Just as we predicted in our CPI preview, where we said that "a hawkish print is more likely than a dovish print", moments ago the BLS reported that both headline and core inflation came in slightly hotter than expected in December, driven as usual by shelter inflation (food prices hit an all time high but that was expected) which not only accounted for more than half of the "all items" increase, but was also the largest factor in the monthly increase for core items.

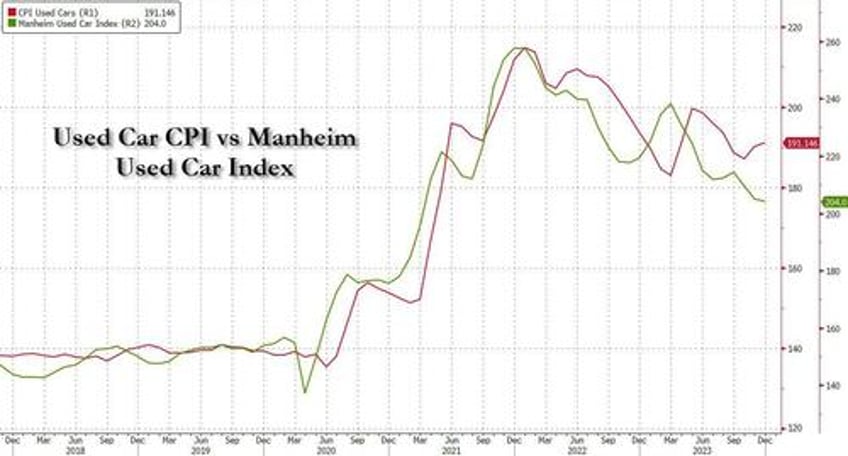

That was not a surprise; what was is that according to the BLS, the used car CPI index rose 0.5% after rising 1.6% in November, even though the much more accurate Manheim index has tumbled to the lowest level in three years.

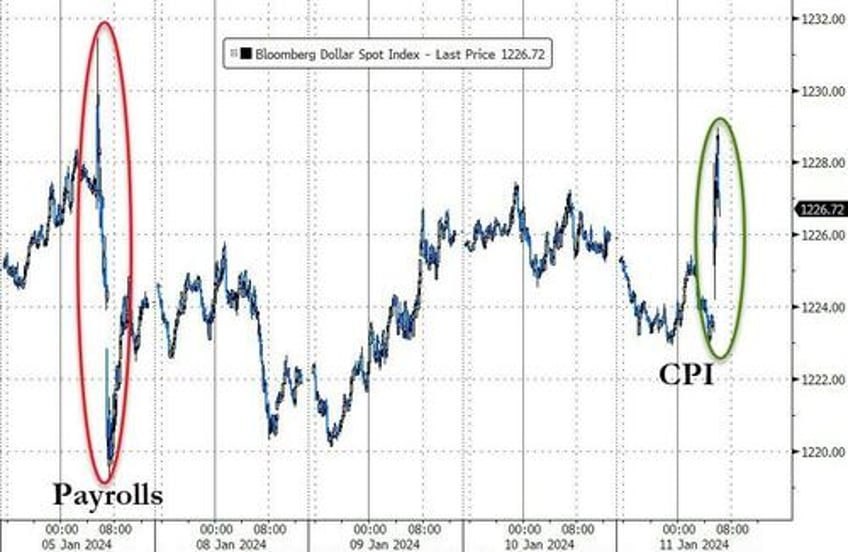

And since it was the used car index that was the swing factor between a core CPI beat and a miss, the confusion in the market was to be expected; here, we saw the Bloomberg dollar index surge to where it was right before last week's jobs number, only to reverse much of the initial gains...

... with yields similarly kneejerking higher before resuming their slide lower...

