Weird day... no macro, no FedSpeak, no notable geopolitical malarkey and yet, markets had a conniption (early on)...

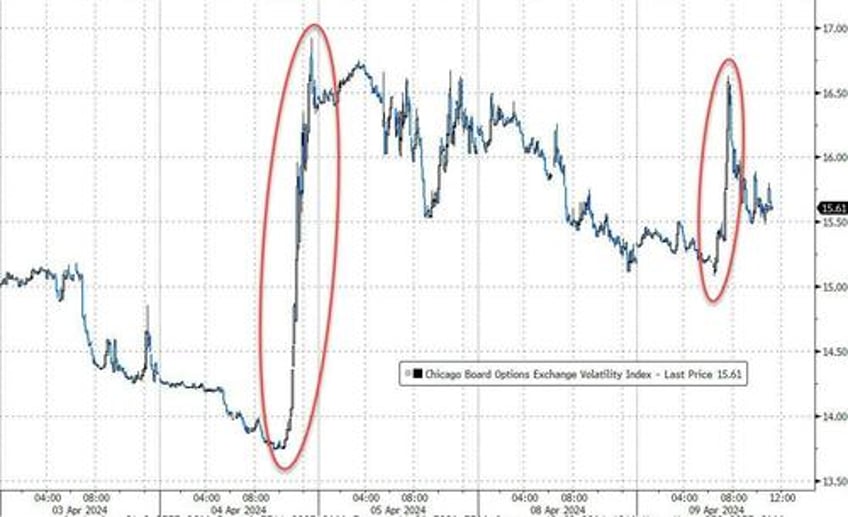

VIX spiked up, modestly reminiscent of last Thursday's manic episode (but we note that the market is implying just a +/-0.8/0.9% implied move in the S&P 500 to tomorrow's close)...

Source: Bloomberg

Stocks puked early (and dip-buyers stepped in). With around 30 mins left in the day Fed's Bostic said some shit and the market went into panic-bid mode. You decide if it made sense to rip higher:

*BOSTIC: IF JOB DATA SIGNALS PAIN TO COME, OPEN TO EARLIER CUTS

*BOSTIC: IF DISINFLATION PACE RESUMES, COULD PULL CUTS FORWARD

*BOSTIC: CPI COMING IN AT CONSENSUS WOULD BE WELCOME DEVELOPMENT

*BOSTIC: POSSIBLE MAY NEED TO DELAY CUTS "EVEN FURTHER OUT"

Seems like exactly more of the same 'data-dependent' crap from The Fed, but as you can see the algos loved it. That fit of buying lifted Small Caps and Nasdaq green (and S&P at the death)...

We note that 0-DTE traders were putting down-pressure on markets from the cash open (with heavy put-buying), then the early 0-DTE call-buyers capitulated (which snapped stocks lower around 1030ET). The rest of the day saw call-buyers return and 0-DTE flow flat on the put-side...

Source: SpotGamma

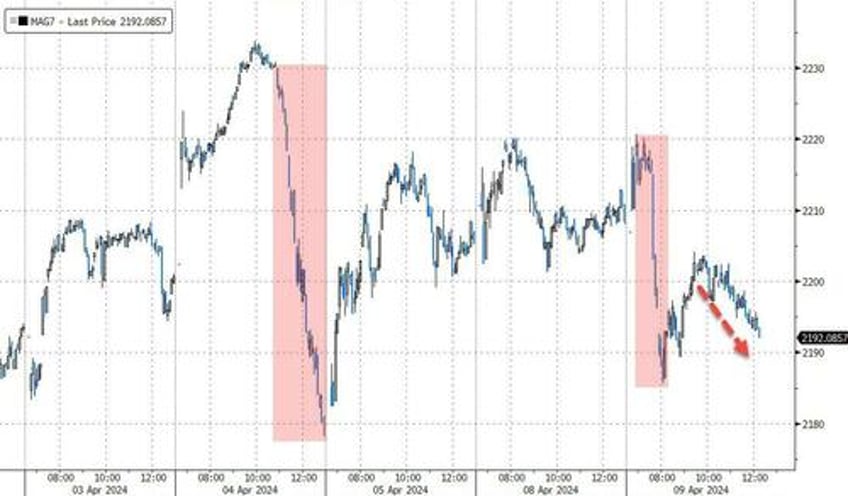

The basket of MAG7 stocks was monkey-hammered at around that time and never really recovered...

