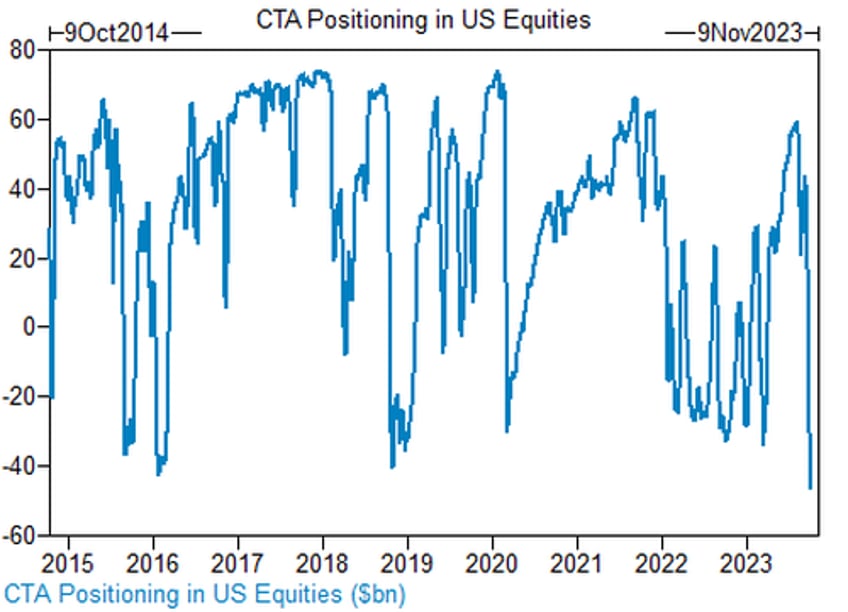

During the weekend we warned readers that after Friday's face-ripping short-squeeze Goldman's prime brokerage cautioned that "Long-Only Sellers had become Exhausted, and HF Short Covering Begins", signaling a change in market sentiment was taking place, which coupled with the shortest CTAs on record...

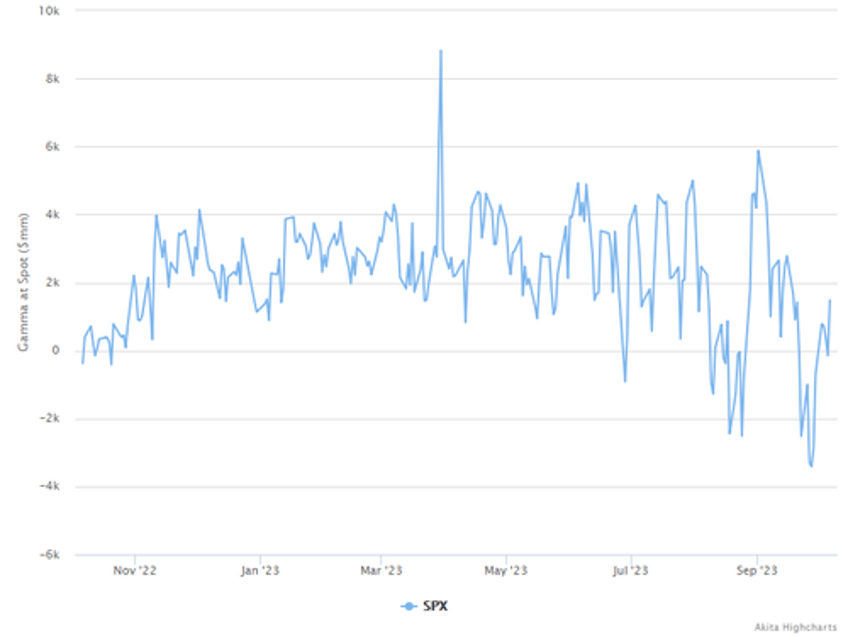

... and dealer gamma flipping positive, and thus conducive to further stock gains...

