By Grant Smith, Bloomberg Markets Live oil reporter

The biggest question in oil markets is how long Saudi Arabia will extend its 1 million-barrel-a-day supply cut. Riyadh’s handling of a previous strategy offers some guidance -- and reassurance -- for crude bulls.

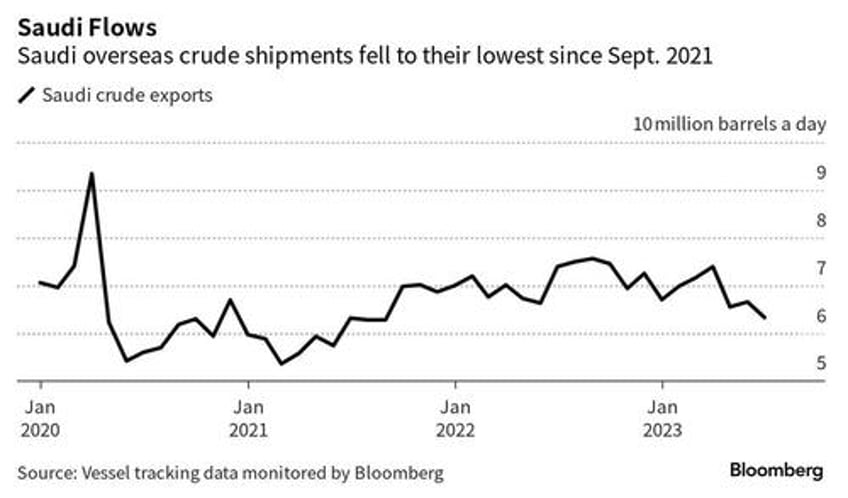

The kingdom launched the unilateral cutback last month in a bid to shore up global oil markets, undertaking the solo effort as its comrades in the OPEC+ coalition had already cut output as much as they could bear. It’s had some qualified success, boosting Brent prices to a three-month high above $85 a barrel in London.

The Saudis have committed to extending the measure into August, and OPEC-watchers expect that Riyadh will announce a further continuation into September this week. Traders are bracing for a statement from Saudi state media in the next couple of days, before an OPEC+ monitoring committee convenes to assess markets on Friday.

To understand what the world’s biggest crude exporter may do after that, it’s useful to consider how it handled a similar intervention two years ago.

In January 2021, the Saudis announced a unilateral 1 million-barrel cut to amplify the efforts of its OPEC+ brethren, to take effect in February and March. It was subsequently extended for one more month, and then unwound in stages over the following three months.

One lesson to draw is that the kingdom is prepared to go it alone with supply curbs for a considerable period; it’s quite possible that the restraints adopted in early 2021 could have lasted longer if others in OPEC+ hadn’t been so eager to increase production.

But at the same time, the limited three-month span of the move shows the Saudis won’t make such sacrifices indefinitely. Energy Minister Prince Abdulaziz bin Salman has described this summer’s curbs as a “lollipop” for markets — and at some point all treats must be taken away.

Perhaps the most important final lesson is that, when it comes to restoring shuttered supplies, Riyadh prefers a cautious and gradual approach rather than any sudden moves.

As a result, we may see the latest 1 million-barrel reduction eventually unwound in piece-meal stages. And that ought to give confidence to oil bulls betting that the current rally can go further.