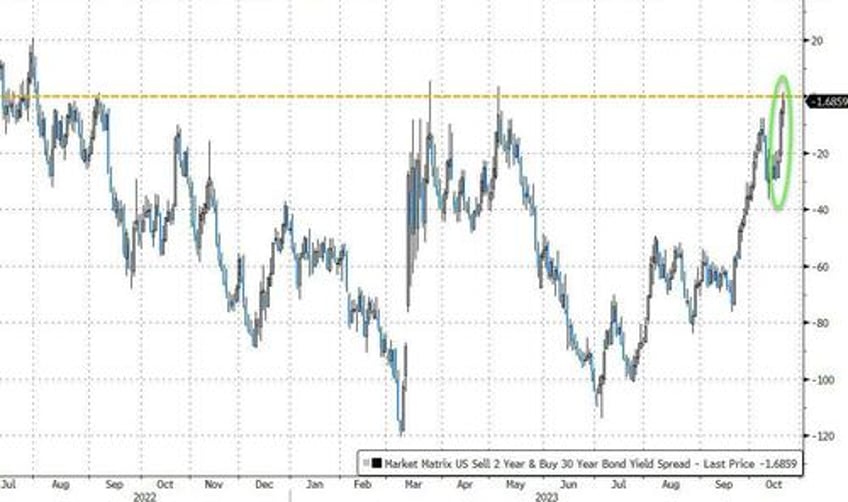

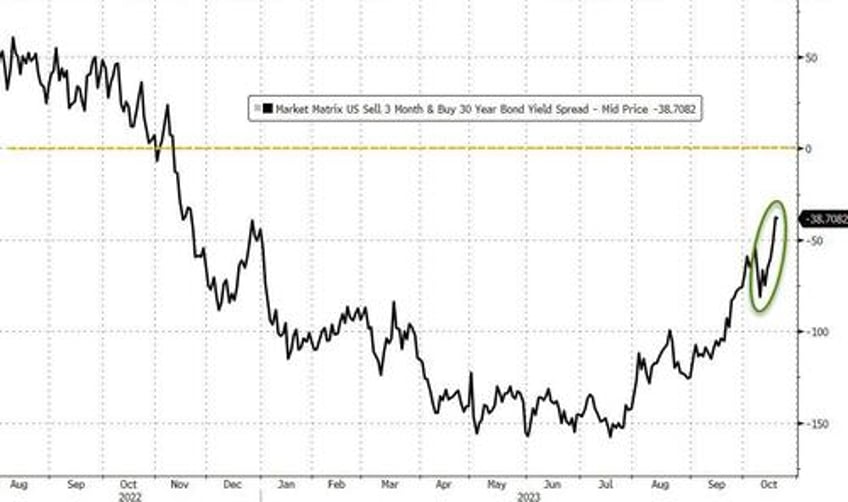

An inverted curve lights the fuse but the un-inversion is 'the bad part' signaling imminent recession...

...and today we saw the 2s30s curve go positive once again and closed at its 'steepest' since Aug 2022...

Source: Bloomberg

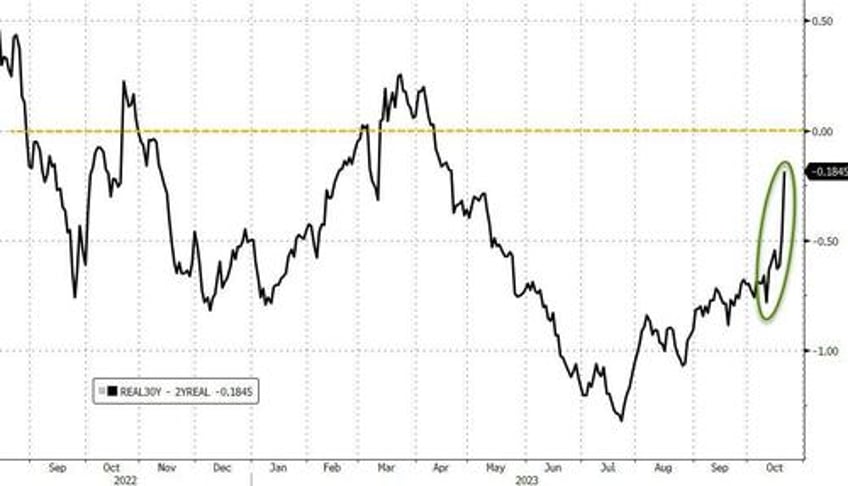

Additionally, the 'real' yield curve steepened dramatically, also pushing back up towards un-inverted...

