The business cycle fluctuates over time, from the highs of an expansion to the lows of a recession, and each phase impacts the performance of S&P 500 sectors differently.

And though affected sectors have different levels of average performance, any given period may see the outperformance of certain sectors due to external factors, such as technological advancements or high-impact global events (i.e. global pandemics, international conflicts, etc.)

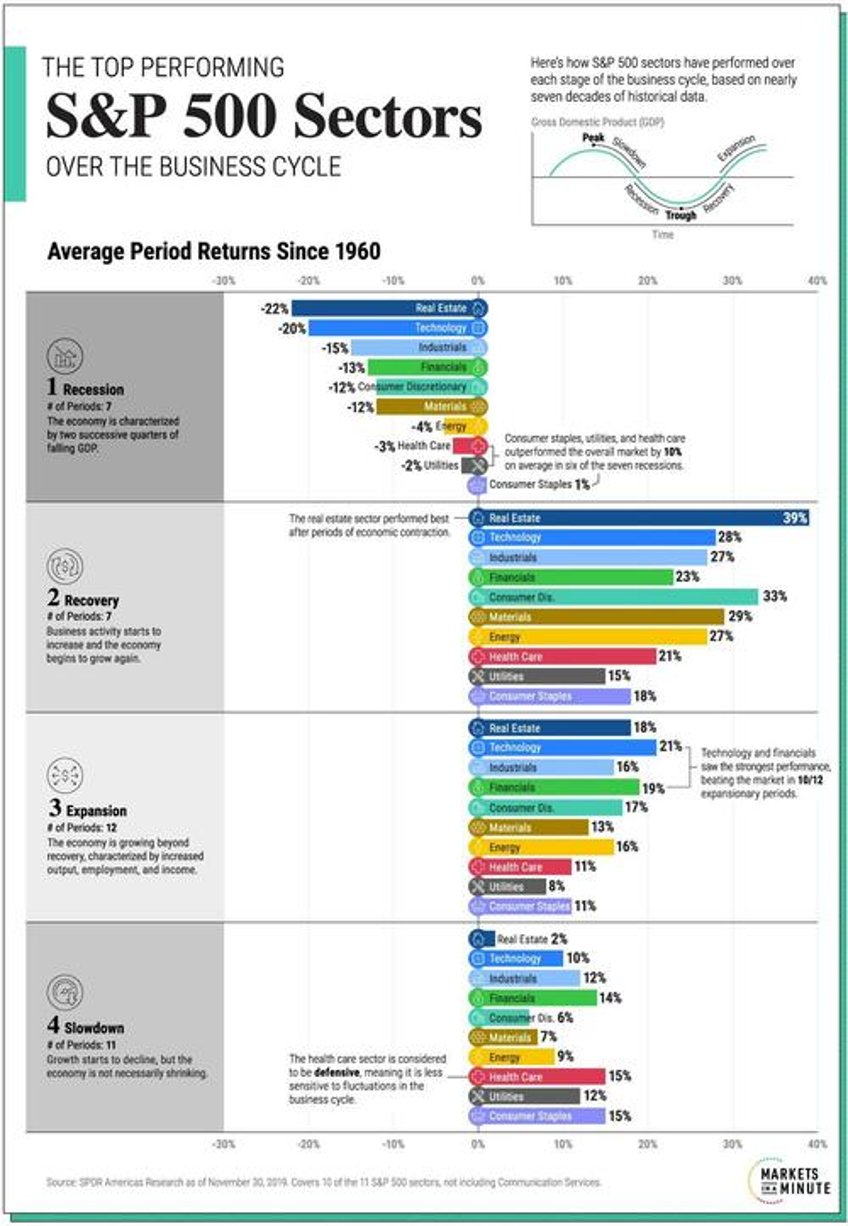

In the graphic below, using data from SPDR Americas Research, Visual Capitalist's Dorothy Neufeld and Sabrina Lam show the top performing sectors through the business cycle over almost 70 years.

The Business Cycle: Methodology

The dataset is based on the Conference Board’s Leading Economic Index, which assesses U.S. economic activity. This index includes 10 economic indicators that reveal typical turning points in the business cycle covering employment, consumer expectations, and financial conditions.