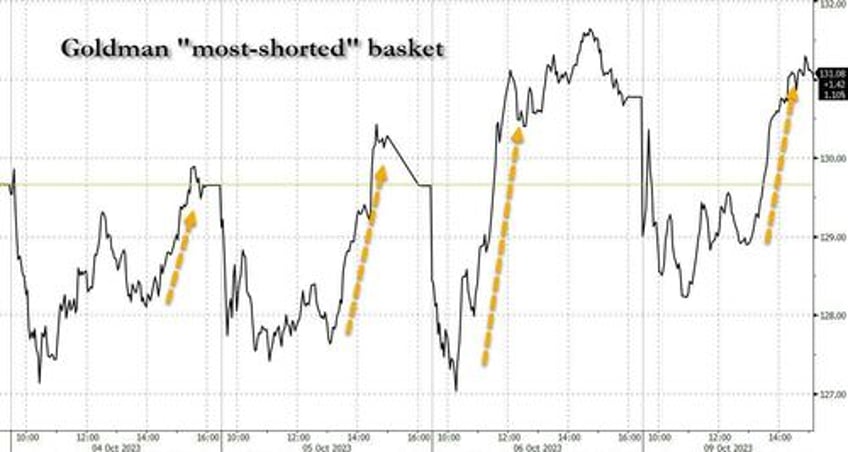

... indicating we would see a continuation higher in the most shorted names, one which would lift the broader market higher.

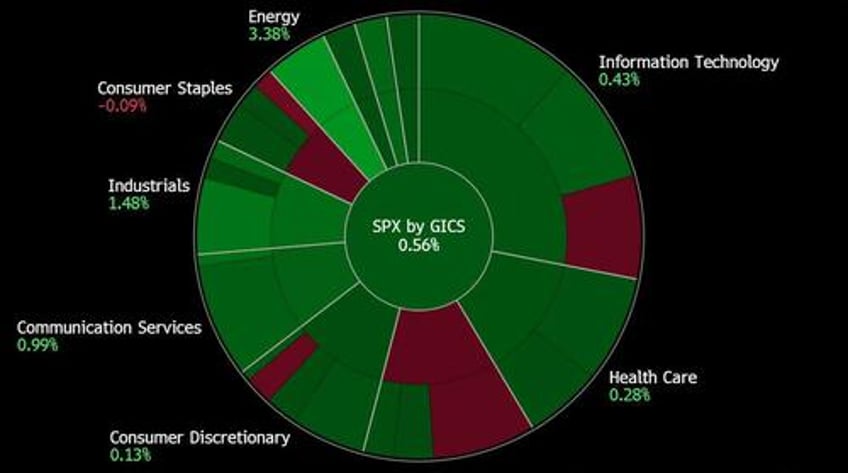

Many balked, saying there was no way we could get a risk rally after the deadliest clash involving Israel in decades, and yet, not only did stocks reverse early weakness, but spoos surged higher after some early weakness in what was a carbon copy of Friday's meltup...

... one which pushed all sectors from deep red to green...

... and sent the Goldman most-shorted basket ripping higher for the 4th afternoon in a row as the massive hedge fund short overhang is getting increasingly concerned, and starting to frontrun the next squeeze.

