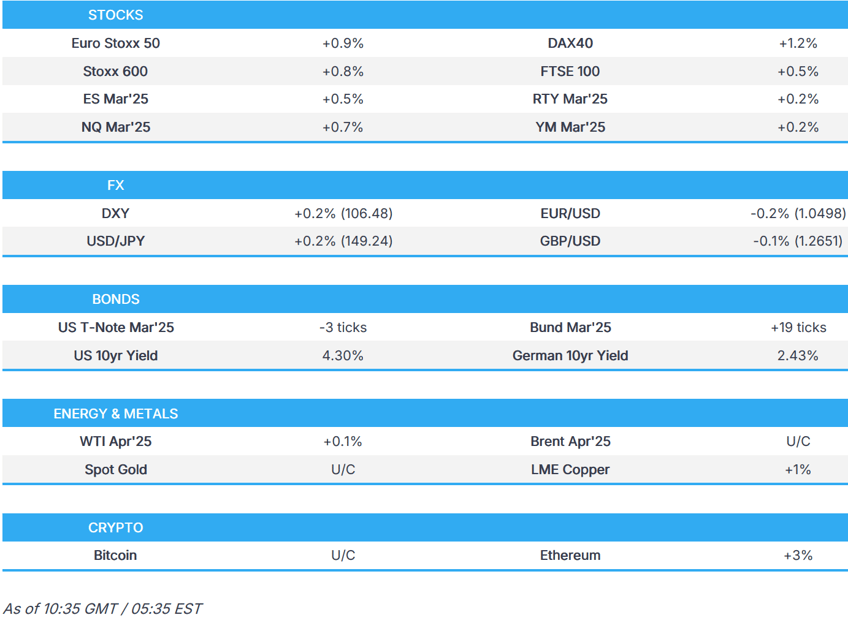

- European bourses gain and currently reside at highs; US futures also stronger with NQ outperforming ahead of key NVIDIA results.

- DXY attempts to claw back recent losses, EUR/USD lingers around 1.05.

- USTs are off lows but remain in the red while EGBs inch higher.

- Crude choppy, gas subdued, but metals hold a positive bias as the complex digests Trump tariff investigations into copper.

- Looking ahead, US New Homes Sales, Speakers including ECB's Lagarde & Cipollone, BoE’s Dhingra, Fed’s Barkin & Bostic, French President Macron, Supply from the US, Earnings from NVIDIA, Snowflake, Salesforce, Lowe's, NRG Energy, Advance Auto Parts.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

TARIFFS/TRADE

- US Commerce Secretary Lutnick said they will investigate the possible imposition of tariffs to rebuild the US copper industry and there will be no exemptions or exceptions, as well as stated it is time for copper to come home. Furthermore, Trump trade adviser Navarro said, similar to actions in steel and aluminium markets, China is using industrial overcapacity and dumping to gain control of the world's copper market, while a White House official said President Trump will recognise the copper sector as a national security issue and the Commerce Department will investigate under Section 232 with the investigation to look at raw mined copper, concentrates, refined copper, copper alloy, scrap copper and derivative products.

- US President Trump confirmed he requested the Secretary of Commerce and USTR to study copper imports and end unfair trade putting Americans out of work, while he added tariffs will help build back the American copper industry.

- USTR announced a proposal for new port fees targeting Chinese shipping companies and vessels.

EUROPEAN TRADE

EQUITIES

- European bourses (STOXX 600 +0.8%) opened stronger across the board and have continued to slowly grind higher as the session progressed; currently at highs.

- European sectors hold a strong positive bias; Basic Resources is by far the clear outperformer, lifted by strength in metals prices (amid US Commerce Secretary Lutnick's copper comments). Media and Telecoms are both hampered by post-earning losses in Wolters Kluwer (-5%) and Deutsche Telekom (-3.8%) respectively.

- US equity futures are firmer across the board with clear outperformance in the tech-heavy NQ (+0.8%), ahead of after-hour earnings from NVIDIA (+2.6% pre-market).

