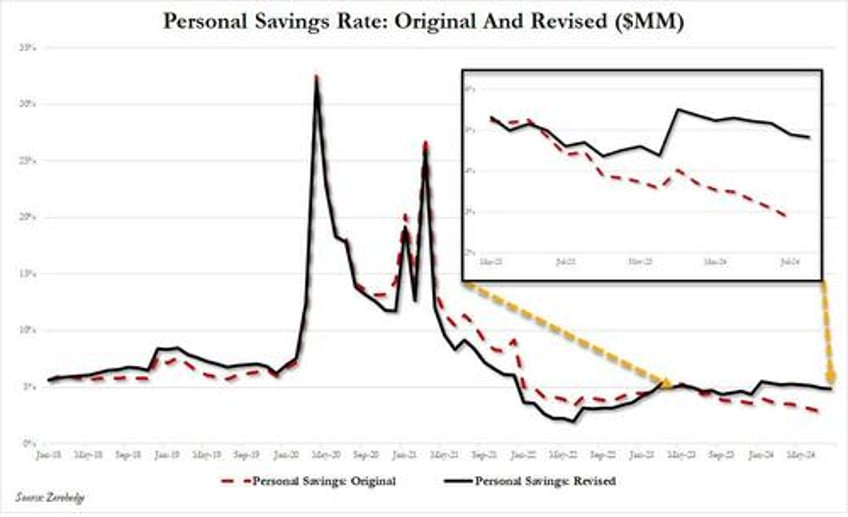

Finally, we can also calculate the revised personal savings rate, which looks like this.

What this chart shows is remarkable: instead of dropping to a near record low - where it was according tot he pre-revised income/spending data just last month - all it took was one assumption about the trajectory of income, spending, and savings, in the post-covid era, to make it seem that US consumer are much healthier than they appears just last month!

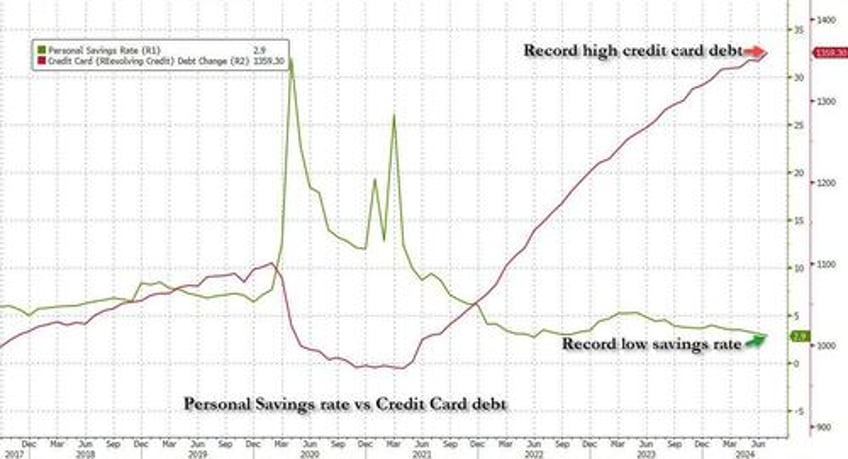

Why does this matter? Because alongside record credit card balances and various Federal Reserve estimates that all the covid excess savings had already been spent, the plunge in personal savings to a record low was the straw that many economists saw would finally break the US consumer's back (see for example this note from Albert Edwards, available to pro subs).

And from there, the path to a self-reinforcing consumer-driven recession narrative was just a breath away.

However, now that a perfectly timed and very strategic data "revision" has come in just in time to drown out the rapidly rising recession narrative, we can pretend - if only for a few months until the election - that US consumer and households are actually quite healthy, even if said healthy is totally fabricated and the result of a mouse click... and nothing else.

So, dear Americans, even as you can barely afford to buy food, eve as you can barely afford your monthly rent, and are several months behind on your record-breaking car and home insurance, you can at least take solace in the fact that while your actual savings int he bank have never been lower, your imputed savings - according to some political appratchik in the Biden Dept of Commerce - have doubled overnight because, well, the election is just over a month from now and you can't talk about a solid economy when you just vaporized over 800K jobs so something had to be revised dramatically higher.

It just so happened that something was the one number that is most easy to fudge and manipulate: a number which bears zero correspondence to reality, even though it may well be the most important number for US consumers - the personal savings number, arbitrarily construed by BEA beancounters - and which in no way reflects the amount of actual savings in the bank.

What it does, reflect, however is that we are about to hear a whole lot of bullshit by Kamala Harris' puppet-masters, how the US consumer has rarely been stronger and how US personal savings - instead of being the lowest on record - are actually the highest in three years.