On Wednesday, Fed Chairman Jerome Powell dismissed the idea that the economy could slide into "stagflation" despite multiple warning signs of a slowing economy and inflation reaccelerating higher.

"I was around for stagflation, and it was 10% unemployment, it was high-single-digit inflation," Powell said, noting, "Right now we have 3% growth, which is pretty solid growth, I would, say by any measure, and we have inflation running under 3%."

Powell then claimed he didn't see "stag" or the "flation" anywhere.

However, Powell has been very wrong before. He missed the initial surge in inflation in the months following the virus pandemic after the government helicopter dropped trillions of dollars on the economy. More recently, Powell prematurely pivoted on the interest rate hiking cycle before having to backtrack.

Meanwhile, America's largest companies are warning consumers are buckling due to the weight of inflation. This comes amid the failure of Bidenomics, where a new Gallup poll has shown a parabolic surge in households complaining about inflation-related financial problems.

All you need to know pic.twitter.com/a3Ay7c0PA0

— zerohedge (@zerohedge) May 2, 2024

On Wednesday, Starbucks logged the largest single-day crash since early Covid, nearly exceeding the 16.2% level that would've made it the worst drawdown since the Dot Com bust. The reason is simple: Earnings were a complete disaster as misses were reported across the board due to headwinds of a "cautious consumer."

Earlier in the week, McDonald's CEO Chris Kempczinski warned the burger chain faced "broad-based consumer pressures persist around the world."

"Consumers continue to be even more discriminating with every dollar that they spend as they faced elevated prices in their day-to-day spending," Kempczinski said.

Clearly, a $15 Big Mac combo meal is too expensive for many working poor folks. Plus, the food quality is junk.

Moving on to the 3M Company, the maker of Scotch tape and Post-it Notes, top executives told analysts during an earnings call that it "continued seeing softness in consumer discretionary spend."

As for Newell Brands, the owner of Rubbermaid, Yankee Candle, Coleman, Paper Mate, and many others, warned, "Consumers continuing to carefully manage their discretionary spend as the cumulative impact of inflation on food, energy and housing cost has outpaced wage growth."

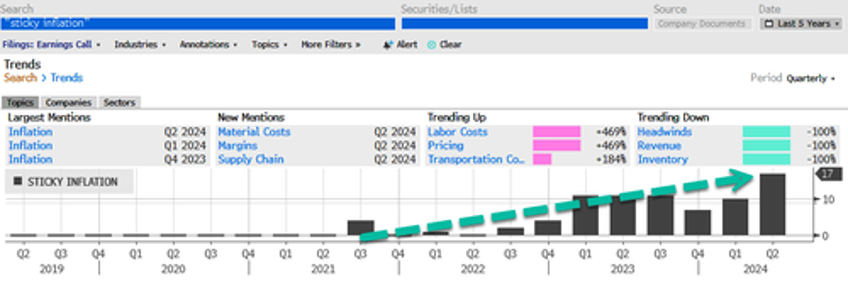

Looking at Bloomberg data, the term "sticky inflation" has surged to a record 17 mentions in earnings calls. Other topics on the rise include "inflation" and "interest rates" and "labor costs."

But don't worry, Powell has glanced over the mounting stagflation threat because it's an election year...