Texas Instruments issued a weaker-than-expected earnings forecast for the first quarter, signaling continued softness in key end markets. Goldman analysts reiterated a "Sell" rating on TXN, citing concerns over elevated valuations, lower fab utilization, and record-high inventory levels that may further pressure margins.

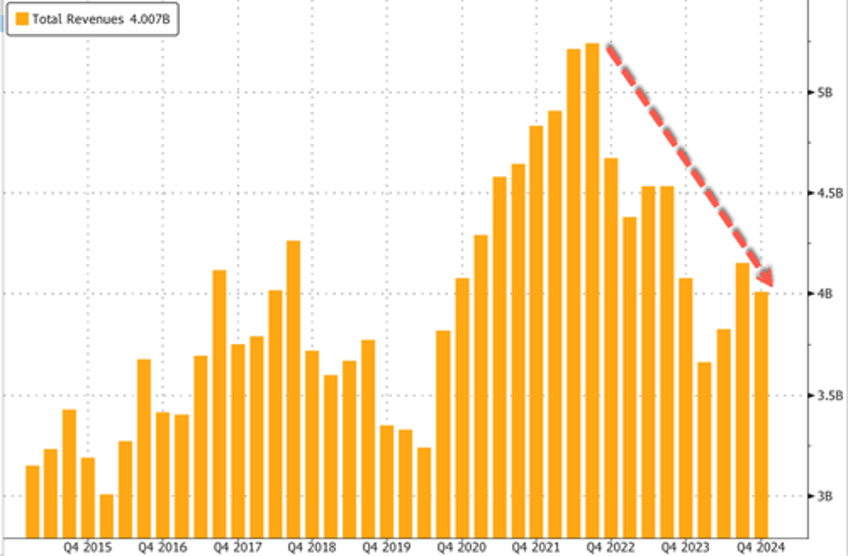

TXN expects first-quarter 2025 revenue between $3.74 billion and $4.06 billion, compared with the Bloomberg Consensus estimate of $3.88 billion. Expected earnings per share range from 94 cents to $1.16, missing the analyst estimate of $1.17. The outlook indicates that TXN's efforts to boost manufacturing capacity will weigh on profitability. Additionally, the broader electronics industry remains in a slump, contributing to nine consecutive quarters of declining sales.

Here is the first quarter forecast (courtesy of Bloomberg):

Sees revenue $3.74 billion to $4.06 billion, estimate $3.88 billion (Bloomberg Consensus)

Sees EPS 94c to $1.16, estimate $1.17

Sees effective tax rate about 12%, estimate 12.9%

TXN is the largest producer of basic semiconductors used in electric systems, including electric vehicles, industrial robots, solar panels, and satellites. Three months ago, management warned that some end markets were experiencing slowdowns, resulting in an inventory chip glut.

In contrast with the gloomy forecast, TXN's fourth-quarter results beat Bloomberg Consensus estimates. Though sales declined 1.7% to $4.01 billion, analysts had projected $3.86 billion. Profit was $1.30 a share, compared with the forecast of $1.21.

Here's a snapshot of fourth-quarter results:

EPS $1.30 vs. $1.49 y/y, estimate $1.21

Revenue $4.01 billion, -1.7% y/y, estimate $3.86 billion

- Analog revenue $3.17 billion, +1.7% y/y, estimate $3.07 billion

- Embedded processing revenue $613 million, -18% y/y, estimate $620.6 million

- Other revenue $220 million, +7.3% y/y, estimate $233 million

Operating profit $1.38 billion, -10% y/y, estimate $1.3 billion

Capital expenditure $1.19 billion, +3.8% y/y, estimate $1.3 billion

Free cash flow $806 million, +3.9% y/y, estimate $613.7 million

R&D expenses $491 million, +6.7% y/y, estimate $498.2 million

Cash and cash equivalents $3.20 billion, +8% y/y, estimate $2.28 billion

Commenting on the earnings, Goldman analysts Toshiya Hari, Chris Kress, and others maintained a "Sell" rating on TXN, noting that valuations remain elevated relative to the higher depreciation costs and lower fab utilization, both of which are expected to pressure margins this quarter.