Source: Bloomberg

The steepening is extremely evident in the week's moves across the curve with 2Y up just 3bps and 30Y up 33bps...

Source: Bloomberg

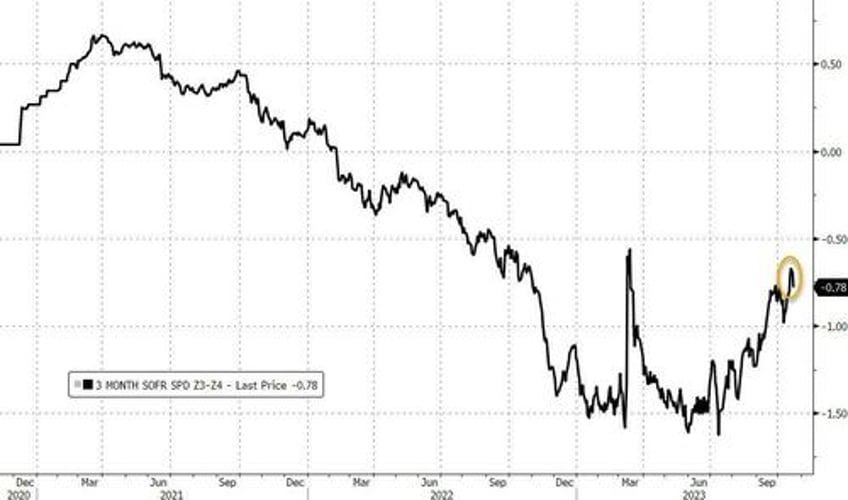

There was also a notable swing in rate-cut expectations for next year. While we zoomed out for context in the chart below, this week saw rate-cut expectations drop from 84bps to 67bps and then reverse back to 78bps (of cuts) after Powell...

Source: Bloomberg

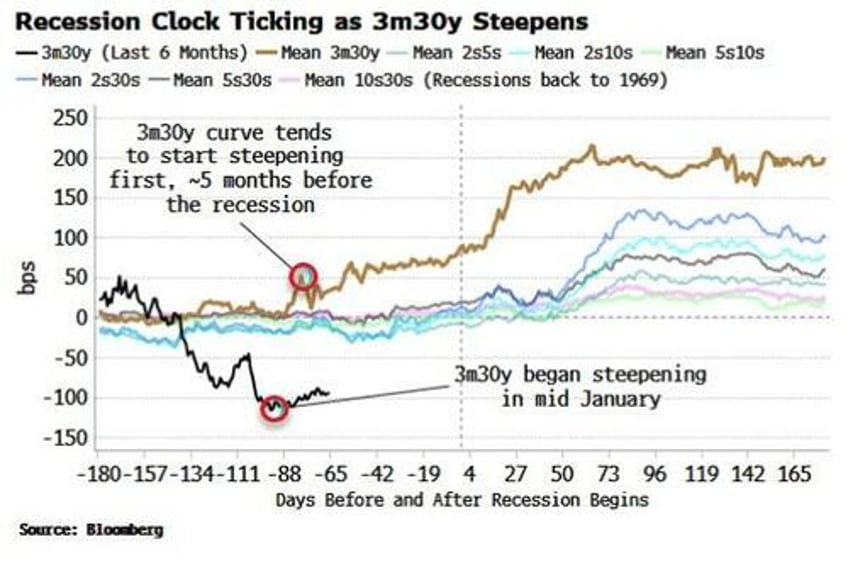

As we discussed previously, this is a warning sign because inverted yield curves precede recessions, but it’s the re-steepening that signals the downturn is going to hit sooner rather than later.

Source: Bloomberg

Historically it is the 3m30y yield curve that has started steepening first before a recession, beginning to rise about five months before its onset. It began in mid-January, which would put a downturn starting as early as June. The spread between 3-month and 30-year yields is about minus 84 basis points, versus the January low of minus 115 basis points.

And 3m30Y has been steepening dramatically this week...

