Momentum stocks are very stretched. A reversal exposes the equity market to the risk of a potentially sizable correction, with rising inflation a potential catalyst. Portfolios taking advantage of cheap hedges are better placed to weather any fall in prices.

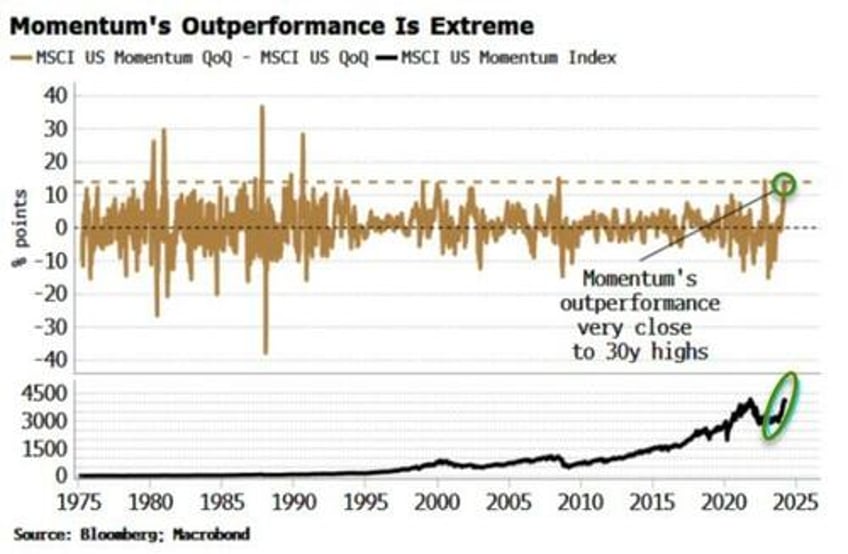

Momentum is leading the charge in the current rally, with it being the best performing of the most popular types of factor. But the trend is looking increasingly extended.

On a quarterly basis, you have to go back over 30 years before you decisively see more extreme outperformance in the factor.

The two most recent times showing a similar degree of relative upside were March 2022 and June 2008, neither of which were particularly propitious for the stock market.

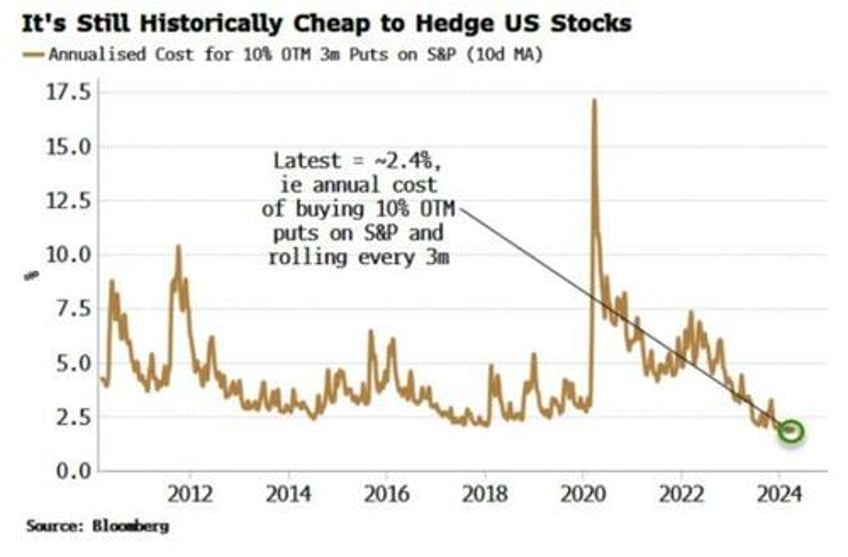

That’s a risk that it would be folly to ignore, especially as — even if the market escapes unscathed — portfolio hedges remain cheap (although that is already changing as vol begins to rise — discussed here last month).