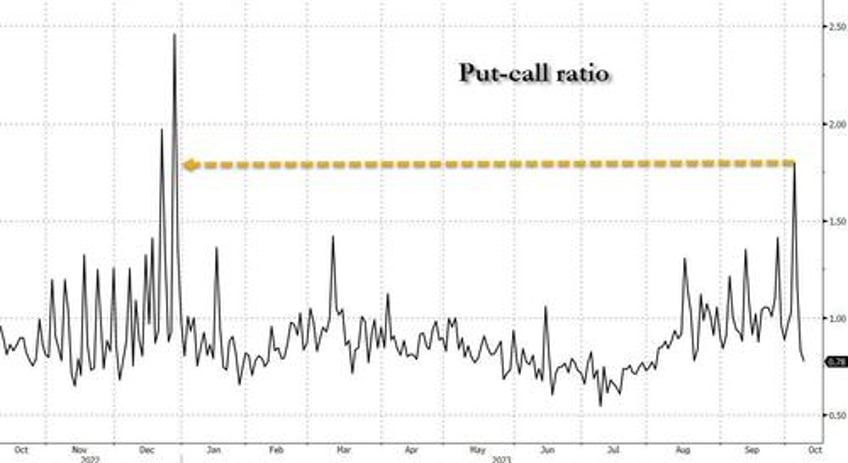

Adding to the upside fuel, just days after we saw the Put-Call ratio hit the highest level in 2023...

... the upward drift in the market meant a theta inferno, and hedged traders liquidated puts en mass, leading to a second consecutive dump in the VIX, following Friday's meltdown.

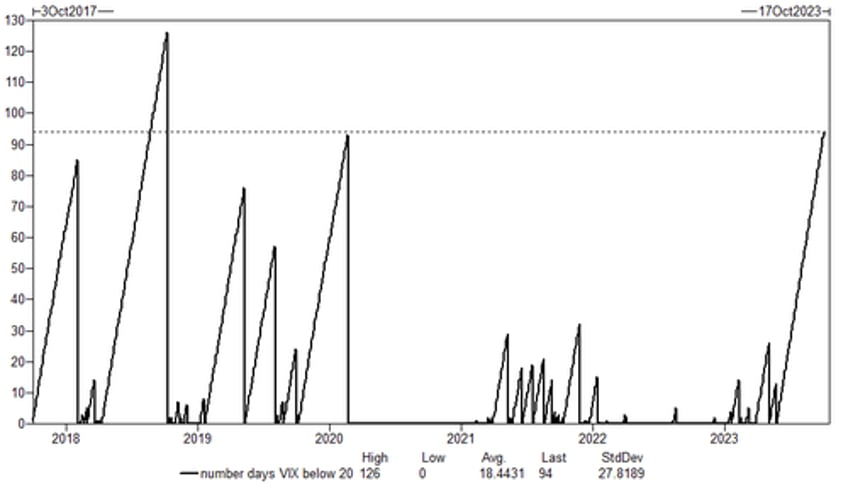

And since the VIX has so far failed to break above 20, we are now just shy of 100 sessions in which the VIX has closed below 20, the longest such stretch since Oct 2018 when, ironically, the market tumbled after the Fed realized it will need to be far more hawkish.

Finally, 0DTE punters lifting the S&P delta flow all day pretty much assured today's green close.

What was the driver behind today's meltup?

Surely it wasn't the war in the middle east which sparked an oil buying spree just days after the biggest liquidation in oil in over a year...

... which helped squeeze the S&P energy sector 3.4% higher, its biggest intraday jump since Jan 2, right on schedule after the biggest pile up in energy shorts just days earlier.

*S&P 500 ENERGY INDEX GAINS 3.2%, MOST INTRADAY SINCE JUNE 2 https://t.co/h6an6n2UCx

— zerohedge (@zerohedge) October 9, 2023

... perhaps as the market realized that the liquidation driven by the DOE's most grotesquely manipulated gasoline demand number in history...

How ridiculous was last week's DOE gasoline demand print? So ridiculous, it was the biggest outlier on RECORD to ethanol-implied gasoline demand.

— zerohedge (@zerohedge) October 9, 2023

Translation: yet another example of DOE desperate to slam oil prices by "adjusting" the underlying data pic.twitter.com/o3EqzNDpis

... won't last long if Iran's 1mmb/d in "embargoed" excess production is taken off the market.