Source: Bloomberg

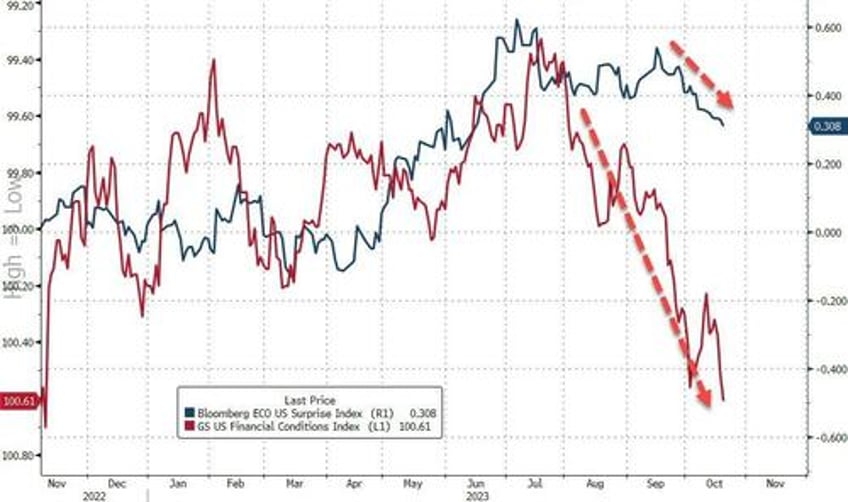

And before we leave bond-land, we note that financial conditions are now at their tightest since Nov 2022.... and it looks like its starting to drag on the real economy...

Source: Bloomberg

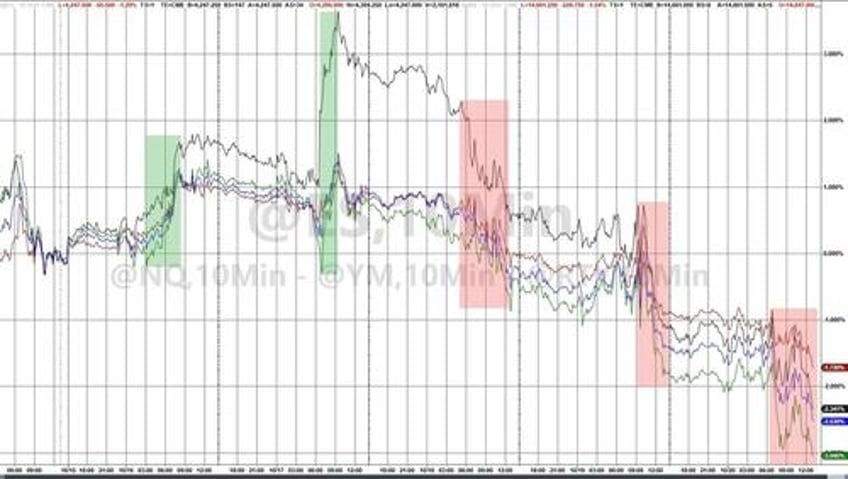

Equity markets did not like this 'high for long' adjustment, especially longer-duration (big tech) as Nasdaq led the week's weakness, down 3%. Equities went out at their lows...

Under the hood today (a monthly OpEx), 0-DTE traders were fighting the down-trend all day - buying calls early and dumping puts later...

Source: SpotGamma

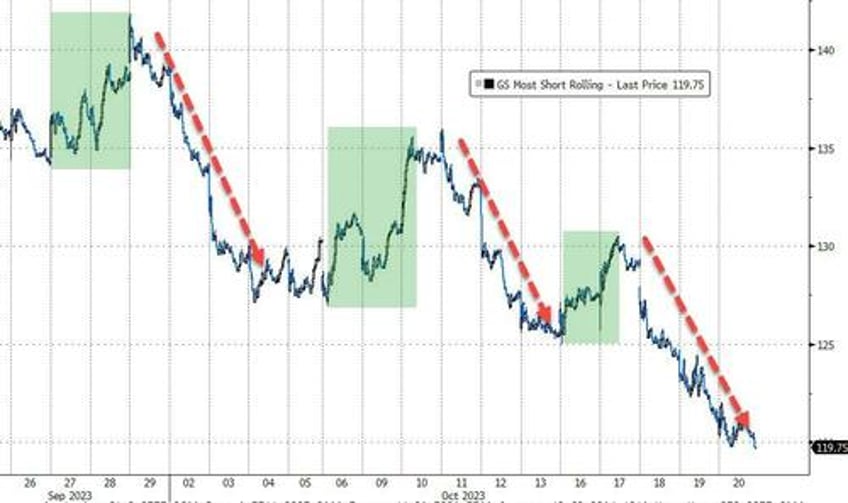

This week saw the 3rd major shorting wave in October with 'Most Shorted' basket dumping...

