Stocks and bonds have been rising together again, with investors getting longer of both assets. Inflation fears are taking a backseat for now, allowing lower yields to boost stock prices.

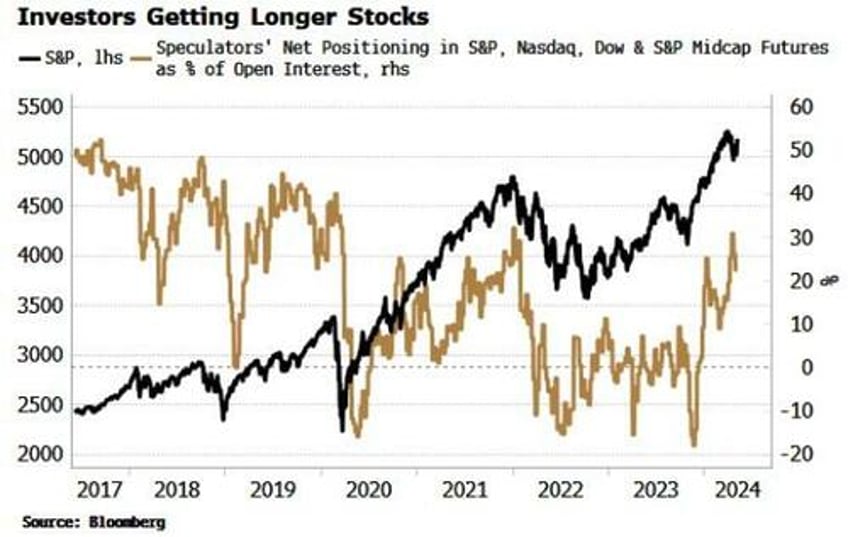

Positioning data for equities shows that investors have been getting longer US stocks all year and are now net long as they have been since late 2021.

This was not long before the market peaked at the start of 2022, but the backdrop was worse then than it is now. CPI was 7% and still rising and excess liquidity was falling quite sharply.

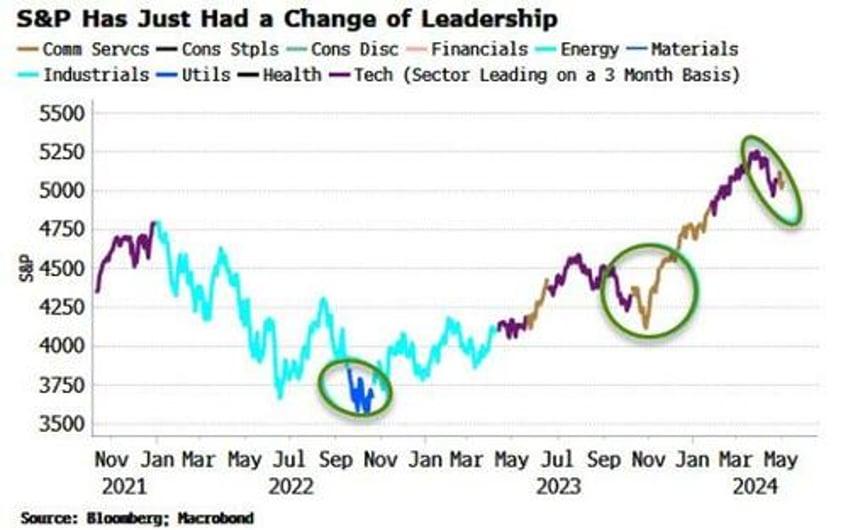

Equities had a good week last week, retracing three-quarters of their recent down move. As discussed last week, they have seen a change of leadership, which has recently been consistent with a bottom in prices being near.

Stocks have rallied as yields have fallen from their recent high of ~4.70%. Bonds had become somewhat oversold, and we also saw some weaker than expected economic prints, e.g. payrolls, that pushed inflation concerns into the backseat and allowed USTs to bounce. Investors appear to have been dipping their toe back in, as positioning data shows an uptick in net long bond positioning.

Yet the longer-term outlook for bonds is still poor. Inflation will linger and leading indicators point to higher price growth to come. Stocks and bonds are rising together at the moment, but the flipside of that positive correlation is that they can fall together too, negating one of the main reasons multi-asset managers own them.

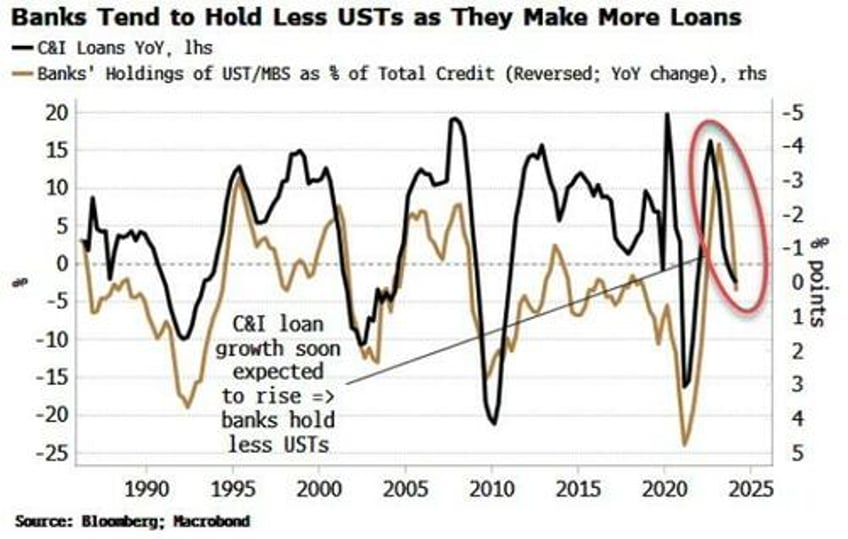

Banks have also been on net divesting themselves of Treasuries and agency securities over the last two years from 33% of assets to 30%. There was little to suggest that is about to start rising again from the latest Senior Loan Officer Survey, released on Monday for the three months to the end of April. The net percent of banks tightening standards for C&I loans remained steady, after rising in the quarters since SVB’s bankruptcy. That leads C&I loan growth by about six-to-nine months.

As the chart below shows, banks tend to reduce their holdings of less profitable Treasuries when they make more commercial loans.

That continues to make it more likely the household sector will be the buyer of last resort for Treasuries, and if inflation continues to be a problem, demand a higher yield premium to do so.