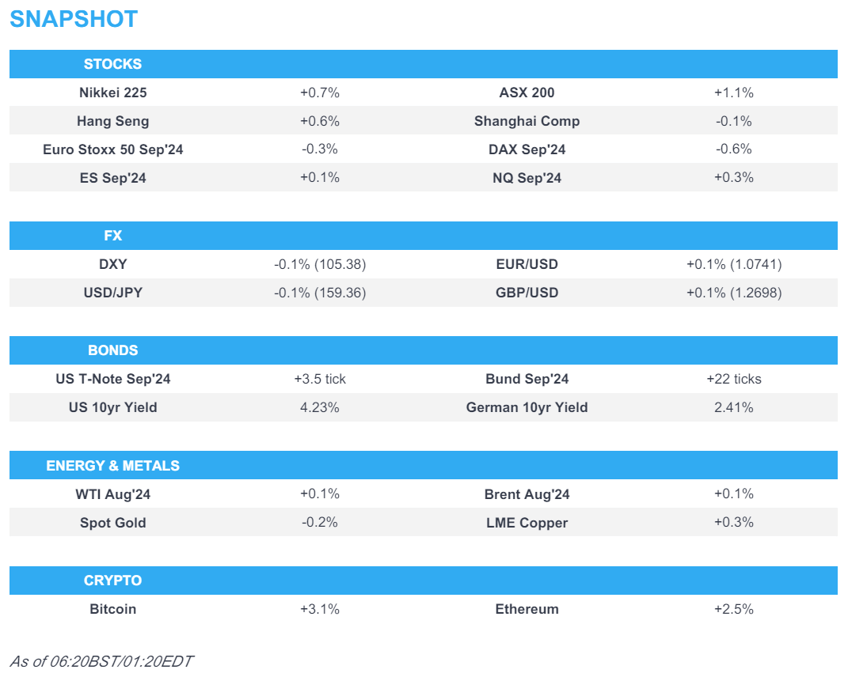

- APAC stocks were mostly positive but with some of the gains capped following the tech underperformance on Wall Street.

- Nvidia (-6.5%) suffered a third consecutive day of losses and was down 13% from its peak last week.

- European equity futures indicate a weaker open with Euro Stoxx 50 future -0.3% after the cash market closed higher by 0.9% on Monday.

- DXY is lacklustre with FX markets broadly contained, USD/JPY remains sub-160.

- Looking ahead, highlights include US Philly Fed Non-manufacturing Business Outlook Survey, US Richmond Fed Index, Canadian CPI, Comments from Fed’s Cook & Bowman, Supply from UK, Italy, Germany & US.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks finished mixed with clear divergence seen among the indices as the DJIA outperformed and the tech-heavy Nasdaq notably lagged amid headwinds from AI-darling Nvidia (NVDA)(-6.5%) which suffered a third consecutive day of losses and was down 13% from its peak last week after a brief stint as the most valuable company.

- SPX -0.31% at 5,448, NDX -1.15% at 19,475, DJI +0.67% at 39,411, RUT +0.43% at 2,031.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Fed's Daly (2024 voter) said the Fed has made a lot of progress on inflation but there is still work to do and inflation is not the only risk although they are nearer to a point where a benign outcome on the labour market could be less likely. Daly said at this point the risks to inflation and employment mandate are in better balance and must be thoughtful about not loosening too early, or holding too long. Furthermore, she said pre-emptive cutting is something you do when you see risks, but right now the labour market is good.

- Fed reportedly floats a weaker version of the bank-capital overhaul, according to Bloomberg citing sources.

- Federal judges in Kansas and Missouri blocked parts of President Biden's student debt relief plan, while the White House later said that it strongly disagreed with the ruling on Biden's student loan plan, according to Reuters.

APAC TRADE

EQUITIES

- APAC stocks were mostly positive but with some of the gains capped following the mixed lead from Wall St where tech underperformed amid Nvidia's continued retreat from last week's record high into correction territory.

- ASX 200 outperformed with energy and real estate leading the advances amid broad optimism across sectors.

- Nikkei 225 shrugged off the initial indecision and gradually reverted to above the psychological 39,000 level.

- Hang Seng and Shanghai Comp. were mixed in which the Hong Kong benchmark advanced as strength in consumer and property stocks atoned for the slack seen in some tech names, while the mainland lagged despite the PBoC's liquidity boost with headwinds from US-China frictions as the Biden administration probes Chinese telcos. Furthermore, Premier Li flagged weak global economic momentum during his WEF address in Dalian.

- US equity futures eked slight gains albeit with price action contained amid quiet catalysts.

- European equity futures indicate a weaker open with Euro Stoxx 50 future -0.3% after the cash market closed higher by 0.9% on Monday.

FX

- DXY was lacklustre after yesterday's selling pressure heading into month and quarter-end with Citi's preliminary estimate of month-end FX hedge rebalancing needs pointing to a net USD selling against all major currencies, while Barclays' model also shows strong dollar selling.