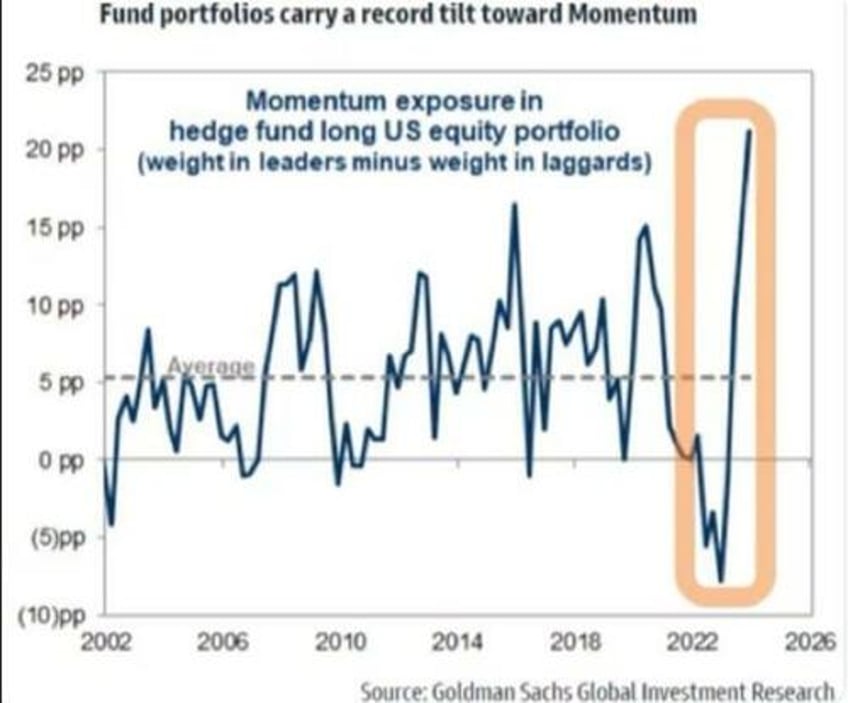

Momentum’s popularity means when the unwind comes, it has the potential to be severe. Hedge-fund portfolios carry a record tilt to momentum, according to Goldman Sachs.

Source: Goldman Sachs

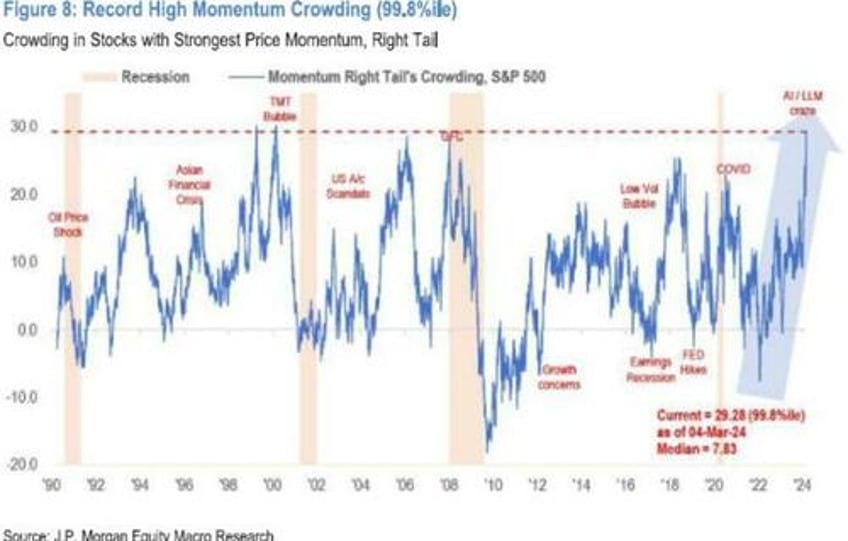

Furthermore, JPMorgan sees record high crowding in momentum stocks (i.e. stocks that are part of momentum-factor portfolios).

