Mounting evidence of a consumer slowdown is becoming undeniable for the Biden team, which has nothing but cheerleaded failed economic policies dubbed 'Bidenomics' ahead of the presidential elections this November. We have detailed the consumer downturn extensively, citing notes from Goldman, whose top analysts told clients earlier this week to begin shorting "our Middle-Income Consumer basket (GSXUMIDC)."

It was only Wednesday that Cheerios cereal maker General Mills reported a dismal sales outlook as consumers pulled back on spending in the era of elevated supermarket prices. Now, drugstore chain Walgreens Boots Alliance Inc. has slashed its full-year earnings thanks to a "worse-than-expected" consumer environment.

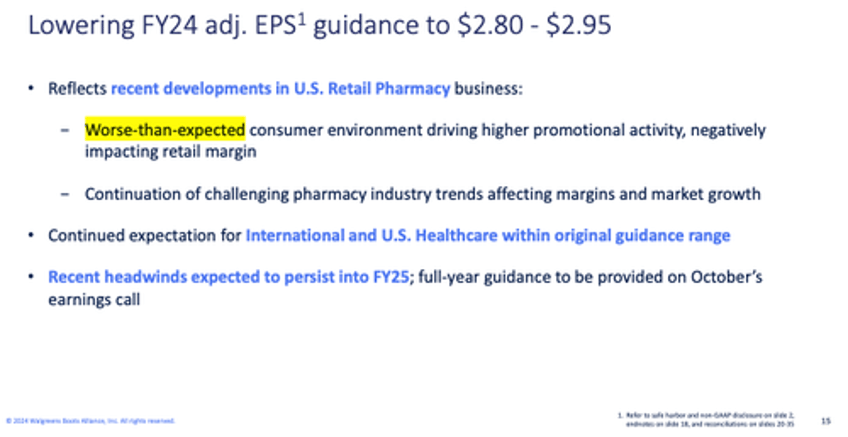

Walgreens revised its forecast range for full-year adjusted earnings to $2.80 to $2.95 per share from $3.20 to $3.35.

- Sees adjusted EPS $2.80 to $2.95, saw $3.20 to $3.35, estimate $3.20 (Bloomberg Consensus)

Adjusted earnings for the third quarter ending May 31 were 63 cents a share, worse than the 68 cents that Wall Street analysts tracked by Bloomberg estimated. Sales beat on the quarter, but investors focused on the dismal full-year guidance.

Here's a snapshot of the third quarter earnings (courtesy of Bloomberg):

Adjusted EPS 63c, estimate 68c

Sales $36.4 billion, estimate $35.81 billion

International sales $5.73 billion, +2.8% y/y, estimate $5.72 billion

US Retail Pharmacy Sales $28.50 billion, +2.3% y/y, estimate $28.04 billion

US Healthcare Sales $2.13 billion, +7.6% y/y, estimate $2.13 billion

On slide 15 of the investor deck released with earnings, Walgreens blamed the worsening outlook for the year on "Worse-than-expected consumer environment driving higher promotional activity, negatively impacting retail margin."

"We continue to face a difficult operating environment, including persistent pressures on the US consumer and the impact of recent marketplace dynamics which have eroded pharmacy margins," Chief Executive Officer Tim Wentworth said in a statement in response to the earnings report.

Wentworth said, "Our results and outlook reflect these headwinds, despite solid performance in both our International and US Healthcare segments," adding, "Informed by our strategic review, we are focused on improving our core business: retail pharmacy, which is central to the future of healthcare. We are addressing critical issues with urgency and working to unlock opportunities for growth."

In an interview with The Wall Street Journal, CEO Wentworth said the drugstore chain plans major store closures nationwide. The chain has approximately 8,600 stores in the US, and the executive said the company has yet to provide a final number of locations to close.

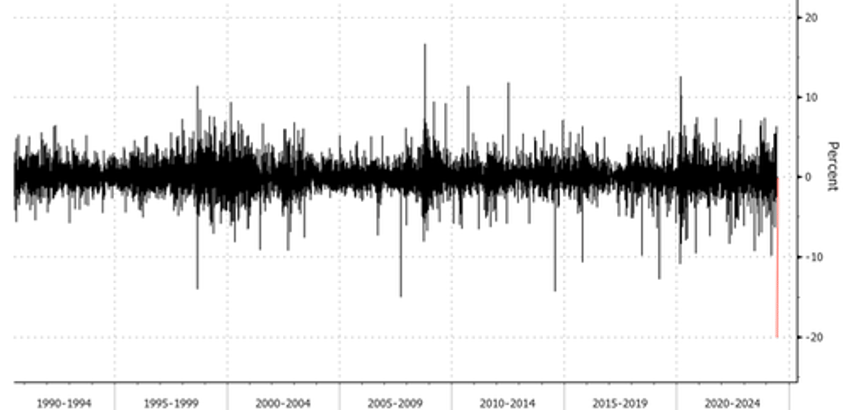

In markets, if premarket losses of -21% hold, this will be the worst single day decline for Walgreens in 30 plus years of data via Bloomberg.