Source: Bloomberg

Energy and Staples were the week's only green sectors with Discretionary and Real Estate hammered...

Source: Bloomberg

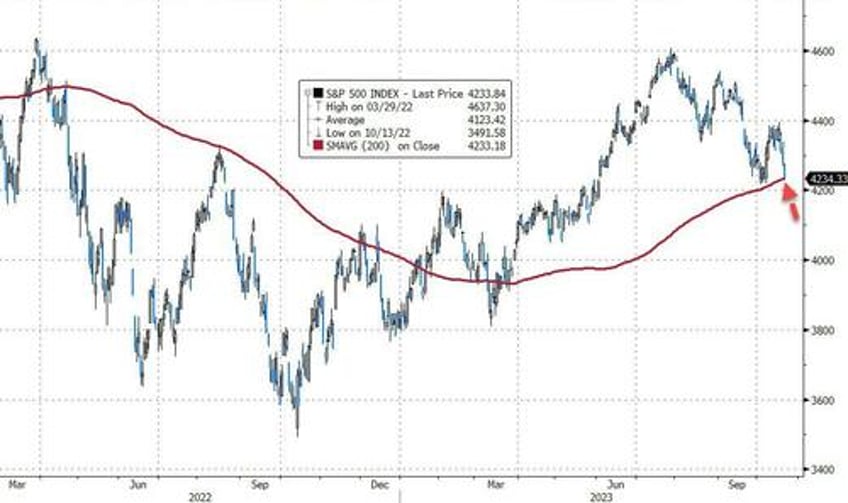

The S&P broke below its uptrendline from September and reached down to its 200DMA

Source: Bloomberg

Regional banks were clubbed like a bay seal this week, now below SVB spike lows...

Source: Bloomberg

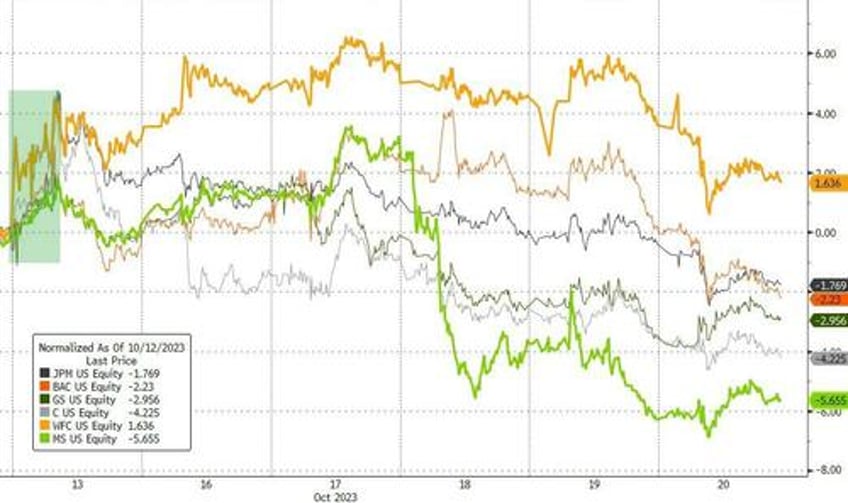

The big banks were very mixed with WFC outperforming since earnings began (and the only one green) and MS the biggest loser...