Source: JP Morgan

Momentum’s blessing is also its curse. Momentum begets momentum, driving the market yet higher. But when the trend changes, momentum strategies can quickly go into reverse, selling stocks that are falling. In some cases, that can cause the market to correct, or worse. That risk is especially elevated when everybody’s in the same trade, as is the case today.

The prognosis is not good from a historical standpoint. The quarterly outperformance of MSCI’s momentum factor is at 13 percentage points. The forward return of the MSCI US is negative on a one and three-month basis when the quarterly outperformance is more than 10 percentage points, and it is well under the average on a six-month horizon. History is telling us too much momentum is a bad thing.

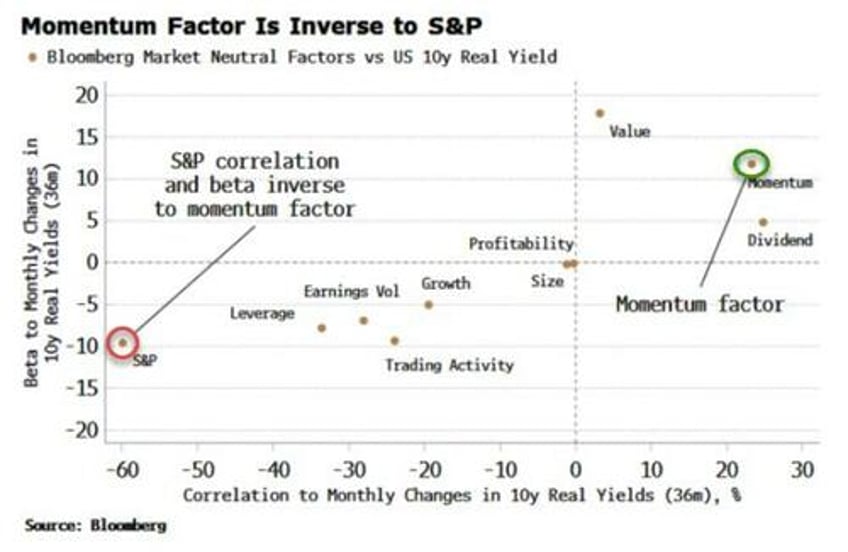

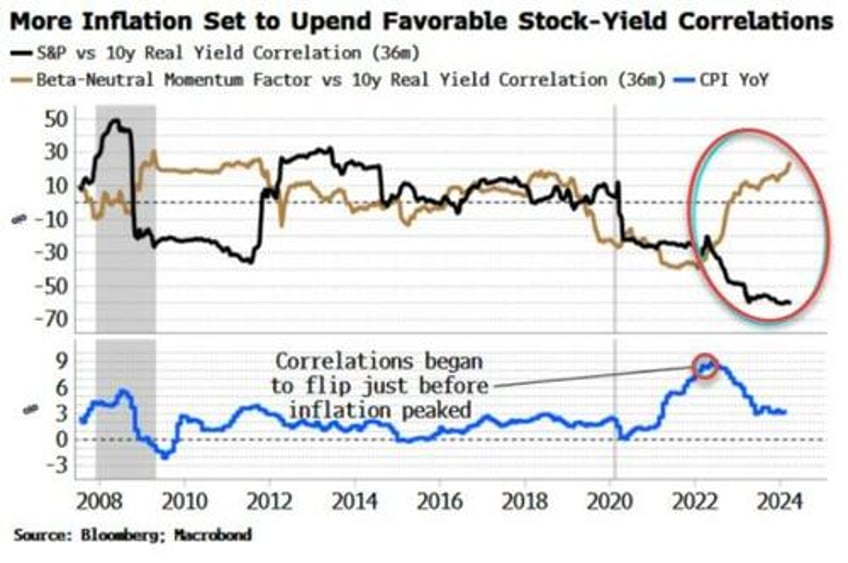

But it could be even worse given the current set up. Momentum is a key reason why the stock market has managed to rally despite elevated and rising yields. Of the most common factors (using the Bloomberg market-neutral factor indexes), momentum currently has the highest beta-and-correlation combination to changes in US 10-year real yields.