Hari outlined the tailwinds for TXN:

China strength: China revenue increased yoy for the second consecutive quarter in 4Q24. Automotive was an area of particular strength as revenue grew high-single digits (%) on a sequential basis driven by sustained strength in EVs. Note Auto revenue outside of China declined high-single digits (%) qoq.

We believe TI is shipping below trend in Analog and Embedded Processing: while Analog revenue increased 2% yoy in 4Q24 (following 8 consecutive quarters of yoy declines), TI's Analog business remains well below trend as illustrated in Exhibit 2 as is the case with its Embedded Processing business (Exhibit 3). We believe this is a positive set-up as we look ahead into 2H25 and 2026 given historical precedent of volumes and revenue ultimately reverting toward trend.

Low cancellation rates and upside in turns are positive signs: although none of the end-markets that TI serves have yet to experience an inflection in demand, we view low (and stable) cancellation rates combined with an improvement in turns (i.e. revenue that is booked in the same quarter) as a precursor to a cyclical recovery.

Improving FCF generation: TI generated $806mn in FCF in 4Q24, the highest since 4Q22. Looking ahead, while the big inflection is likely to happen in 2026 (when we forecast a ~$3bn yoy decrease in capital spending), we do expect a gradual recovery in FCF over the next several quarters on an improving net income and working capital outlook.

And her concerns:

Timing and magnitude of recovery remain uncertain: despite our belief that TI and the rest of the industry is nearing a cyclical bottom, we acknowledge that the shape of the recovery remains uncertain given the fluid macroeconomic and geopolitical backdrop.

Compression in gross margin: in 4Q24, gross margin declined 190bps qoq to 57.7% due to lower volumes, higher depreciation and reduced factory loadings. Gross margin is expected to decline again in 1Q25 by a few hundred bps on a sequential basis, per management, on lower revenue and further cuts to production.

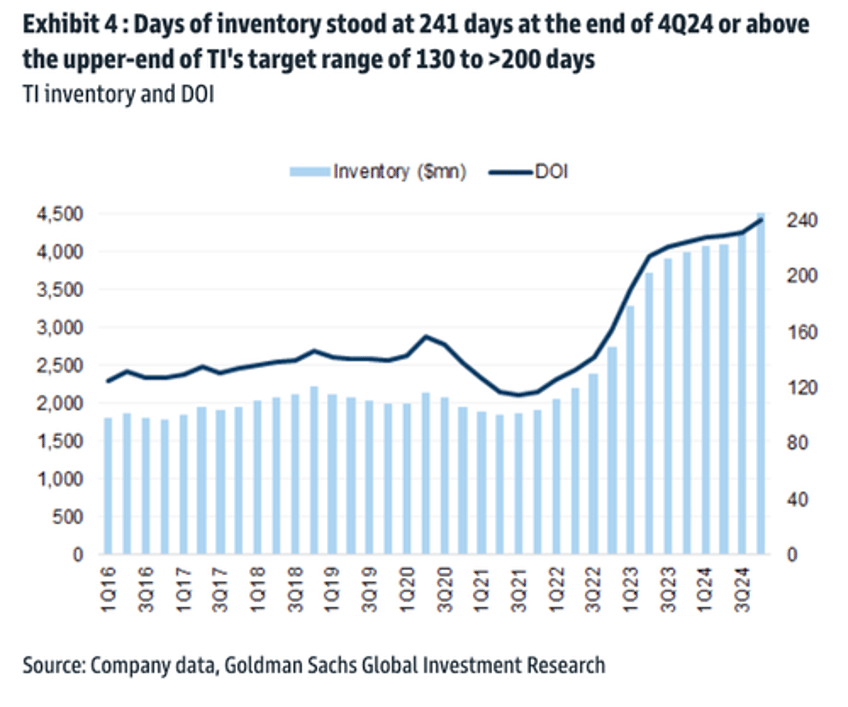

Record high inventory: while management remains content with its balance sheet, inventory grew further and reached a new all-time high of $4.5bn (+5% qoq, +13% yoy), while days of inventory increased 10 days qoq to 241 days at the end of 4Q24 or above the high-end of the company's target range of 130 to >200 days. Management reiterated its emphasis on reducing factory loadings in 1Q25, and we expect inventory dynamics to weigh on near-term gross margins.