Source: Bloomberg

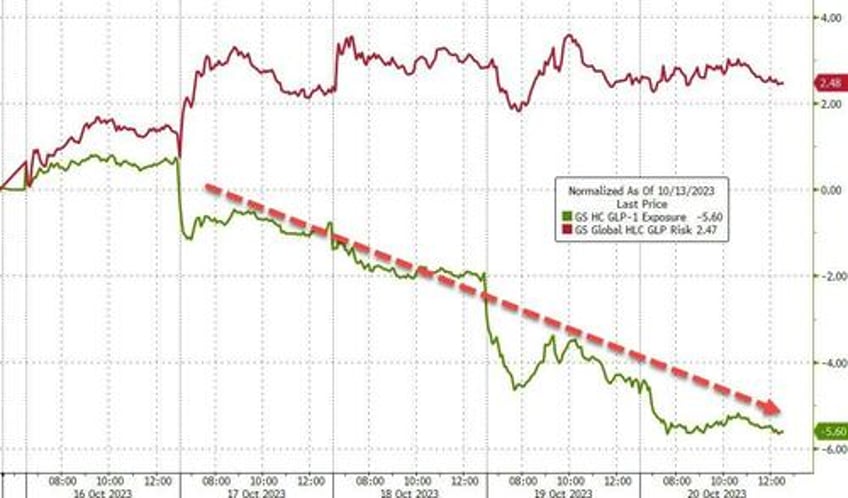

Of particular note, the GLP-1s (Anti-Obesity drugs) significantly underperformed this week...

Source: Bloomberg

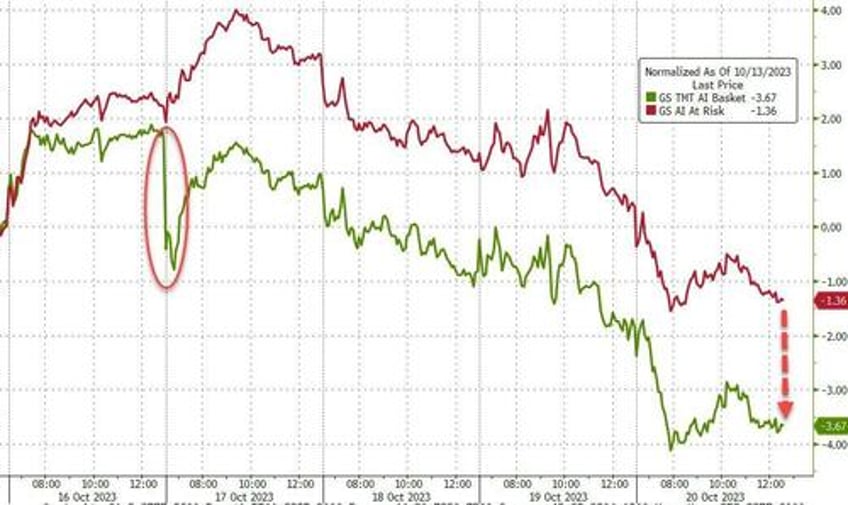

And AI-related names underperformed the AI-at-risk names (amid an admittedly weak market for tech)...

