Coming soon to a "developed" capital market near you.

On Sunday, South Korea's Financial Services Commission shocked markets when it announced it would prohibit stock short-selling until June 2024 to allow regulators to “actively” improve rules and systems, a move analysts said was "unusual” and “unwarranted” when no (obvious) financial crisis or external shock that would lead to a sell-off exists. The news sent Korean stocks surging in early Monday trade.

In a rehash of various short selling bans implemented in the US during periods of market turmoil, the commission announced that trading with borrowed shares will be banned for equities on the Kospi 200 Index and Kosdaq 150 Index from Monday until the end of June.

“Amidst market turmoil, we’ve discovered massive illegal naked short-selling by global investment banks and circumstances of additional illegal activities,” Financial Services Commission Chairman Kim Joo-hyun told a briefing. “It’s a grave situation where illegal short-selling undermines fair price formation and hurts market confidence.”

Lee Bokhyun, governor of the Financial Supervisory Service watchdog, told reporters about 10 global banks will face investigations which account for most short-selling transactions in South Korea.

Translation: stocks are lower than where we want them to be, and so we will blame the short sellers, a familiar refrain. The only problem is what happens when stocks now crash for real, and this time the country won't be able to blame shorts.

During the ban, South Korea will seek a “fundamental improvement” to level the playing field for retail investors in the coming months, including seeking ways to narrow the different short-selling requirements and conditions between institutions and individual investors, Kim said. Authorities will also seek stronger punishments on illegal short-selling activities. They will continue to look into short-selling transactions of global banks with the introduction of a special investigation team on Monday.

South Korea started allowing short-selling of stocks on the two indexes in May 2021 while keeping a pandemic-era ban in place for more than 2,000 equities. Reimposing the full ban on the widely used trading practice could hinder the nation’s efforts to seek an upgrade in a key global index, according to Smartkarma Holdings Pte. analyst Brian Freitas.

“The short-sell ban will further jeopardize Korea’s chances of moving from Emerging Market to Developed Market,” Freitas said. “Expect bubbles to form in pockets of the market that are favored by retail investors as short selling no longer acts as a brake on absurd valuations.”

Hilariously, short selling accounts for a tiny portion of the nation’s $1.7 trillion stock market — about 0.6% of the Kospi’s market value and 1.6% of the Kosdaq’s, according to exchange data. And yet, according to regulators, it is the evil short sellers who are responsible for the market not complying with central planning mandates.

According to Bloomberg, the regulator’s announcement comes ahead of general legislative elections to select National Assembly members in April. Some ruling party lawmakers have urged the government to temporarily end stock short-selling in response to demands by retail investors who have staged protests against the practice.

The investors say short-selling leads to unfair advantages for foreign and institutional investors.

South Korean President Yoon Suk Yeol and his party have campaigned on reforms, including changes to the pension

system and the prevention of market monopolies. Yoon’s popularity has edged up in recent months to a high of 34% on Friday, after dipping last year.

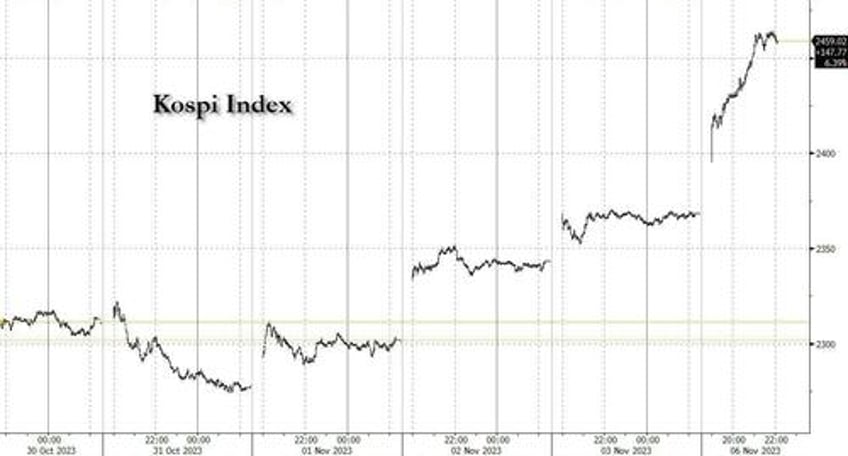

The regulator’s ban coincides with a nascent recovery in the main South Korean equity benchmark index. The Kospi has climbed in November after suffering its worst monthly drop in October amid foreign sell-offs. The index is still down more than 10% from its August peak. The small-cap Kosdaq Index also bounced back from the lowest level since January, but is down 17% from its July peak.

Following news of the ban, the Kospi surged 4%, extending its recent gains.

The response from analysts and traders was one of puzzled confusion, with consensus that the move to ban short-selling is “unusual” and “unwarranted” when no financial crisis or external shock that would lead to a sell-off exists (suggesting that it would be warranted to ban short-selling when there is a crisis, which is why markets remain a complete farce 15 years after Lehman). Here are some thoughts from Wongmo Kang of Exome Asset Management.

The ban’s impact could be “more limited” compared to such policy in the past as South Korea has been allowing short selling on companies listed in Kospi 200 Index and Kosdaq 150 Index

- As South Korea is heavily influenced by retail investors, individual investors might exhibit increased confidence and willingness to engage in the stock market after the measure; that could lead to perception that downside risks are relatively restricted when short selling is prohibited, which may not necessarily be true

- Funds that employ long-short strategies may need to adjust their long position in accordance with limitations on short position; that may potentially lead to sell out in their long positions

- There is a possibility that international investors may lose trust and opportunity in the Korean market

- This policy reversal in short selling is unwarranted now as South Korea is increasingly viewed with excitement and as being diverse as its popular music and electric vehicles. Given this view, short selling should be encouraged as a means of building an efficient market

- Although financial system improvements to prevent illegal and inefficient activities are necessary, there seems to be a need for efforts to evaluate true values through short selling, especially in markets like South Korea where there are significant surges in “theme” stocks without any clear reasons and company fundamentals