Given that TXN is a bellwether for the global economy, the record-high inventory of its chips is a very deep concern on the global macro level:

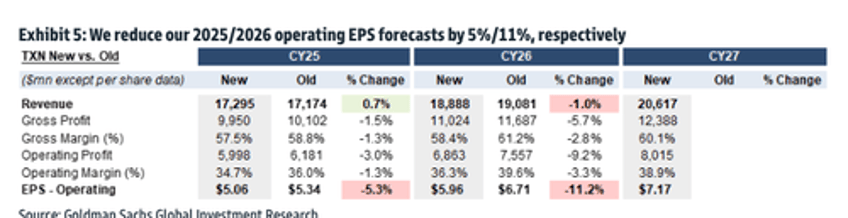

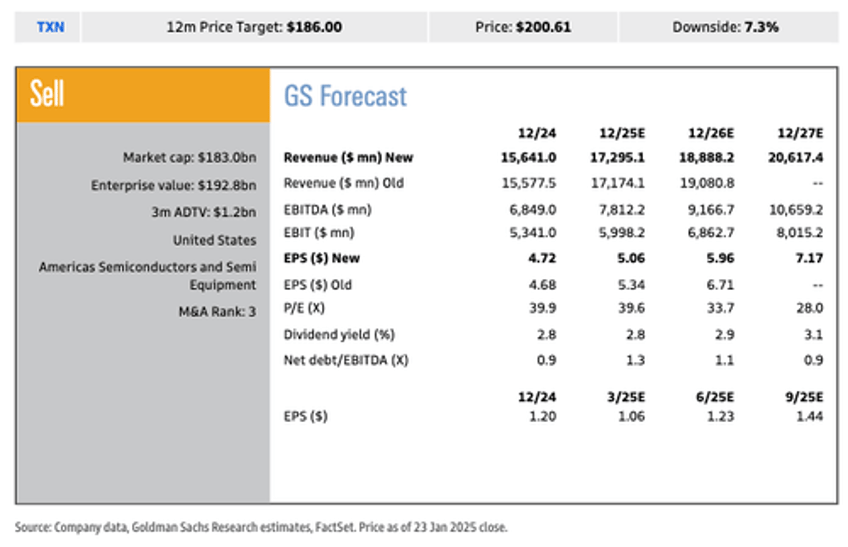

Here's an update to the analysts' estimates for 2025 and 2026:

We tweak our 2025/26 revenue estimates by <+1%/-1%, respectively. We reduce our 2025/26 operating EPS forecasts by 5%/11% to $5.06/$5.96 from $5.34/$6.71, respectively, on lower gross margin and marginally higher opex. Note we also introduce 2027 estimates in conjunction with this note.

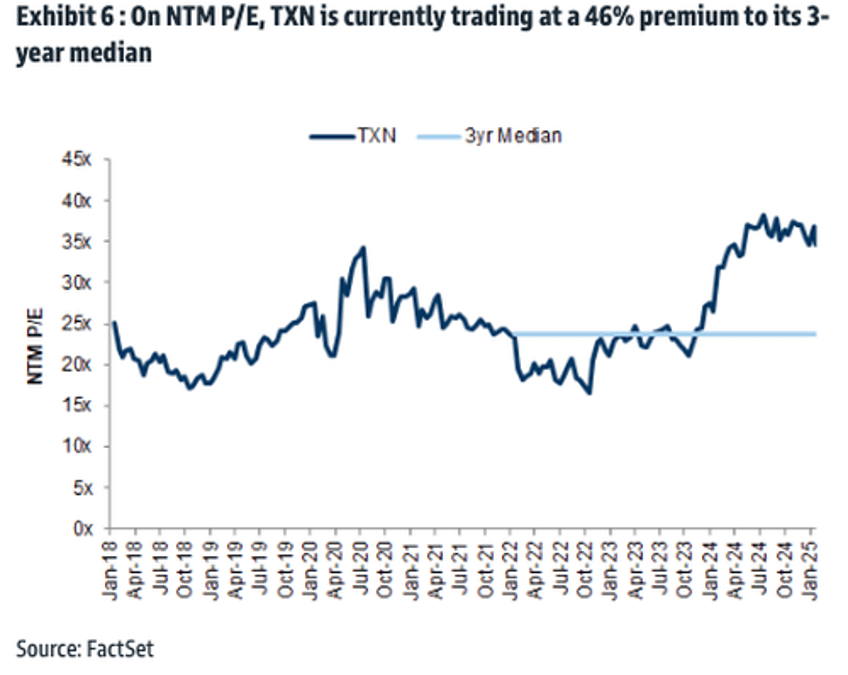

Hari noted that TXN's valuation is rich at these levels.