- DeepSeek is lowering its off-peak API pricing by up to 75%, according to a statement.

- BP (BP/ LN) strategy reset; strategic review of Castrol, reducing annual Capex to USD 13-15bln to 2027, USD 20bln divestments by 2027, targeting 20% compound annual growth in adj. FCF to 2027.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

NVIDIA PREVIEW

- The AI darling NVIDIA will report its quarterly earnings on Wednesday, February 26th, at 21:20 GMT/16:20 EST.

- Ahead of the release, KeyBanc believes NVIDIA's strong results should ease concerns that DeepSeek could hinder near-term AI capital expenditure. Despite previous worries over constraints related to the ramp-up of GB200 NVL servers, KeyBanc anticipates NVIDIA will exceed expectations and offer guidance for Q1 that is conservatively and moderately higher than consensus. Separately, Susquehanna expects a beat/raise, though more in line with recent reports due to near-term concerns regarding GB200 delays and pushbacks.

- NVIDIA's Q4 EPS is expected to be USD 0.83, with revenue forecast at USD 35.08bln. The consensus breakdown shows Data Centre revenue at USD 30.77bln, Gaming at USD 3.28bln, Professional Visualisation at USD 486mln, and Automotive at USD 449mln. Gross profit margin is expected at 73.5%, with operating expenses at USD 3.4bln. For Q1, forward guidance sees revenue at USD 55.93bln and EPS at USD 1.25.

- Click for a full Newsquawk NVIDIA preview

FX

- USD is attempting to claw back Tuesday's losses which were in part triggered by the ongoing pullback in US yields with the latest leg lower led by a disappointing Consumer Confidence print. Elsewhere, events on Capitol Hill are increasingly in focus after the US House passed the Republican budget blueprint for advancing the Trump agenda and sent the measure to the Senate. DXY has ventured as high as 106.55 vs. Tuesday's 106.78 peak. Note, if DXY reverses course, the YTD low sits at 106.16.

- EUR is marginally softer vs. the USD. Aside from ongoing focus for the bloc on efforts to fund the EU's increased defence needs, macro drivers are relatively light. This morning's GFK consumer sentiment data fell short of expectations, however, this has been largely shrugged off given the need to see how the coalition building process in Germany develops. EUR/USD is currently pivoting around the 1.05 mark.

- USD/JPY hit a fresh YTD low overnight at 148.56 in the aftermath of yesterday's risk-averse moves in the US which acted as a drag on US yields. Fresh macro drivers out of Japan are lacking and therefore the USD leg of the equation may remain the driving force for the pair in the near-term. USD/JPY has ventured as high as 149.63 with focus on a potential reclaim of the 150 level.

- GBP marginally softer vs. the USD and flat vs. the EUR. Fresh macro drivers for the UK are lacking aside from yesterday's announced increase in defence spending which is ultimately not set to move the dial on the fiscal front given that money from elsewhere will be reassigned to fund it. Cable is currently contained within Tuesday's 1.2606-78 range, ahead of BoE's Dhingra.

- Antipodeans are both softer vs. the broadly stronger USD. AUD/USD is now down for a fourth consecutive session after printing a YTD peak on Feb 21st at 0.6408. Overnight data saw disappointing Construction Work data (which feeds into Australia's GDP) and an in-line print for monthly CPI (Weighted CPI YY 2.50% vs. Exp. 2.50%, Prev. 2.50%).

- Deutsche Bank month-end model: a reasonable shift towards USD buying, most pronounced vs European equities and as such points toward EUR/USD supply.

- PBoC set USD/CNY mid-point at 7.1732 vs exp. 7.2526 (prev. 7.1726).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- An upward bias is present, though USTs remain in the red, a move off lows which began in the European morning despite a lack of specific drivers at the time and was potentially a function of a bout of pressure in the crude space weighing on yields. As it stands, USTs are at the mid-point of a 110-08 to 110-19+ band and while they have been in the green on a few occasions the moves have been fleeting at best and minimal in nature. Today’s session is largely a waiting game until the after-hours numbers from NVIDIA. However, we do get Fed’s Barkin & Bostic alongside a 7yr auction and more executive orders from POTUS beforehand.

