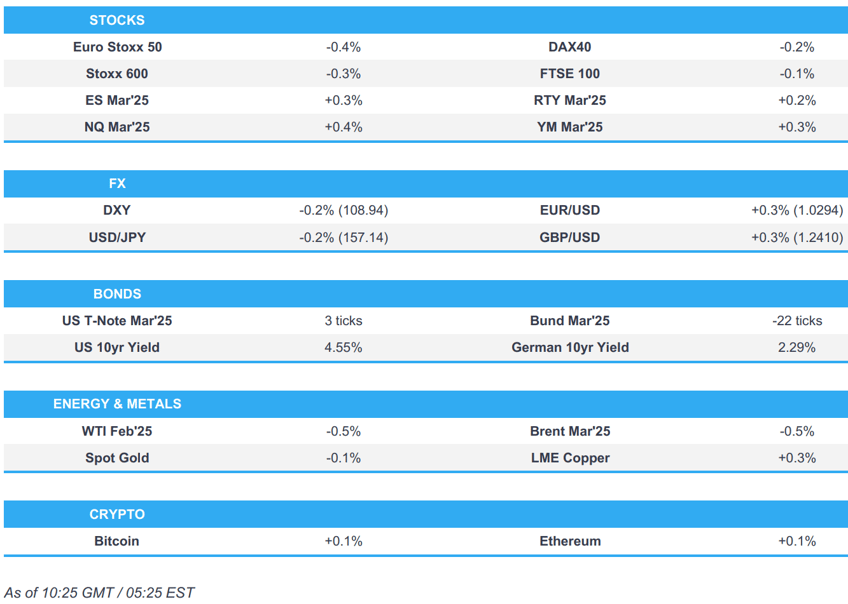

- European bourses are generally lower whilst US futures gain modestly.

- USD is a little lower, holding around the 109.00 mark.

- Mild divergence in fixed income, USTs a little higher whilst EGBs are pressured

- Commodities fail to benefit from a softer Dollar as crude gives back recent strength.

- Looking ahead, US ISM Manufacturing PMI, US House Speaker Vote, Fed’s Barkin & ECB's Lane.

More Newsquawk in 3 steps:

More Newsquawk in 3 steps:1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses opened modestly mixed, but quickly succumbed to some selling pressure to display a negative picture in Europe thus far.

- European sectors opened mixed, but now hold a slight negative bias. A broker upgrade for UBS has helped to prop up Financial Services; Consumer Products once again is towards the foot of the sector list, with Luxury names doing much of the dragging.

- US equity futures are modestly firmer, with modest outperformance in the NQ after trading lower in the prior session.

- Phone shipments within China -5.1% Y/Y at 29.61mln handsets in November (vs +1.8% Y/Y to 29.67mln units in October), according to CAICT; shipments of foreign branded phones including Apple (AAPL) iPhone within China -47.4% Y/Y at 3.04mln handsets in November (vs -44.3% Y/Y in October), according to Reuters calculations based on CAICT data.

- China Auto Industry Body CPCA says Tesla (TSLA) sold 93,766 in December (prev. 78,856 in November)

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD is giving back some of yesterday's gains vs. peers with DXY returning to a 108 handle after topping out at 109 yesterday (highest since November 2022); currently around the 109.00 mark. For today's data docket, focus will be on the December ISM manufacturing print which is expected to remain in contractionary territory at 48.4. Elsewhere, markets will be awaiting the outcome of the US House speaker vote (from around 17:00GMT, according to NBC).

- EUR has managed to claw back some lost ground vs. the broadly softer USD but is yet to undo a bulk of the damage yesterday which saw the pair slip from a 1.0375 peak to a 1.0224 low (lowest since November 2022).

- Japanese-specific newsflow remains on the light side with Japan way from market overnight. As such, the USD leg of the USD/JPY pair has been doing a bulk of the heavy lifting and therefore the broadly softer USD has dragged the pair lower. That being said, the pair has been unable to return to a 157 handle after delving as low as 156.44 yesterday.

