Tomorrow morning years of politically-motivated upward drift in US economic "data" will get their come to Jesus moment of gravitational reacquaintance: at 8:30am ET on Thursday, alongside the final Q2 GDP print (expected unchanged at 2.2%) the BEA will also publish its once-every-five-years revision of GDP from Q1 2005 to Q1 2023, which according to Morgan Stanley will lead to a sharp downward revision, of as much as 80bps from Q2 GDP, and could potentially even indicate economic contraction in the first half of 2023.

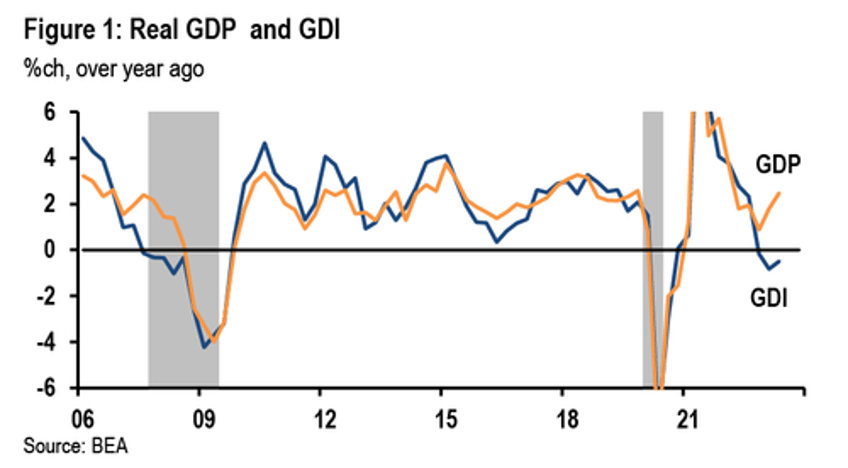

There are several reasons why GDP may be revised right off the proverbial cliff, but chief among them is the previously discussed record divergence between GDP and GDI, two series which - in theory - should be identical.

Besides GDP, Gross domestic income (GDI) and select income components will also be revised from Q1 1979 through Q1 2023, but as Morgan Stanley explained previously, the likely drift in revisions will be toward a lower GDP and higher GDI. This is how the bank's chief US economist Ellen Zentner explained it previously:

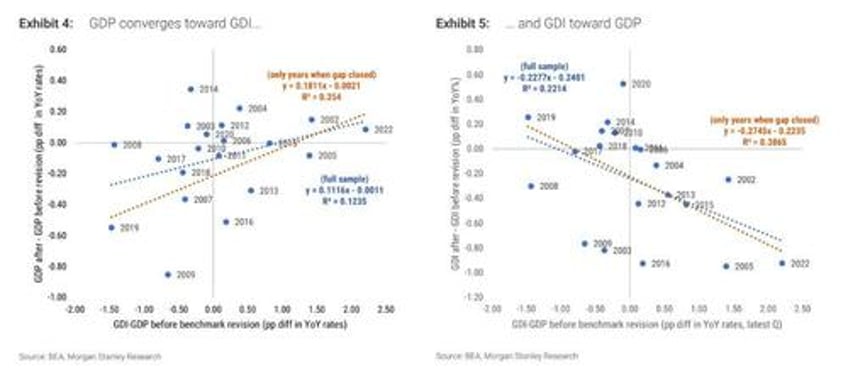

GDP will likely be revised down toward GDI. Not only does the GDI/GDP gap tend to close in absolute terms, but we also find evidence that GDP usually converges toward GDI in YoY% rates. Exhibit 4 shows the relationship between the percentage point difference between GDI and GDP before the revision (latest quarter available before revision, YoY%) and the change in GDP growth rate after the revision (pp difference after vs before). There is a positive link between the two variables suggesting that a negative GDI/GDP difference like the one we have now might result in a downward revision to GDP. In Exhibit 4 we show two linear fits, one using the 20-year sample and the other only focusing on the revisions where the GDI/GDP gap closed, with a stronger link between the variables. Using the predictions from these simple models, we would expect to see a downward revision to 2Q 23 YoY% GDP of as much as -50bp to -80bp

And while we discussed all this and more previously, a key question some may ask is what is the reason behind the massive divergence between GDP and GDI?

For the answer we go to a recent note from JPM chief economist Michael Feroli who correctly notes that one dark cloud hanging over the US economic outlook all year has been the very weak performance of real gross domestic income (GDI), which has contracted 0.5% over the past four quarters.