- Bunds are firmer, picked up in the early European morning in tandem with the mentioned move in USTs. Aside from energy dynamics, drivers behind the move at the time were limited. Since, with newsflow quiet and despite a pick-up in the crude benchmarks, EGBs remain in the green and just off best. Specifically, Bunds picked up from a 132.24 base to opening levels of 132.47 in the early morning and then extended to a 132.76 peak after the cash open. Ahead traders will keep an eye out for remarks from French President Macron who is set to provide other EU leaders with a summary of his meeting with US President Trump. No move to the 2038/2036 Bund auctions.

- Gilts are in-fitting with EGBs. UK specifics have been very light so far as we await UK PM Starmer’s PMQs appearance for fresh insight into the defence spending increase he announced on Tuesday and details ahead of his US trip on Thursday. Gilts at the upper-end of a 93.07 to 93.48 band.

- Germany sells EUR 1.252bln vs Exp. EUR 1.5bln 1.00% 2038 and EUR 400mln vs exp 500mln 0.00% 2036 Bunds.

- Click for a detailed summary

COMMODITIES

- Choppy trade across the crude complex once again after prices tumbled on Tuesday as soft consumer confidence data added fears to the demand side of the equation. Newsflow for the complex has been light this morning, although a mild dip was seen around the time Trafigura's Global Oil Head Lockock suggested the oil market is pricing out geopolitical risk, and that OPEC will be pragmatic in its approach to oil supply. Brent Apr in a USD 72.40-72.81/bbl parameter.

- Upward bias across precious metals in what is seemingly a recovery of recent losses and come despite the firmer Dollar this morning. Spot gold resumed its gradual rebound from yesterday's trough with the precious metal back above the USD 2,900/oz level.

- Copper futures continue to be underpinned following a power surge in Chile which affected all of state miner Codelco's mines and prompted a state of emergency declaration, while prices were further boosted overnight on reports that the Trump administration will investigate the possible imposition of tariffs to rebuild the US copper industry. 3M LME copper trades on either side of USD 9,500/t in a USD 9,454.90-9,558.00/t range.

- US Private Inventory Data: Crude -0.6mln (exp. +2.6mln), Distillate -1.1mln (exp. -1.5mln), Gasoline +0.5mln (exp. -0.9mln), Cushing +1.2mln..

- Serbia's increases crude oil and fuel reserves to supply market for at least three months, according to the energy minister.

- Kazakhstan's Energy Ministry says 2025 oil output at Tengiz seen at 34.8mln T.

- Click for a detailed summary

NOTABLE DATA RECAP

- German GfK Consumer Sentiment (Mar) -24.7 vs. Exp. -21.4 (Prev. -22.4, Rev. -22.6)

- French Consumer Confidence (Feb) 93.0 vs. Exp. 93.0 (Prev. 92.0)

- South African CPI MM (Jan) 0.3% vs. Exp. 0.3% (Prev. 0.1%); YY (Jan) 3.2% vs. Exp. 3.3% (Prev. 3.0%)

NOTABLE EUROPEAN HEADLINES

- BRC warned 160k part-time retail jobs are at risk of being axed over the next 3 years due to higher employer taxes announced in the Budget and regulatory changes.

- EU Commission proposes to mobilise EUR 100bln of funding to support EU-made "clean" manufacturing; EUR 1bln from current budget will be part of guarantees.

NOTABLE US HEADLINES

- US President Trump said will begin a program to sell 'Trump gold cards' for USD 5mln for foreigners who want to come to the US and create jobs with the sale of gold cards to start in about two weeks.

- White House Press Secretary said US President Trump is looking at the House and Senate budget proposals.

- US House passed the Republican budget blueprint for advancing the Trump agenda after reversing course on cancelling the vote and sent the measure to the Senate.