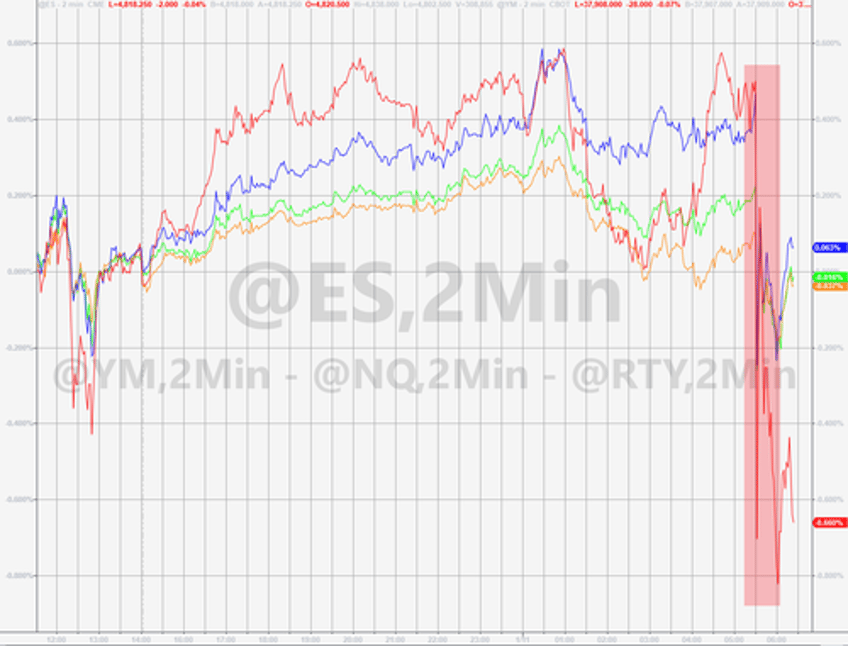

... while stocks dumped instantly, only to reverse higher.

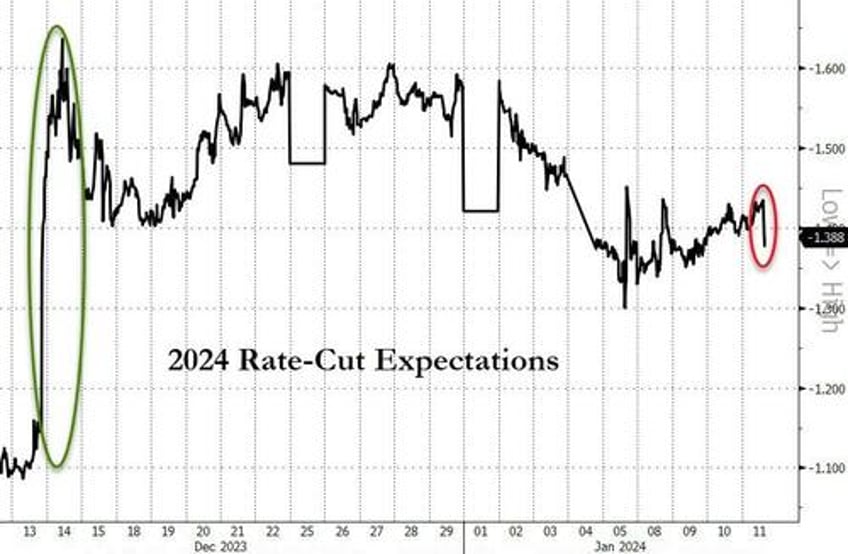

And while the market has yet to find its bearing, as it jumps around, the reaction by Wall Street pundits and traderswas more muted. Here consensus was that if one strips away the outlier elements, the closely watched - by Powell and his peers - supercore services print rose 3.9% on a year-on-year basis, same as in November, and was also little changed from the 0.4% monthly increase in November. The fact that this category appears to have bottomed isn’t helping the Fed right now: as Bloomberg notes, "there were soft readings from April to July, but it’s picked up again unfortunately for policymakers." Still the overall trajectory remains lower, which is why market expectations for 2024 rate cuts did not really move all that much.