- GBP is attempting to reverse some of yesterday's heavy selling pressure which dragged the pair from a 1.2540 peak to a 1.2353 low. Whilst there was no specific catalyst for yesterday's price action, desks pointed to a reversal of last year's relative outperformance of the GBP vs. peers (ex-USD).

- Antipodeans are both firmer vs. the broadly weaker USD with AUD managing to overlook losses in iron ore. Newsflow for both has been light, however, attention was on events in China overnight amid reports of support measures from China's state planner.

- RBI likely selling USD around 85.77-79 levels to support the INR, according to traders cited by Reuters.

- PBoC set USD/CNY mid-point at 7.1878 vs exp. 7.2868 (prev. 7.1879).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- A relatively contained start for benchmarks, with USTs in a narrow 108-27+ to 109-01 band with the docket light until we get to the US morning when ISM Manufacturing PMI is due before the expected commencement of the vote concerning House Speaker Johnson at around 17:00GMT.

- Bunds hold a bearish bias as the benchmark pares some of the upside seen late-doors on Thursday. Currently, at the low-end of a 132.95-133.48 band, which remains entirely within but approaching the trough of Thursday’s 132.90-133.86 range.

- OATs are the EGB laggard, with pressure stemming from reports in Le Monde that French PM Bayrou is aiming for a 2025 budget deficit as a % of GDP of 5.4%, higher than the 5.0% targeted by Barnier’s failed administration.

- Gilts stand as the marginal outperformer, initially gapped higher at the open, but has since succumbed to the broader fixed income pressure; currently near the day's trough at 92.24. Specifics include mortgage and money supply data for November from the BoE, metrics which came in below forecast across the board but spurred no real Gilt follow through.

- Click for a detailed summary

COMMODITIES

- Subdued trade in the crude complex as prices take a breather from the prior day's surge, and amid a generally cautious risk tone. Brent sits in a USD 75.53-76.26/bbl parameter.

- Nat gas is slightly softer intraday in tandem with broader energy markets, with Dutch TTF front-month oscillating on either side of EUR 50/MWh.

- Mixed trade across precious metals with Palladium clearly benefitting from the softer Dollar, whilst silver ekes mild gains and gold trades subdued. Spot gold resides towards the middle of a current USD 2,649.95-2,665.40/oz range.

- Base metals are modestly higher but with price action contained to a tight range between 8,781.50-8,852.00/t awaiting the next catalyst.

- Goldman Sachs sees significant risks that TTF gas prices rally towards oil-switching economics in a EUR 63-84/MWh range in the coming months.

- Russian oil product exports from the Black Sea port of Tuapse are reportedly planned at 0.798mln/T in January (0.885mln/T scheduled in Dec.), via Reuters citing sources.

- Austria's Grid Manager says other NatGas sources are compensating for the loss of Russian fuel via Ukraine, gas imports via Germany and Italy are sufficient, according to Bloomberg's Stapczynski.

- Indonesia Minister says Indonesia is reviewing nickel ore mining quote, seeking to prevent further price falls.

- Click for a detailed summary

NOTABLE DATA RECAP

- German Unemployment Chg SA (Dec) 10.0k vs. Exp. 15.0k (Prev. 6.0k); Unemployment Rate SA (Dec) 6.1% vs. Exp. 6.2% (Prev. 6.1%); Unemployment Total SA (Dec) 2.869M (Prev. 2.86M); Unemployment Total NSA (Dec) 2.807M (Prev. 2.774M)

- Swiss Manufacturing PMI (Dec) 48.4 vs. Exp. 48.3 (Prev. 48.5)

- UK Mortgage Approvals (Nov) 65.72k vs. Exp. 68.5k (Prev. 68.303k, Rev. 68.129k); Mortgage Lending (Nov) 2.474B GB vs. Exp. 3.2B GB (Prev. 3.435B GB, Rev. 3.466B GB); BOE Consumer Credit (Nov) 0.878B GB vs. Exp. 1.2B GB (Prev. 1.098B GB, Rev. 0.995B GB)

NOTABLE EUROPEAN HEADLINES

- UK Chancellor Reeves warned ministers to consider cuts to frontline services to fund above-inflation pay increases for public sector workers, according to The Times.