As noted before, GDI should equate with GDP, and past research has indicated that averaging GDI with GDP (also called GDO, or gross domestic output) provides a better measure of the underlying growth of economic activity than either measure viewed in isolation. Obviously, incorporating GDI clearly sends a more downbeat message about the economy’s recent performance, and suggests that the surge in the US Dollar and 10Y yields are just huge headfakes, and once the revised data is released we could see a brutal mean reversion in both the greenback and US Treasuries.

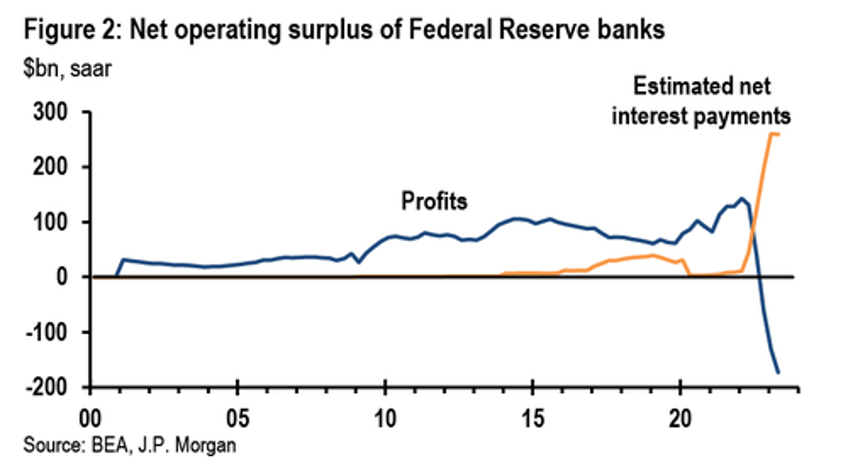

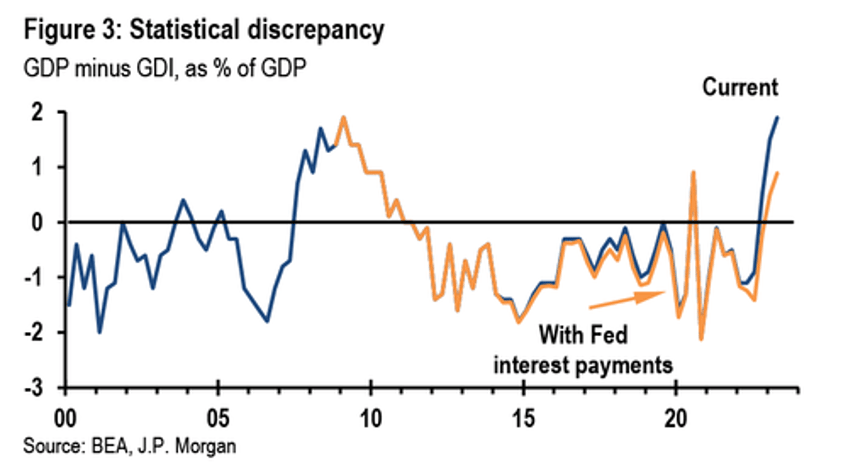

But going back to the key question - what is behind the record difference between GDP and GDI - Feroli answers that this is the result of previously omitted net interest payments by the Federal Reserve, which will be corrected by tomorrow's data revision, thereby boosting GDI. By itself this revision would close about half of the gap between these two broadest measures of the size of the economy.

As Feroli explains next, "consistent with their legal status, the National Income and Product Accounts (NIPAs) consider the Federal Reserve banks to be financial corporate businesses." Their contribution to GDI has so far been in corporate profits, which track closely to the net income of the Federal Reserve system. Recently, the profits of the Federal Reserve banks have rapidly deteriorated, contributing to the weakness in GDI.

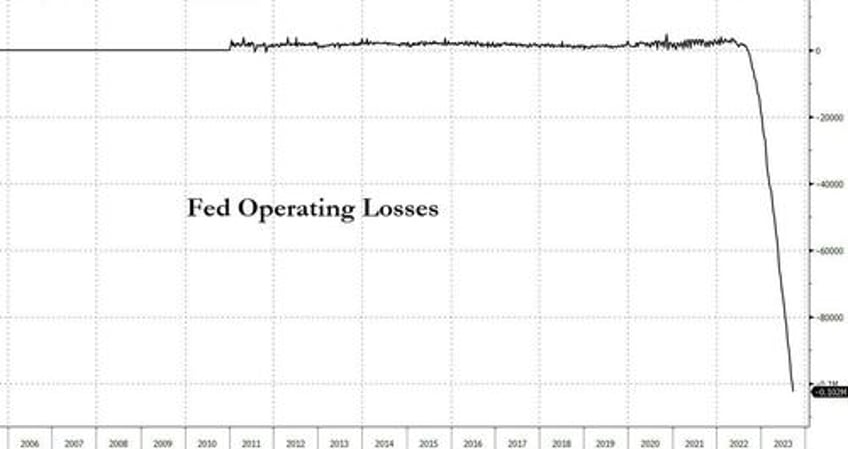

This deterioration has been the result of ballooning interest payments on the Fed’s liabilities as short-term interest rates have increased (this would also explain the confusion experienced by Albert Edwards recently when he looked at a variation of this chart to conclude that it was "The Maddest Macro Chart I Have Seen In Many Years").