Here are some of the more notable comments in response to the CPI report:

Richard Flynn, managing director at Charles Schwab

Today’s increase in the rate of inflation will be a change that will likely be interpreted by the market as unwelcome, but unsurprising. If today’s report is the start of an upward pattern, there is a good chance that the Fed will delay rate cuts until later than previously expected. It looks like the market may have jumped the gun in penciling in as many as six Federal Reserve rate cuts in 2024.”

Seema Shah, Principal Asset Management

"The report underscores the fact that market participants had gotten a little overexcited around the timing of rate cuts. These are not bad numbers, but they do show that disinflation progress is still slow and unlikely to be a straight line down to 2%. Certainly, as long as shelter inflation remains stubbornly elevated, the Fed will keep pushing back at the idea of imminent rate cuts.”

Brian Coulton, chief economist at Fitch Ratings:

“Looking through the small rise in headline inflation - which was due to energy prices rising -- I think the message from this release is that core inflation is proving sticky....This will give the Fed grounds for caution and they are unlikely to cut rates as quickly as the markets currently expect.”

Alexandra Wilson-Elizondo, Goldman Sachs Asset Management,

"There is nothing in the report that will push the Fed to cut rates sooner. However, because it was not too hot, it should leave the hopes of a soft landing intact. Ultimately, we are focused on the labor market to dictate the speed and extent of the cutting cycle, and we continue to believe the middle of the year to be more appropriate to start.”

Ali Jaffery, economist at CIBC Capital Markets

“Even though we are not fully there yet in year-over-year terms, the substantial progress on core inflation momentum will make the Fed less willing to tolerate a material slowing of the economy. We expect the Fed to start easing policy in the second half of this year.”

Jay Hatfield of Infrastructure Capital Advisors

"We continue to expect CPI core to approach the Fed’s 2% target after May due to strong base effects as the high inflation of early 2023 rolls off. This, will result in the Fed cutting rates at the July meeting and resulting in a total of four rate cuts in 2024."

Phillip Neuhart, First Citizens Bank Wealth Management

"The print is a reminder that the cooling of inflation to the Fed’s target will take time. With core inflation still near double the Fed’s target, we remain skeptical that the FOMC will cut the overnight rate as soon as the March meeting."

Ira Jersey, Bloomberg Econ US Interest Rate Strategist

“The modest beat of CPI probably won’t have a major effect on pricing for the Fed near term, but another 0.3% monthly print in the January print could take a March rate cut off the table, and less certainty of a May cut. If so, the yield curve would bear flatten a bit further.”

Bloomberg Economics’ Anna Wong says:

“The surprisingly strong CPI print shows the road to a durable return to 2% inflation is bumpy, and the last mile could be difficult. Some of the disinflationary impulse for core goods – a key driver of easing price pressures over the past few months — has faded. It likely will take more than the much-anticipated disinflation in rents for inflation to get to the Fed’s 2% target. That said, some categories that drove core CPI in December have lesser weight or depend more on producer prices in the Fed’s preferred inflation gauge, the PCE deflator. A definitive read on how the Fed sees the latest inflation figures will depend on PPI data out tomorrow.”

* * *

Finally, going back to bizarre spike in used car prices, it looks like the BLS will be applying a new methodology to used cars and trucks from this month. Here’s their primer:

“With the release of January 2024 data, the CPI program plans to update the mileage adjustment applied to each sampled used vehicle in the used cars and trucks index. Historically, a single, stable mileage amount estimated for a given make and model was applied to each sampled vehicle and was unchanged throughout the year. The assigned mileage amount will now be replaced with a monthly average mileage amount based on the age of the sampled used vehicle, and not the make and model. Each estimated price for a sampled used vehicle will still be adjusted for depreciation.”

In other words, this month's hot print will be followed by an "unexpectedly" cold report, just in time for the March rate cut...