Source: Bloomberg

Also of note, AI stocks have gone nowhere (well they've gone down) for the last six weeks...

Source: Bloomberg

Of course, it didn't help that Boeing shit the bed again on whistleblower warnings about the 787...

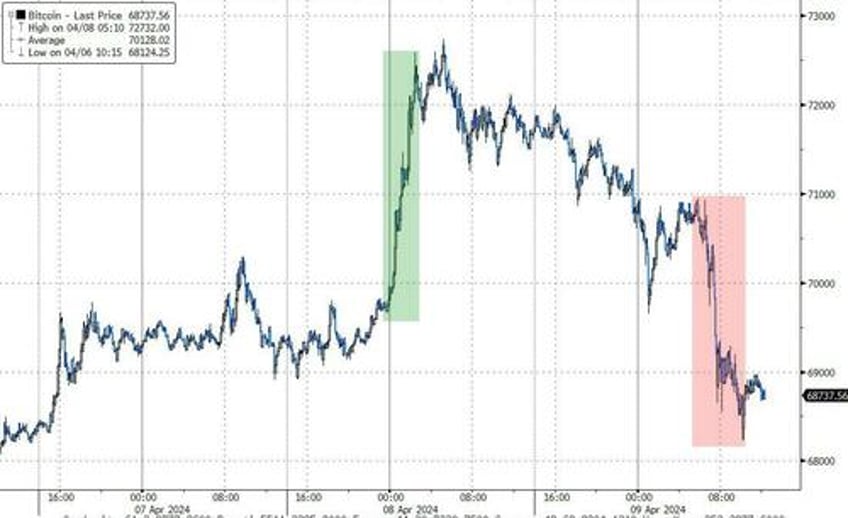

Away from stocks, crypto crashed with Bitcoin erasing all of yesterday's gains and some...

Source: Bloomberg

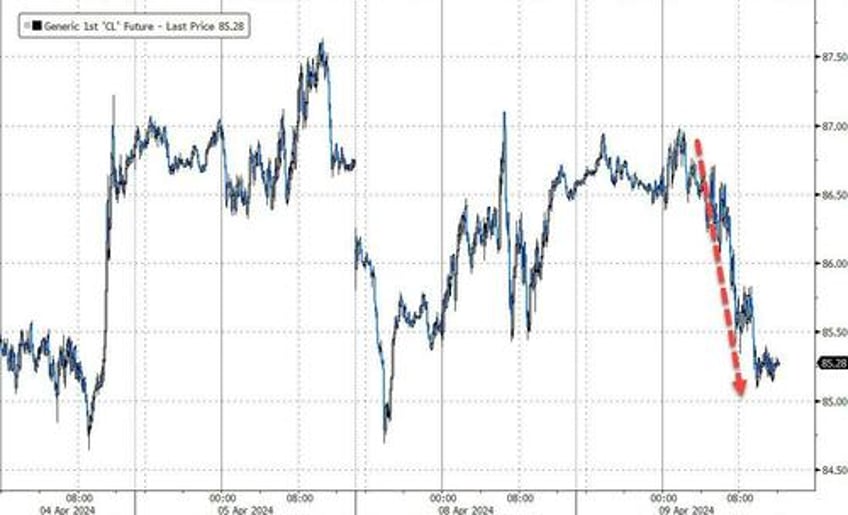

Crude was clubbed like a baby seal after WTI tagged $87 to the tick overnight...