Source: Bloomberg

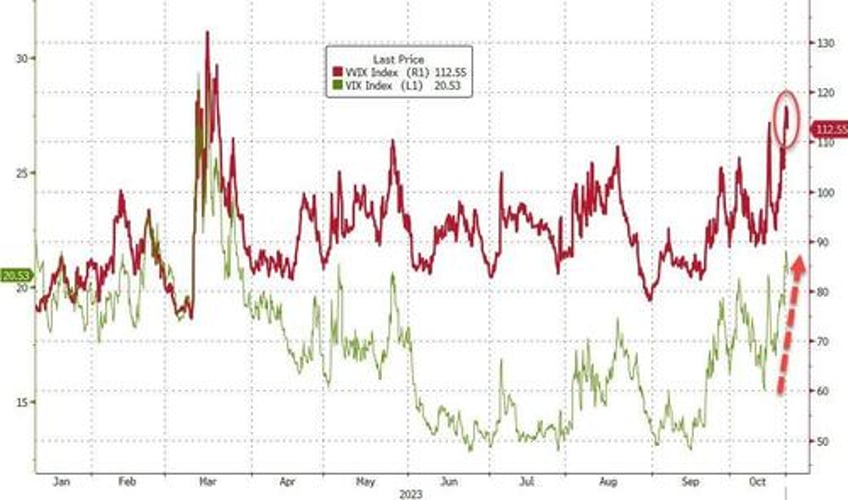

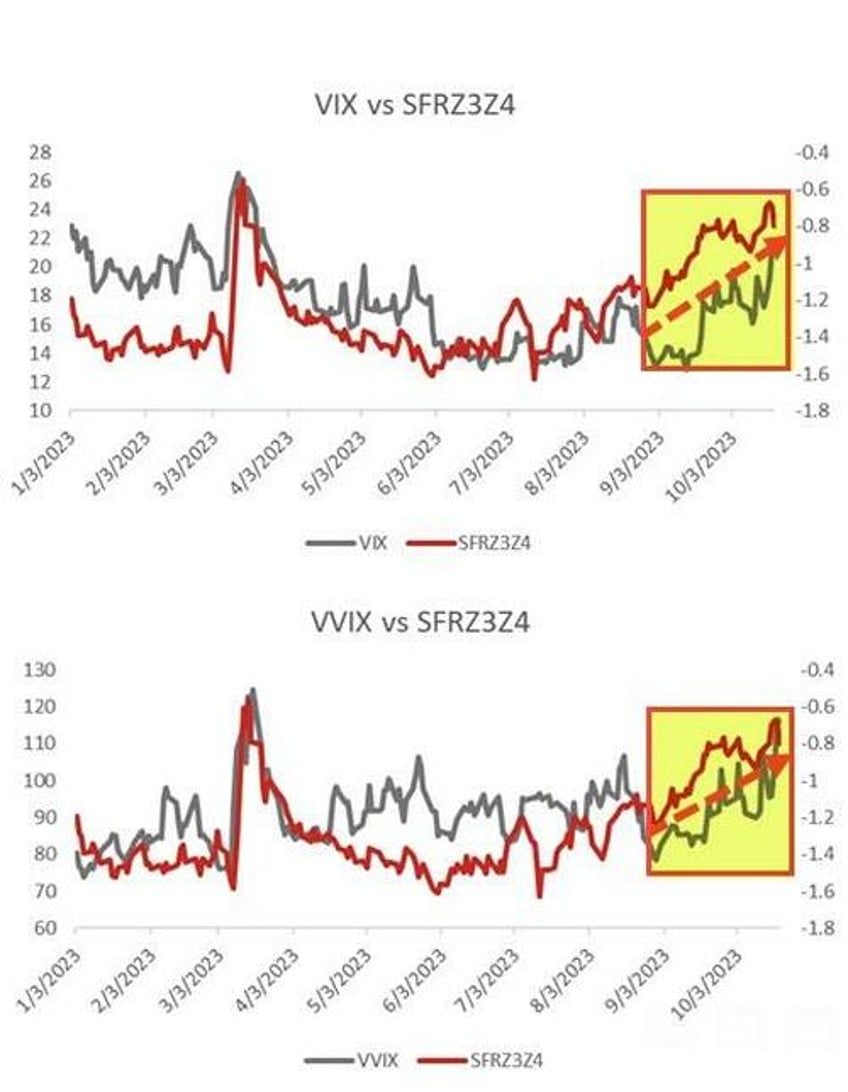

VIX is on the rise (finally) back above 20 but as Nomura's Charlie McElligott warns, make no mistake: there is no “all clear” [to sell 'high vol'] when “Vol of Vol” VVIX remains parked at 115...

Source: Bloomberg

...which tells you that via “demand for Tails” and a broader distribution of market outcomes that we can remain “stressed,” particularly as client hedging is moving away from short-dated “1 day event risk” and now, into the “unknowable” - where you add geopolitics now on top of the “real risk” being the Credit cycle turn.

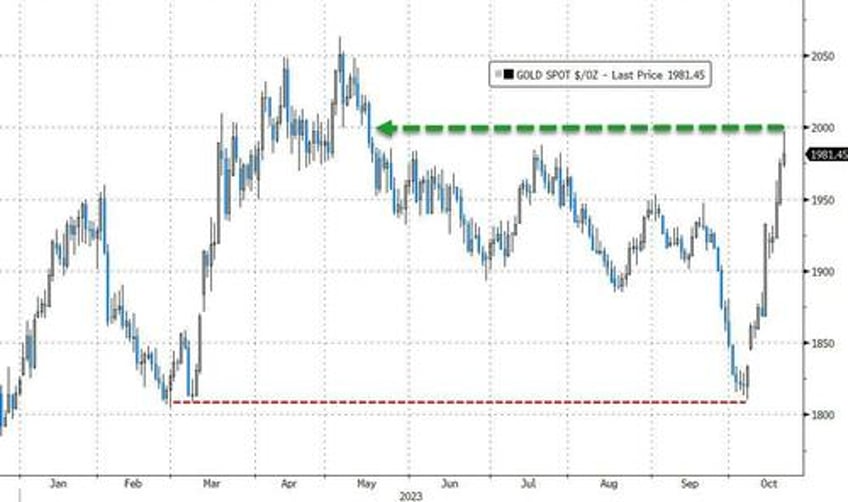

While VIX was rising, Gold surged this week with spot prices very close to breaking $2000...