So to address the unprecedented collapse in Fed profits as a result of soaring interest rates...

... In June, the BEA discussed how in the upcoming annual revision of the NIPAs they will begin recording interest paid by the Federal Reserve banks. Like corporate profits, net interest payments are an element of corporate operating surplus, which is an element of GDI. This methodological revision updates the NIPAs to keep them more consistent across accounts considering the Fed’s relatively newfound ability to pay interest.

What does this mean for the record statistical discrepancy using between GDP and GDP? The answer comes from data pulled from the Fed’s balance sheet and administered interest rates. (Although the BEA documentation is ambiguous, JPM assumes that all paid liabilities will be recorded, including those for the overnight reverse repo facility).

This inclusion would cut in half the statistical discrepancy in 2Q23, bringing it down from 1.8% of GDP to 0.9%.

In other words, this revision would still leave real GDI growth negative in 4Q22 and 1Q23 - suggesting that GDP would also be revised negative for two quarters, potentially springing an unexpected recession on the US - but would raise the annualized growth in those quarters by about 1%-pt.

The inclusion of Fed interest payments in GDI isn’t the only component that will be revised later this month. The inclusion of more complete data could push estimates of GDP and GDI either up or down. That said, JPM agrees with Morgan Stanley that there is a tendency for GDP and GDI to be revised toward each other. This fact, suggests that while GDI may not look so worrisome in another three weeks, GDP will also see some very substantive haircuts which may effectively eliminate much if not all purported "growth" in 2023.

Finally, Deutsche Bank's Jim Reid agrees, and in a recent note he writes that while tomorrow's revisions could make GDI look more healthy (interest payments add income to parts of the economy) they could "also make interest costs in the economy look more realistic and hurt fundamental models of interest cover for those indebted." As such, "the revisions are potentially an important event and could make us think differently about the US economy in the recent past and therefore the future" especially if it is revealed that due to faulty data, the Fed kept hiking in the first half of 2023 even though true GDP was flat if not outright negative.

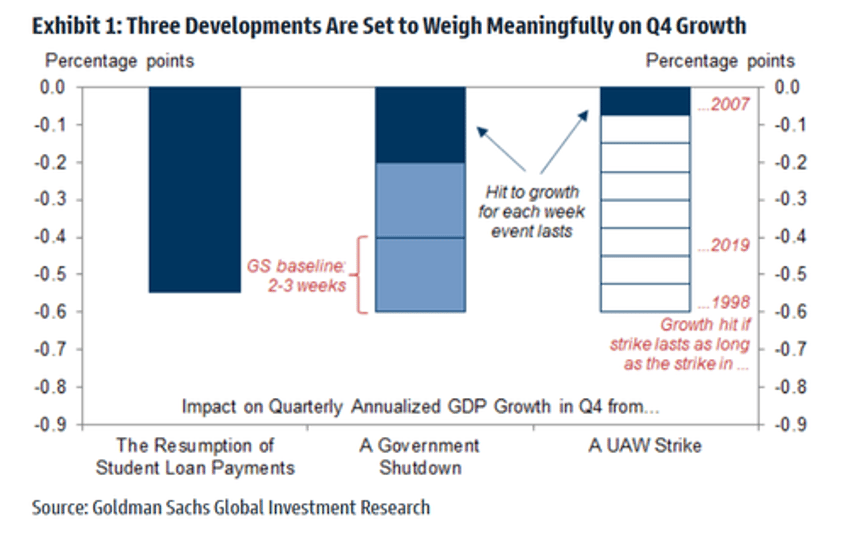

And if the sharp historical revision to GDP wasn't enough, the coming plunge in Q4 GDP on the back of...

- The resumption of student loan payments, which will subtract (at least) 0.5% (and likely much more) from quarterly annualized GDP growth

- The government shutdown which will reduce quarterly annualized growth by 0.2% for each week it lasts

- The ongoing UAW auto strike which reduces quarterly annualized growth by 0.05-0.10% for each week it lasts.

...which will almost certainly push the economy into contraction, should be sufficient to put a sharp stop to any further surge in either the dollar or US interest rates.

More in the GDI/GDP reports from JPM, DB and Morgan Stanley