No, none of that moved the broader market. What did, and what cracked the Bloomberg dollar index sharply lower, was multiple Fed speakers such as Dallas Fed Lorie Logan and Fed vice chair Philip Jefferson echiung what SF Fed Mary Daly said on Friday, suggesting that soaring 10Y yields/term premium have done the Fed's tightening job for them, and no more hikes are coming. This is how UBS's trading desk put it:

Fed Vice Chair Philip Jefferson sounds dovish. He said he will remain cognizant of tightening financial conditions through higher bond yields and will keep that in mind when assessing the future path of policy. Also, he said the Fed is in a sensitive period of risk management, where they have to balance the risk of not having tightened enough, against the risk of policy being too restrictive.

The unexpectedly dovish wind blowing from Fed talking heads sent the Dec24 SOFR futures surging more than 20bps higher...

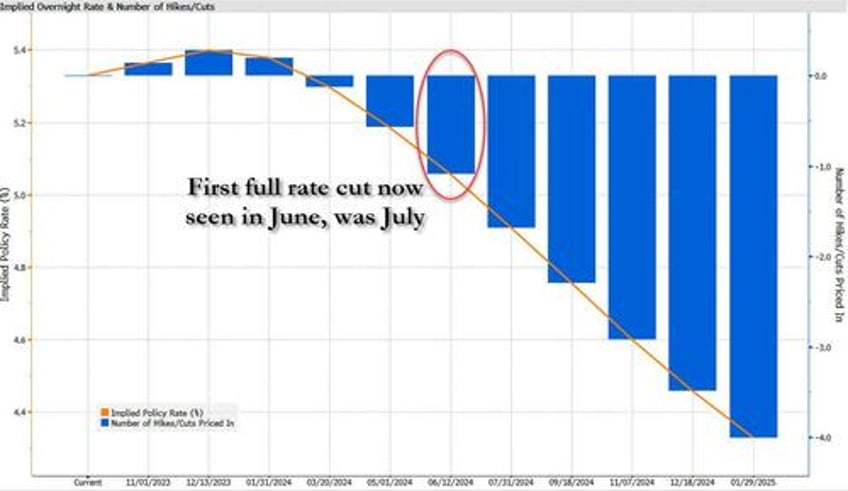

... and as the sudden dovish sentiment blew away much of the recent hawkish hangover which meant that the first full rate cut has now been moved to June from July...

... we also saw 10Y (implied) yields tumble 20 bps from Friday's close, because even though cash Treasuries were closed for Columbus Day, 10Y futures surged, indicating that 10Y yields were last trading around 4.60%, the lowest level in about a week.

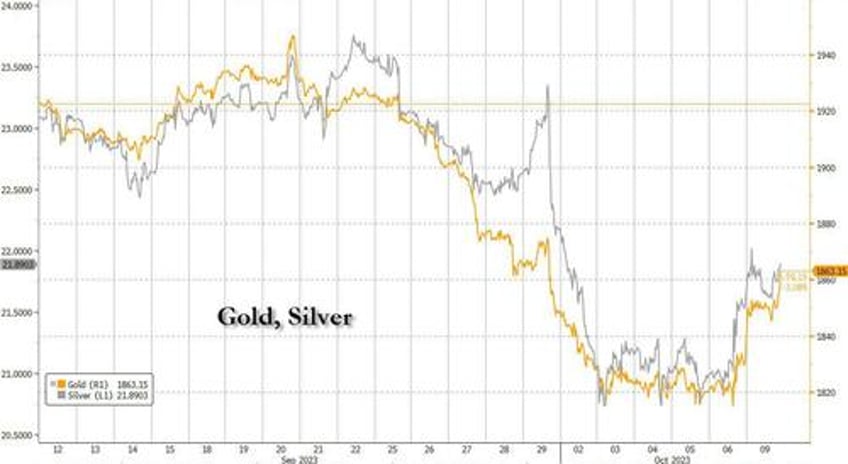

While the dovish reversion in sentiment helped propel stocks higher, it also sent gold and silver - both of which had tumbled at the end of September and into October, back to to the highest level since the start of the month.

Of course, if the Fed's tightening cycle is over and rate cuts are starting to get priced in again, expect to see precious metals - and stocks, crypto, and everything else for that matter - push sharply higher in coming days.