Overall from December 1, 1960 to November 30, 2019, the dataset covers:

7 recessions

7 recoveries

12 expansions

11 slowdowns

Returns are shown for all of the S&P 500 sectors with the exception of the communication services sector. This is because the sector was created relatively recently in 2018 and comprises previous technology, consumer discretionary, and telecommunication stocks already covered in the dataset.

1. Recession

Broadly speaking, a recession is a period of temporary economic decline characterized by two successive quarters of falling GDP.

During this period, consumer staples was the top performing S&P 500 sector, and the only one that has averaged a positive return. Utilities and health care, traditionally defensive sectors, followed next in line. Together, these sectors averaged 10% higher returns than the overall market during six of the seven recessions.

| Rank | S&P 500 Sector | Average Period Return |

|---|---|---|

| 1 | Consumer Staples | +1% |

| 2 | Utilities | -2% |

| 3 | Health Care | -3% |

| 4 | Energy | -4% |

| 5 | Consumer Discretionary | -12% |

| 6 | Materials | -12% |

| 7 | Financials | -13% |

| 8 | Industrials | -15% |

| 9 | Technology | -20% |

| 10 | Real Estate | -22% |

Real estate has been the worst performer during recessions, given its high sensitivity to discretionary spending as both household income and business activity tend to decline.

2. Recovery

A recovery is the phase following a recession where economic activity starts to increase and the economy begins to grow again.

Real estate outperformed all other sectors with an average 39% return. As monetary policy eases and interest rates fall historically after recessions, this makes purchasing real estate more affordable, in turn supporting the sector’s performance.

| Rank | S&P 500 Sector | Average Period Return |

|---|---|---|

| 1 | Real Estate | +39% |

| 2 | Consumer Discretionary | +33% |

| 3 | Materials | +29% |

| 4 | Technology | +28% |

| 5 | Industrials | +27% |

| 6 | Energy | +27% |

| 7 | Financials | +23% |

| 8 | Health Care | +21% |

| 9 | Consumer Staples | +18% |

| 10 | Utilities | +15% |

We can see in the above table that all sectors posted double-digit returns as consumer confidence and labor market conditions improved during recoveries.

3. Expansion

In this phase of the business cycle, the economy is growing beyond recovery. It is characterized by increased economic output, employment, and income.

Interestingly, market returns were the second-best overall after recoveries. Top sectors included technology (21%), financials (19%), and real estate (18%) as economic activity climbed to its peak.

| Rank | S&P 500 Sector | Average Period Return |

|---|---|---|

| 1 | Technology | +21% |

| 2 | Financials | +19% |

| 3 | Real Estate | +18% |

| 4 | Consumer Discretionary | +17% |

| 5 | Industrials | +16% |

| 6 | Energy | +16% |

| 7 | Materials | +13% |

| 8 | Consumer Staples | +11% |

| 9 | Health Care | +11% |

| 10 | Utilities | +8% |

The utilities sector has historically seen the slowest growth across all sectors as investors tend to favor cyclical S&P 500 sectors that rise with an expanding economy.

4. Slowdown

This phase is often considered a peak in the business cycle, where growth starts to decline, but the economy is not necessarily shrinking.

With 15% average returns, health care excelled during slowdowns. Often, investors reduce their exposure to cyclical sectors as they prepare for an economic downturn, looking for more defensive investments. Similarly, consumer staples saw strong performance on average.

| Rank | S&P 500 Sector | Average Period Return |

|---|---|---|

| 1 | Health Care | +15% |

| 2 | Consumer Staples | +15% |

| 3 | Financials | +14% |

| 4 | Utilities | +12% |

| 5 | Industrials | +12% |

| 6 | Technology | +10% |

| 7 | Energy | +9% |

| 8 | Materials | +7% |

| 9 | Consumer Discretionary | +6% |

| 10 | Real Estate | +2% |

Just as real estate saw a steep drop-off during recessions, it witnessed the lowest relative returns when the economy slows and costs tend to increase.

The Case for Diversification

The above data highlights how having a diversified portfolio of investments can help reduce sector-specific risk given the distinct performance trends of individual sectors over the business cycle.