- EUR/USD traded flat and held on to its recent spoils as political uncertainty took a back seat.

- GBP/USD took a breather after recent advances and lingered beneath 1.2700 where it previously hit resistance.

- USD/JPY softened but was off the lows seen during Monday's session where a brief slide beneath 159.00 spurred intervention murmurs.

- Antipodeans conformed to the non-committal mood in the FX space amid a light calendar with no tier-1 data.

- PBoC set USD/CNY mid-point at 7.1225 vs exp. 7.2587 (prev. 7.1201).

- BoC Governor Macklem continues to think they don't need a large climb in the jobless rate to get inflation back to target.

FIXED INCOME

- 10-year UST futures proceeded sideways overnight but did see a mild uptick around the time of the New York closing bell as rumours circulated regarding a US drone being shot down in the Black Sea which was later refuted by a US defence official.

- Bund futures remained afloat after yesterday's intraday rebound and ahead of a German 2-year auction.

- 10-year JGB futures were subdued despite softer Services PPI data and following mostly weaker results from the 20-year JGB auction.

COMMODITIES

- Crude futures took a breather after gaining yesterday on a softer dollar and the ongoing geopolitical backdrop.

- Spot gold marginally softened amid a lack of major catalysts and ahead of key inflation metrics later this week.

- Copper futures traded quietly and failed to meaningfully benefit from the mostly positive risk appetite.

CRYPTO

- Bitcoin found some reprieve overnight and tested the USD 61,500 level to the upside after rebounding from a brief dip beneath USD 59,000.

NOTABLE ASIA-PAC HEADLINES

- Chinese Premier Li called for facing up to the difficulty of global economic growth and said that weak global economic growth momentum was hit by Covid, high inflation and increasing debt, while he added that economic growth is becoming more difficult to achieve and noted that decoupling and protectionism will only raise economic costs for the world. Furthermore, he said they should seize the new opportunities of the tech revolution and industrial transformation and they are confident and capable of achieving the full-year growth target of around 5%, as well as noted that the Chinese economy is expected to continue to show steady improvement in Q2.

- US President Biden’s administration is investigating China Telecom (728 HK), China Mobile (941 HK) and China Unicom (762 HK) with the probe focused on potential national security risks from their US cloud and internet infrastructure, according to Reuters sources

- Japan is to revise January-March GDP to reflect corrected data on construction orders from the Land Ministry with the revised figure to be released on July 1st 00:50BST, according to the Cabinet Office.

DATA RECAP

- Japanese Services PPI (May) 2.50% vs. Exp. 3.00% (Prev. 2.80%)

- Australian Consumer Sentiment MM (Jun) 1.7% (Prev. -0.3%)

- Australian Westpac Consumer Confidence Index (Jun) 83.6 (Prev. 82.2)

GEOPOLITICAL

MIDDLE EAST

- Israeli PM Netanyahu said Iran is working on multiple fronts to destroy Israel but added they will thwart Iran's intentions to destroy them at any cost and in any way, according to Iran International.

- Israeli media reported news about the killing of the sister of the head of Hamas' political bureau, Ismail Haniyeh, in an Israeli bombardment that targeted the beach camp west of Gaza which killed 13 people, according to Sky News Arabia.

- US State Department said Israel told them that they are getting close to an end to major combat operations in Rafah, while there is no agreement on the future of Gaza and the US continues to oppose reoccupation without end.

- US Secretary of State Blinken emphasised to Israel's Defence Minister Gallant the need to take additional steps to protect humanitarian workers in Gaza and deliver assistance in coordination with the UN, while Blinken underscored the importance of avoiding escalation and reaching a diplomatic resolution that allows both Israeli and Lebanese families to return home, according to the State Department.

- There were initial rumours on social media that something of note occurred in the Black Sea and that a US drone had been shot down although there was no confirmation, according to Faytuks News via social media platform X. However, social media reports later noted that a US defence official said no incident involving a US surveillance drone occurred today over the Black Sea, despite claims earlier by several Russian sources

OTHER

- Ukraine will start EU accession talks on Tuesday and will meet with EU ministers in Luxembourg to officially begin a process that is set to take years but which represents a symbolic moment, according to FT.

- Russian President Putin said in a message to North Korean leader Kim that his recent visit to North Korea raised ties to an unprecedentedly high level of partnership, while he added that Kim is an honoured guest Russia waits for, according to KCNA.

- South Korean President Yoon criticised North Korea's balloon sending and vowed a strong response to North Korean provocation, according to Yonhap.

EU/UK

NOTABLE HEADLINES

- Harris Interactive Poll showed far-right National Rally (RN) party in the lead with 33% of votes in the first round of the French parliament election and left-wing New Popular Front (NFP) seen in 2nd with 27% of votes, while President Macron's centrist camp is seen in 3rd with 20% of votes.