The “Liberation Day” Tariffs announced at the Rose Garden last week went into effect as of 12:01 am. The tariffs on China have been increased since then, as China already retaliated by increasing their tariffs. I, like many refer to them as the “Liberation Day” tariffs, as that is a talking point that seems to appeal to the President and avoids calling them “reciprocal” which they are not.

There have been some interesting “surprises” overnight.

U.S. stock futures dropped between 2% and 3% a little after midnight but are now down less than 1% or even in positive in some cases (depending on whether you focus on the S&P 500 or Nasdaq 100 futures). They are moving rapidly.

European stock markets are down 2.5% to 3% across the board.

What is interesting though, is that Chinese ETF’s (KWEB, FXI) are up over 5%.

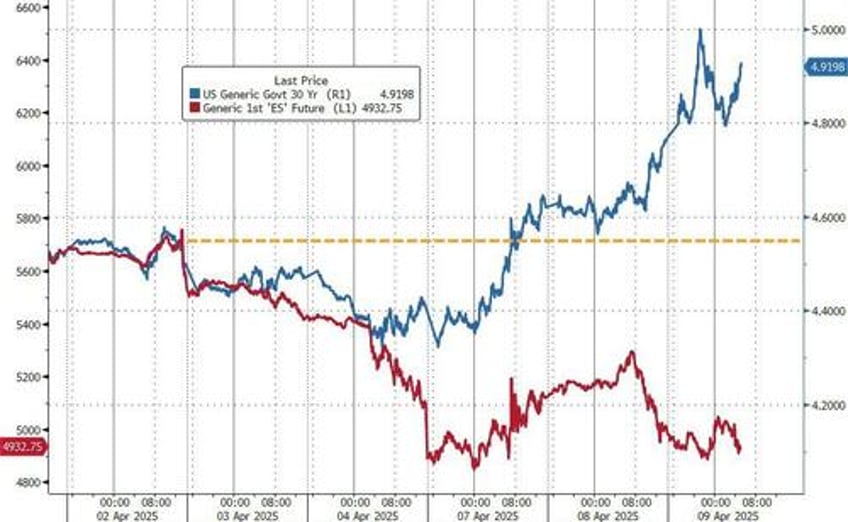

We will come back to stocks, but bonds were the big story overnight!

If you were up last night waiting to see if there was a last-minute reprieve, your social media likely got overwhelmed with stories about the bond market – with the U.S. longer dated maturities being the focal point.

The 30-year bond briefly breached 5%. The always important 10-year yield rose above 4.5% as yields marched incessantly higher from around 10 pm until just after midnight. They are currently back to 4.37%, about 7 bps higher than where they closed.

The yield story is the biggest, so here is our take on what happened:

Some large and relentless volumes went through during a period of low liquidity. Why would anyone dump treasuries overnight when the market has limited liquidity relative to the U.S. hours? Large foreign or off-shore firms all have desks to trade treasuries during U.S. hours, so it was a bit weird. Leads me to think someone either was trying to “make a statement” or someone was trying to push markets and trigger stops (seems plausible). So in any case, while the move was eye-opening, I dismiss some of it, as it seems to have been done with intention.

To a large degree, this was a global phenomenon. Most major countries (except for Germany – which is the EU “safe haven”) moved higher. Though not to the extent the U.S. did and certainly not with the same level of focus from market watchers.

Could this be foreign selling of bonds? China has come up as a culprit in the selling. Maybe other countries were selling bonds overnight to “hurt” the U.S., but that doesn’t seem that likely. As mentioned already, anyone with size, probably does the bulk of their trading during U.S. hours. I cannot think of many entities who have large exposure to U.S. bonds (large enough to move markets) that doesn’t transact primarily during U.S. hours. So I’m not sure this theory holds much water for the overnight move.

Central banks, tend to hold treasuries with maturities of 5 years and in. It has been awhile since I did the digging on this (the obvious TIC data pages just show “short-term” of less than 1 year and “long-term” as longer than 1 year), but that was what I found last time. I think it was during the European debt crisis, so need to go through my notes, when I’m back at the office (am in Boston today). So I don’t think the pressure on longer maturity bonds is coming from Central Banks.