Source: Bloomberg

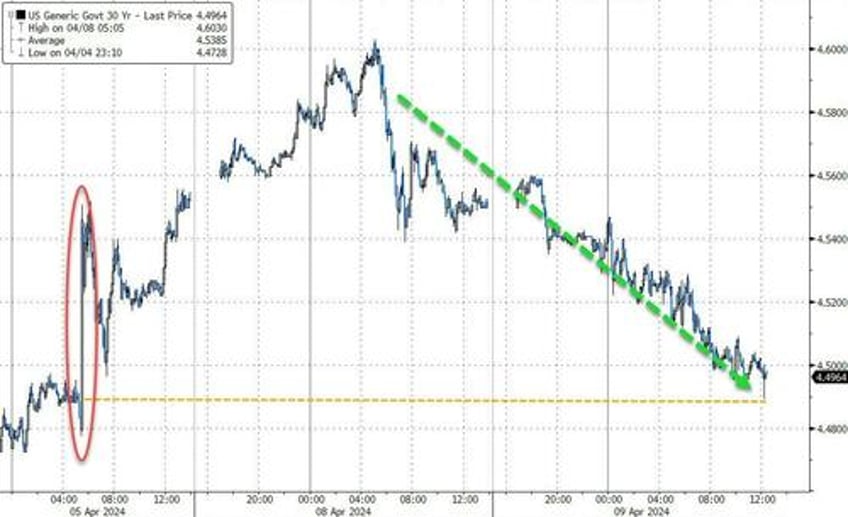

Amid all this, Treasuries were bid with the long-end modestly outperforming (30Y -6bps, 2Y -4.5bps). Yields are down notably from yesterday's highs...

Source: Bloomberg

With the 30Y Yield having erased all of the post-payrolls spike now...

Source: Bloomberg

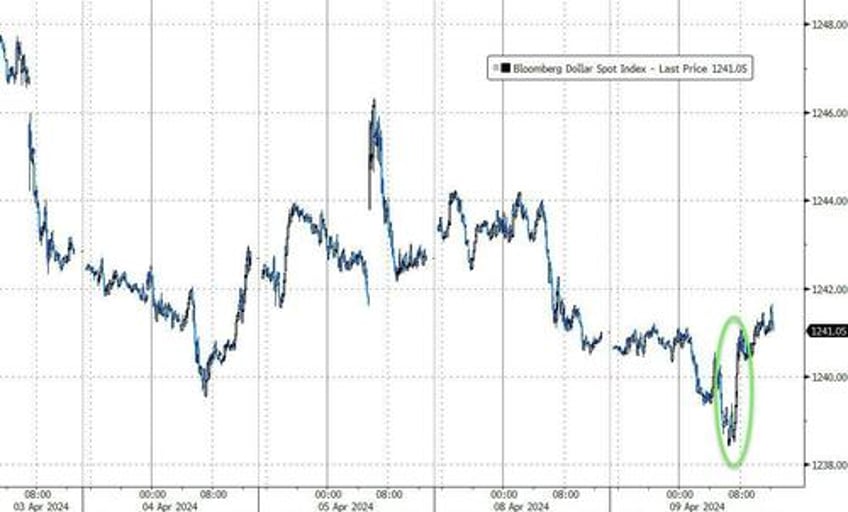

The dollar was weaker overnight but jumped higher as the market conniptions struck early on to end modestly higher...