Her 12-month price target for TXN has been shifted down from $190 to $186.

Here's what other Wall Street analysts are saying (courtesy of Bloomberg):

Morgan Stanley analyst Joseph Moore (underweight, PT $165)

- Texas Instruments' lower gross margins in the quarter pressure EPS

- The company will "see gross margins underperform peers through CY26"

JPMorgan analyst Harlan Sur (overweight, PT $230)

- Cyclical trends are slowly improving for Texas Instruments but industria and auto end-markets continue "to weigh on slope of recovery"

- The company's free cash flow "remains muted" on strong capital expenditure and slower end market recovery

Bloomberg Intelligence analyst Kunjan Sobhani

- Texas Instruments "continues to seek a bottom, prompting further production cuts and pricing actions, which will shave gross margin and lead to softer 1Q earnings per share"

- Industrial and auto "could bottom by mid-2025," given the turmoil in the sector and uncertainty around global trade

Truist Securities (hold, PT to $195 from $199)

- "TXN makes it clear" that "autos & industrial have not bottomed yet"

- "Profitability is under incremental pressure from a combination of lower utilization, steady OpEx, and lower interest income"

Vital Knowledge

- The results show "solid upside" on earnings and sales, but guidance mid-points for 1Q are "mixed," with revenue roughly in line and earnings below expectations

TXN shares rejected the $200 handle.

As for the broader chip industry, sentiment around Trump's Stargate project sent the PHLX Semiconductor Sector higher on the year, yet still remains below a 2024 peak.

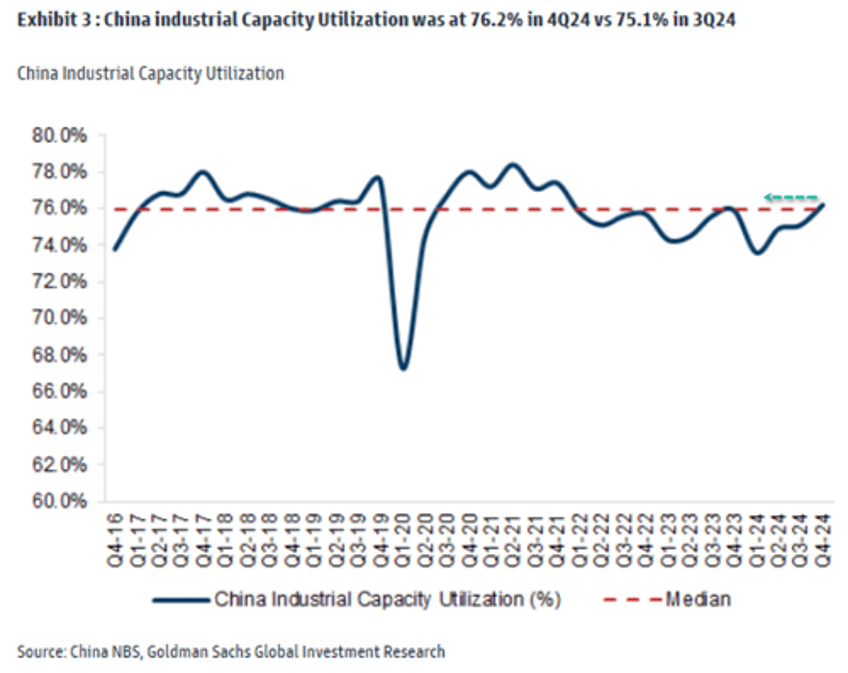

Maybe an improving industrial capacity utliazaiton in China will help TXN.

The takeaway is that TXN's outlook highlights an uneven recovery across the sector, while companies supplying data center chips remain in focus with bulls. Meanwhile, persistent weakness in the automotive and industrial markets suggests more headwinds ahead for TXN.