This is almost exactly inverse to the S&P, which has a very negative correlation and beta to 10-year real yield changes. It is unusual to have this combination. But it is a mix that has allowed stocks to continue rallying despite higher real yields.

Why? In the months when yields have risen, the index was down slightly, but the momentum factor was up strongly. In months when yields were down, the momentum factor fell by more than the index rose. But as yields increased in about twice as many rolling-month periods as they fell since the rally began in October 2022, overall the market has been able to rise — despite real yields rising over 150 bps.

The positive yield-versus-momentum correlation and the negative yield-versus-index correlation started to develop at the beginning of 2022, before inflation had topped, but around the time when the peak was soon anticipated. A re-acceleration in inflation would likely trigger a reversal in this trend, with elevated real yields quickly becoming a problem for stocks.

We will get March data for US CPI on Wednesday. Disinflation has already stalled, while leading indicators see a re-rise in inflation.

Assets are not priced for this eventuality. Among the biggest stocks in many momentum portfolios are tech firms, such as Nvidia, Meta and Broadcom, which have high duration and are therefore in the inflation headlights. With such extreme crowding in the momentum space, a re-increase in CPI has the potential to trigger a selloff that could develop into a nasty correction, or worse.

Top 10 Stocks in iShares MSCI US Momentum Factor ETF

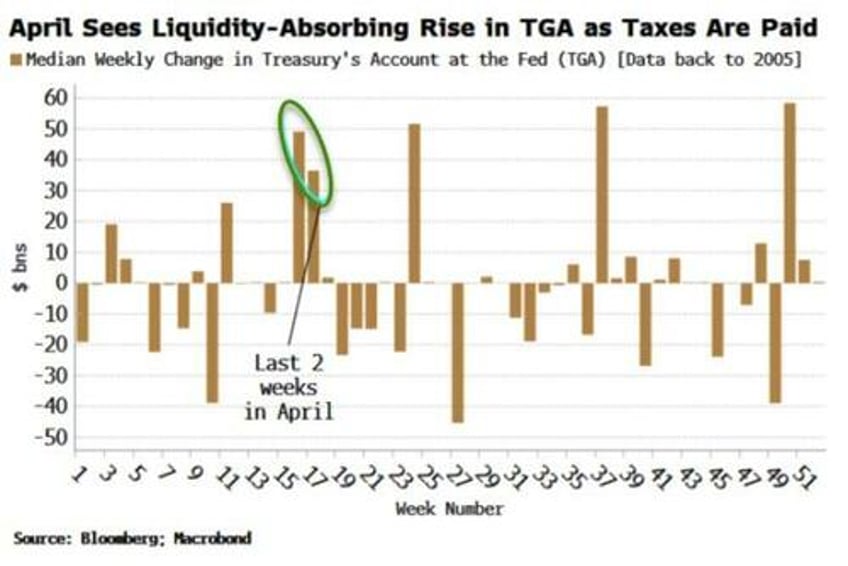

It comes at a time of potential short-term headwinds from liquidity as taxes are paid to the Treasury. The Treasury General Account at the Federal Reserve has its largest average two-week rise in the second half of April — leading to the removal of market liquidity, all other things equal — until the Treasury re-injects the money back into the system.

It’s probably not enough to derail the bull market as recession risk remains low and excess liquidity is supportive, but that doesn’t mean it won’t be uncomfortable.

Equity hedges, though, still remain cheap.

Other hedges include VIX call options (vol of vol remains low), short credit, and bond volatility.

Momentum signals for US stocks, such as Z scores of returns, look to have peaked and are rolling over. That brings forward the time when systematic strategies such as CTAs start to exit high-momentum and crowded stocks.

A trickle of selling could turn into a flood. Momentum begets momentum — until it doesn’t.