Foreign Pension funds in particular do hold long dated bonds and are quite likely selling as one consequence of the administrations’ actions and threatened actions (imposing fees on holders, etc.). That is a likely source of pressure on the long end, though I would think that is mostly affecting rates during normal trading hours (which also haven’t been kind to bonds of late).

The “basis trade”. Apparently, many hedge funds (and other market participants) hold long term treasuries versus swaps. That has been unwinding of late. This makes more sense as part of last night’s moves, as this community is far more likely to have “stops” and get forced to sell, even at illiquid periods, than central banks or foreign pension funds. For now, I would attribute most of the blame on this trade/unwind.

What is helping risk assets right now?

Lots of QE and Fed emergency move chatter. I’m incredibly skeptical that anything happening in the bond market, especially in an overnight session with a once in a lifetime tariff event went into effect (at least once in my lifetime event, so far).

Countries are “begging” for deals. President Trump was speaking last night and was very aggressive in pointing out how many countries were basically begging for deals! There were no details on which countries (though he did say some “large trading counterparties” were among those “kissing his..” looking for a deal. We will see what countries and what deals. The devil will be in the detail in terms of which countries and what the deals are. On many things, tariffs alone, won’t solve trade imbalances (even if they go to zero), but it could provide a lift to markets if we get that rolling. Even after almost a week of senior administration officials discussing tariffs, it is still difficult to divine the true end goal – get tariffs to zero (probably not that hard, and didn’t necessarily need the “nuclear option”), to generate revenue (in which case they need to stay on), or to get trade balances to zero (not sure how that works with poorer countries, and despite the U.S. being “ripped off” by everyone, the U.S. does have one of the higher per capita GDP’s of any nation. Optimism is understandable, but I remain cautious on this front.

China which had the largest tariffs, continues to push back and their stock market rallied further overnight (they had been down a lot too of late). So not sure we can see U.S. stocks higher as a clear “we are winning” signal.

There is still some time for a “reprieve”. My understanding is that there are exemptions for goods already at sea, if they arrive in the U.S. within the next month or so. Between what has already in inventory and what is on the way and exempt, the full impact of tariffs for countries shipping via container ships (Asia and Europe, more than Canada and Mexico) won’t be felt for another month or so. That gives time for the negotiations to occur while not being as disruptive as the headline numbers suggest.

On positioning, on a quick glance yesterday may have been a record day of inflows for ETFs. Whatever the sentiment (soft data) indicators are telling you, the hard data indicators (ETF flows) are telling us that we are positioned for a bounce. I think that trade will fail, yet again.

Corporate credit was quite weak yesterday. I will be watching the front end closely (VCSH is a good proxy for those of you not deep in the weeds of trading corporate bonds). I will be watching the discount to NAV on large corporate ETF’s like a hawk (to the extent I can watch anything in between meetings). When funds like HYG, JNK, LQD trade at a discount to NAV, it has a tendency to unleash the ETF Spiral™! I will try and send around some old notes on this, but basically my strong view is that the “arbitrage” that is created by large discounts to NAV, at the early stages of times of stress, leads to more selling! Since the arb itself is risk neutral (sell bonds, buy the ETF), some argue that it doesn’t exist, but experience tells me that when people are uncertain, that $1 of owning bonds feels far more risking than owning $1 of ETF/index and it promotes more selling.

Credit could turn today and perform well.

The Fed could indicate some interest in supporting markets.

We could see some details on potential deals.

Any and all of those would be positive, but I don’t think that it will be enough and am still extremely cautious on risk assets here.

I don’t mind buying some bonds here, even with the potential for foreign selling, but not until after the auctions!

Good luck and welcome to the post Liberation Day tariff world (which, as you can tell, I still don’t think the market is fully pricing in the risks).

Also, as last minute addition, changing correlations (like stocks and bonds both moving down together) tends to cause de-grossing (cutting positions) in any sort of strategy that relies on cross asset correlations (from true Risk Parity to Risk Parity Lite strategies, like 60/40 funds).