NOTABLE US HEADLINES

- US President Biden decided to block the sale of US Steel (X) to Nippon Steel (5401 JT), according to The Washington Post.

- US President-elect Trump named a team to work in conjunction with US Treasury Secretary nominee Scott Bessent with Ken Kies to be Assistant Secretary for Tax Policy and he named Cora Alvi as Deputy Chief of Staff.

- US House Speaker vote is scheduled for today, NBC reports that the first call should begin at around 17:00GMT/12:00EST.

GEOPOLITICS

- Israeli PM Netanyahu will convene a meeting today to discuss the mandate of the Israeli delegation that will leave for Qatar, according to Journalist Stein.

- Israeli army noted sirens sounded in several areas of central Israel after a rocket was fired from Yemen, according to Sky News Arabia.

- Sky News Arabia correspondent reported huge explosions in Syria's Aleppo amid Israeli raids.

CRYPTO

- Bitcoin is essentially flat and holds around the USD 96k mark; Ethereum attempts to climb back above USD 3.5k.

APAC TRADE

- APAC stocks were ultimately mixed with most major indices higher although the gains were capped amid the holiday closure in Japan and after the negative handover from the US where the dollar strengthened and Tesla deliveries disappointed.

- ASX 200 was underpinned with energy and gold miners leading the advances after recent gains in underlying commodity prices.

- KOSPI outperformed despite reports of a standoff between a military unit and South Korean investigative authorities attempting to arrest impeached President Yoon, while acting President Choi ordered to deploy market stabilising measures swiftly and boldly if volatility heightens.

- Hang Seng and Shanghai Comp traded mixed despite falling yields amid a report the PBoC is said to plan a policy overhaul as pressure mounts on the economy and would likely cut interest rates from the current level of 1.5% at an appropriate time. Nonetheless, some support was seen for Hong Kong tech stocks after an NDRC official said they will sharply increase funding from ultra-long treasury bonds this year to support "two new" programmes and will broaden the consumer trade-in initiative to include smartphones, while the mainland failed to benefit amid the ongoing US-China trade-related frictions.

NOTABLE ASIA-PAC HEADLINES

- PBoC is reportedly to plan a policy overhaul as pressure mounts on the economy and said it was likely it would cut interest rates from the current level of 1.5% at an appropriate time, while the report noted it would prioritise “the role of interest rate adjustments” and move away from “quantitative objectives” for loan growth in what would amount to a transformation of Chinese monetary policy, according to FT.

- China's NDRC held a briefing regarding high-quality growth and announced it will sharply increase funding from ultra-long treasury bonds this year to support "two new" programmes, while it is to broaden the consumer trade-in initiative to include smartphones. NDRC expects consumption to maintain steady growth in 2025 and noted China's economy is facing many new difficulties and challenges in 2025 but added there is ample room for macro policies in 2025. Furthermore, the NDRC deputy head announced an allocation of CNY 100bln in 2025 for two new and two major projects in advance, while it will push major reforms in 2025 to stabilise expectations, boost confidence and promote development, as well as step up efforts surrounding employment.

- South Korean investigative authorities visited President Yoon's residence to attempt to carry out an arrest warrant but were prevented from carrying out the arrest amid a standoff with a military unit, while two South Korean military officials including the martial law commander were indicted and detained by prosecutors. Furthermore, South Korean acting President Choi ordered to deploy market stabilising measures swiftly and boldly if volatility heightens, as well as announced to prepare tax support measures for small and medium-sized firms to boost corporate investment.