Shares are set to crash to levels not seen since the mid-1990s.

Here's how Wall Street analysts are responding (courtesy of Bloomberg):

Evercore ISI, Elizabeth Anderson (in line, PT $17)

Calls the results disappointing

Says lowered guidance will raise investor questions about the run rate number for FY25

Leerink Partners, Michael Cherny (market perform)

Says the outlook cut on the back of this quarter's performance is not "overly shocking to us as the company now begins the next leg of its turnaround"

Sees a "murky multi-year pathway" with persistent near-term challenges that will make creating a constructive case on the stock challenging

Bloomberg Intelligence, Jonathan Palmer

Says Walgreens' second reduction to fiscal 2024 guidance "underscores the challenges in its turnaround"

"Modest Ebitda in US Healthcare is a minor positive, though the wait is on for a more meaningful strategic transaction"

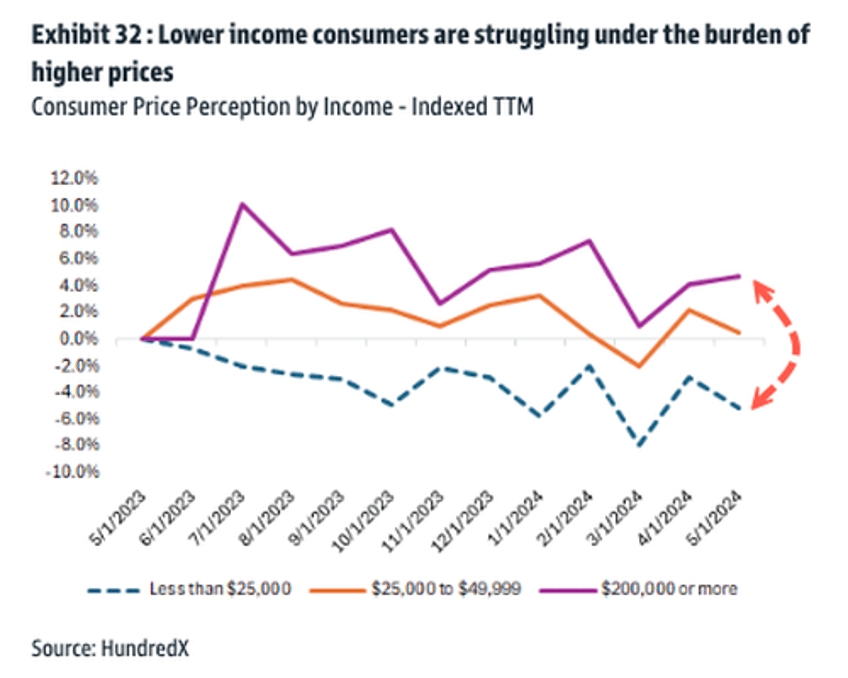

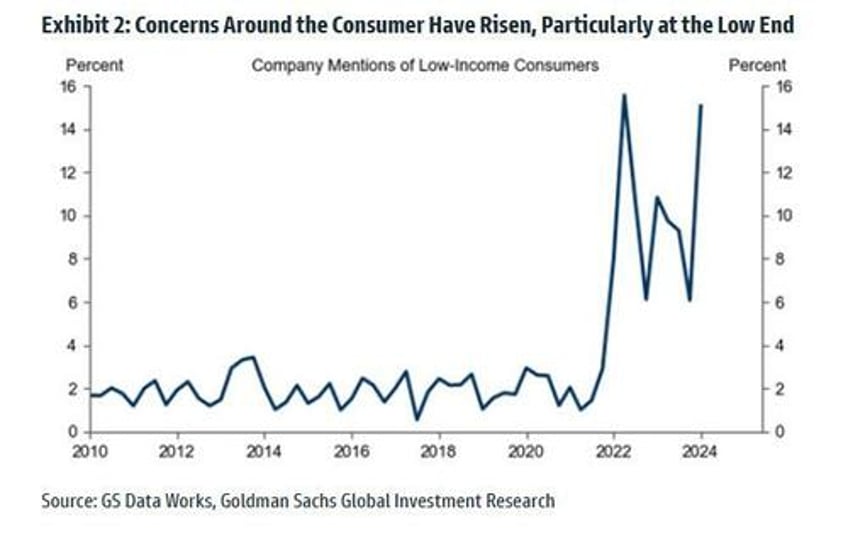

The big theme here is that low-income and middle-class Americans are suffering. Goldman recently illustrated this with charts, which we highlighted in a note titled "Goldman Exposes Bidenomics Real-World Disconnect: Low-Income Americans Are Struggling With High Prices."

Besides Goldman, corporate America as a whole is beginning to freak out about the pullback in spending.

We suspect corporate America's warnings about the consumer slowdown will grow louder as the fall elections approach.

Let's not forget that consumerism is nearly 68% of GDP. And, if you're wondering how a recession could form, all it takes is one incident in the Middle East to spike Brent crude over $100/bbl to create a shock (remember 2007/08).