- The US House Ways and Means Committee has reportedly had discussions about options like ratcheting up taxes on public companies’ stock buybacks or adjusting limits on deducting executive pay, according to sources cited by Punchbowl. "Proposals such as raising endowment taxes on universities and significant cuts to clean energy tax credits are being viewed as even more likely"

GEOPOLITICS

MIDDLE EAST

- Mediators in Egypt and Qatar with the US administration are reportedly pushing towards the start of negotiations for the second phase of the Gaza agreement", according to Palestinian sources cited by Al-Sharq.

- Egypt Investment Minister says the details of the Gaza plan will be decided on the 4th of March.

- Israeli air force targeted military bases of the former Syrian army and destroyed "weapons means" in Damascus, while Israel's Defence Minister said they will not allow a repeat of the experience of southern Lebanon in southern Syria and will not allow the stationing of Syrian forces in the buffer zone.

- Hamas appointed new commanders and is regrouping its military forces for a potential return to fighting with Israel in Gaza as mediators work to salvage the ceasefire that expires this weekend, according to WSJ.

- US Secretary of State Rubio and Saudi Arabia's Defence Minister discussed ways to promote peace and stability in Syria, while they also discussed ways to promote peace and stability in Lebanon, Gaza, and across the region

- Israel is said to be pursuing an indefinite extension to the first phase Gaza ceasefire rather than moving to a planned second stage meant to end the conflict, according to FT sources.

RUSSIA-UKRAINE

- Russia's Kremlin says expert-level talks with the US are being prepared; no current plans for a US President Trump/ Russian President Putin call, but may take place if necessary; still interested in implementing economic cooperation in "different" areas.

- US President Trump said Ukrainian President Zelensky would like to sign a minerals deal with him, while Trump stated that they have pretty much negotiated their deal on rare earths and would like to get access to Russian rare earths.

- Russian Foreign Minister Lavrov says they don't consider the option of European troops deployment in Ukraine.

TAIWAN

- Taiwan dispatches forces after China announces 'shooting' drills off island, says Taipei defence ministry via AFP

CRYPTO

- Bitcoin is a little firmer having stabilised from the hefty losses seen in the prior session; BTC currently around USD 89k.

APAC TRADE

- APAC stocks traded mixed as a tech rally in China offset the weak handover from Wall St where the Nasdaq led the declines once again and risk appetite was sapped by weak consumer confidence data.

- ASX 200 was led lower by weakness in mining, materials and consumer staples as participants digested disappointing Construction Work data which feeds into Australia's GDP and with supermarket operator Woolworths pressured post-earnings.

- Nikkei 225 fell beneath the 38,000 level for the first time this year with the index underperforming following recent currency strength although was off worst levels as the yen then pared some of its recent advances.

- Hang Seng and Shanghai Comp gained with Hong Kong leading the advances amid tech strength and recent earnings, while Hong Kong continued to record a higher deficit for this year in the Budget and will increase the scale of bond issuances.

NOTABLE ASIA-PAC HEADLINES

- China to reportedly start recapitalizing banks with at least USD 55bln, according to Bloomberg sources.

- Chinese President Xi urged to maintain stability across and calmly address domestic and international challenges.

- Hong Kong Financial Secretary delivered the Budget address and noted Hong Kong continues to record a higher budget deficit this year and will increase the scale of bond issuance, while the government aims to reduce accumulated expenditure by 7% in the fiscal year 2027-2028. Hong Kong's government announced a reduction in salaries tax payable by 100% capped at HKD 1,500 and the HKMA is to launch a new CNY 100bln facility for renminbi trade financing liquidity support for banks.

- China's NFRA and NDRC held a meeting on additional support for private firms; NFRA is to increase support for tech and private companies, according to Bloomberg. Has vowed to optimise the equity investment environment.

DATA RECAP

- Australian Weighted CPI YY (Jan) 2.50% vs. Exp. 2.50% (Prev. 2.50%)

- Australian Annual Trimmed Mean CPI YY (Jan) 2.80% (Prev. 2.70%)

- Australian Construction Work Done (Q4) 0.5% vs. Exp. 1.0% (Prev. 1.6%)