Source: Bloomberg

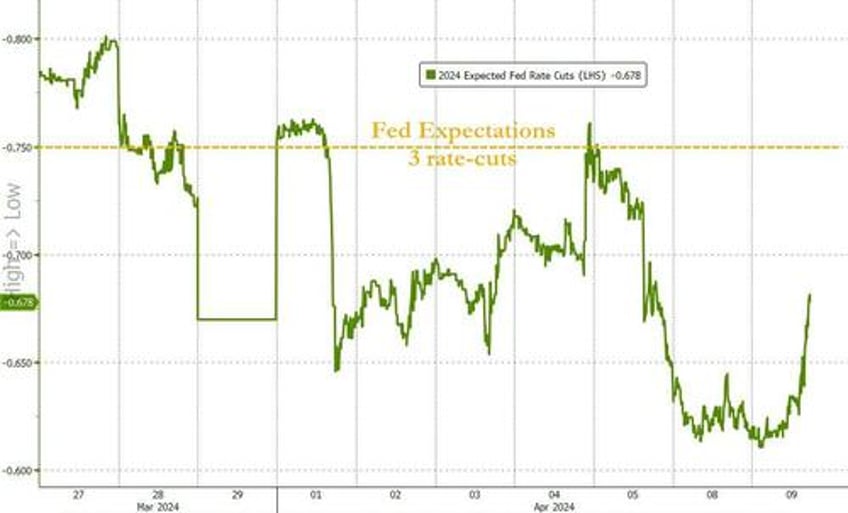

But, amid all that, rate-cut expectations actually improved notably on the day...

Source: Bloomberg

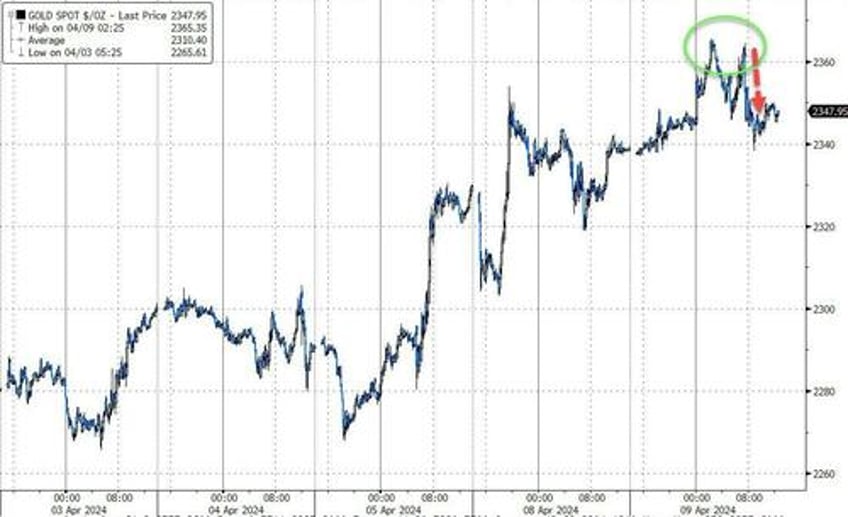

Despite dollar gains, gold managed to hit new record highs once again at $2365...

Source: Bloomberg

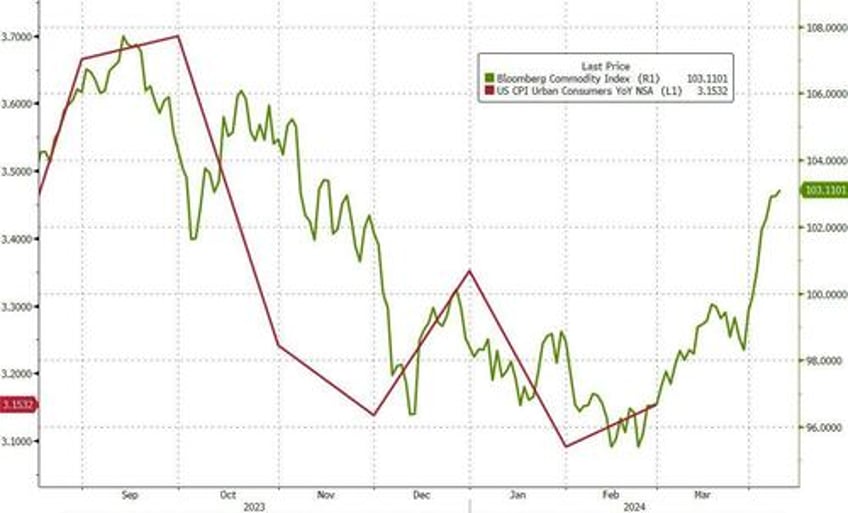

Finally, for everyone anxious about a hot print tomorrow...

Source: Bloomberg

...there, that should help calm any fears.