Source: Bloomberg

Oil rallied on the week with WTI getting close to $90 intraday before sliding today...

Bitcoin also caught a safe-haven (and ETF-driven) bid...

"Bitcoin is more user-friendly, stable, and global than some local currencies, especially in geopolitical conflicts and sanctions. In other words, the more unrest and uncertainty in the world, the more value bitcoin demonstrates, it's a sad truth," BTCM Chief Economist Youwei Yang told The Block.

"Bitcoin's resilience, especially when juxtaposed with the recent downturns in stock market indices, lends credence to the narrative that the digital asset serves as a potential hedge in tumultuous times, akin to gold," Sei Labs Co-Founder Jeff Feng added.

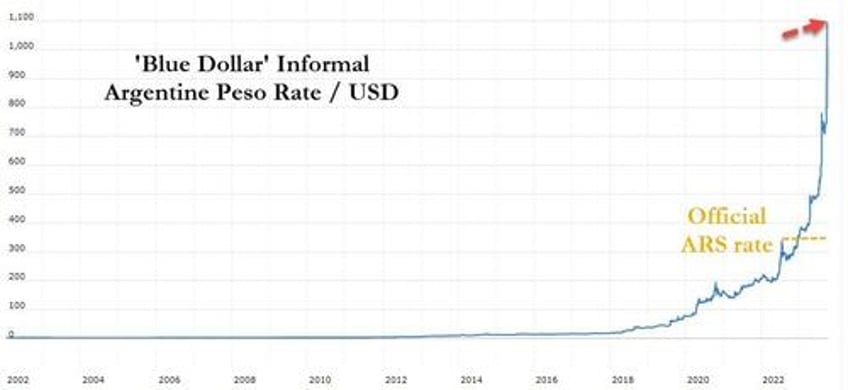

Talking of panic and capital ouflows (which also surged in China), the black market price for the Argentine Peso crashed 10% to 1100/USD (the official-ish price has been 'capped' at 350/USD for 3 months)...

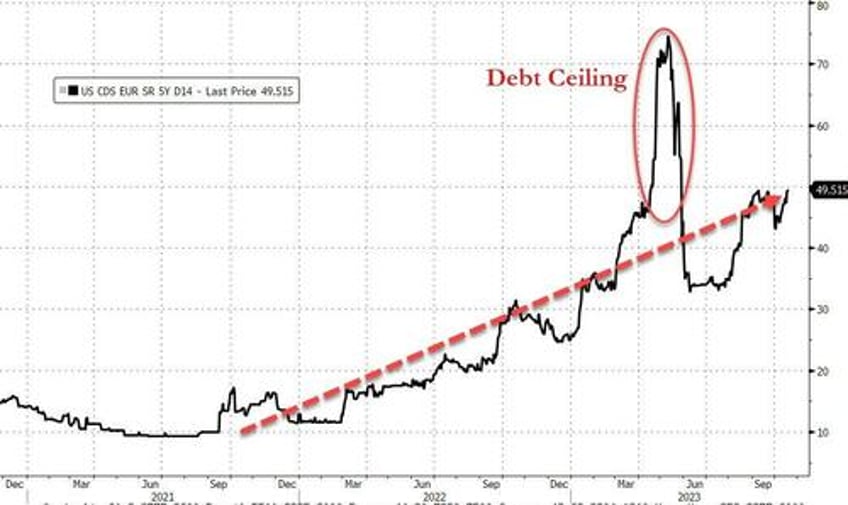

Finally, this is worth paying attention in the context of surging US interest rates...

Source: Bloomberg

...since the Biden administration came into office, the risk of a US sovereign credit event has risen by 5x and are on the rise again now back to levels last seen during the debt-ceiling debacle. That trend is not Americans' friend (and is perhaps why gold has been so bid).