Exxon Mobil shares have dropped as much as 5% after agreeing to buy Pioneer Natural Resources for $59.5 billion in an all-stock deal that Wall Street said offers not only cost-savings for Exxon ($2 billion per year over the next decade according to the company), but makes the company the new undisputed US shale king. While sellside research was supportive of the transaction, some such as Piper Sandler went so far as describing the deal as a long-term "home run."

BMO Capital Markets, Phillip Jungwirth (market perform; PT $118)

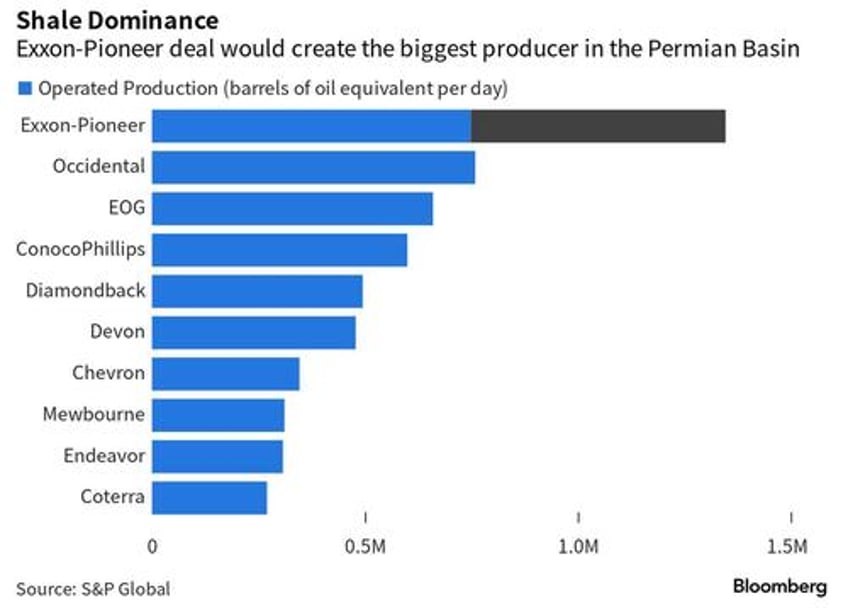

- “Deal more than doubles Exxon’s Permian footprint” as Pioneer had 850,000 net acres of land in the basin, while Exxon previously held 570,000 net acres

- The expanded Permian footprint, combined with Guyana assets is, “expected to drive most of future upstream growth”

- Calls deal “slightly accretive, highly strategic”

Piper Sandler, Ryan Todd (overweight; PT $132)

- “Strategically, we view the deal as a home run for XOM” as it answers the “only identifiable ‘question’ in its portfolio”

- Says the acquisition firmly establishes Exxon among the most “dominant players across nearly every business segment”

- Deal will “further increase pressure on its closest peers” including Chevron, to add to their portfolios

Tudor Pickering Holt, Jeoffrey Lambujon (hold; PT $120)

- Says Exxon “already held the most attractive global upstream portfolio in the space longer-term”; and Pioneer deal “further cements that characterization given our highly favorable view of the PXD assets”

- Sees Exxon accelerating development of Pioneer’s assets

Goldman Sachs, Neil Mehta (Neutral, PT $116, full note here available to pro subs):

- "Deal rationale. Permian M&A has been a key point of investor focus as it relates to XOM more recently, with the topic in-focus on recent earnings calls and at our recent Houston Headquarter visit. Management expects the transaction to be immediately accretive to XOM's earnings per share, operating cash flow and free cash flow. XOM expects the transaction to immediately add $5 bn in annual free cash flow and with synergies, incremental FCF of $6 bn in the second full year post-closing, growing to >$10 bn by the end of the decade."

- "The focus will be on XOM's plans around improving resource recovery. To the extent this can be replicated by other producers"

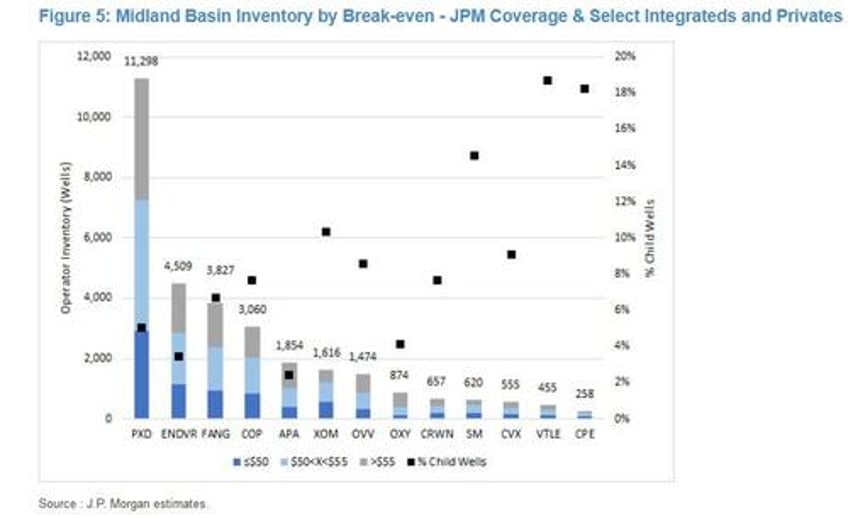

- "We see potential for another leg of improvement for shale capital efficiency where investors are concerned on both the quality and duration of the resource. On consolidation, while recent public transactions have been at no/little premiums, we note that this transaction is ~18% above the undisturbed closing price of PXD on October 5."

JPMorgan, John Royall (overweight, PT$137, full note here available to pro subs)

- "We think the deal makes strategic sense, as it grows XOM’s Permian footprint, which had been smaller than that of peers CVX and COP, and allows the company to high-grade and apply its own production techniques to PXD’s acreage, which has a strong overlap with XOM’s legacy acreage"

- "XOM expects <$35/boe cost of supply for PXD’s assets and is targeting double-digit returns on the transaction."

- "XOM expects to generate $5B of FCF from the deal in year 1, growing to $6B in year 2, and $10B by 2030. XOM described the deal as immediately accretive to EPS and FCF and discussed upside opportunity to returns of capital to shareholders"

Some more details from the JPM note (full report here):

JPM View:

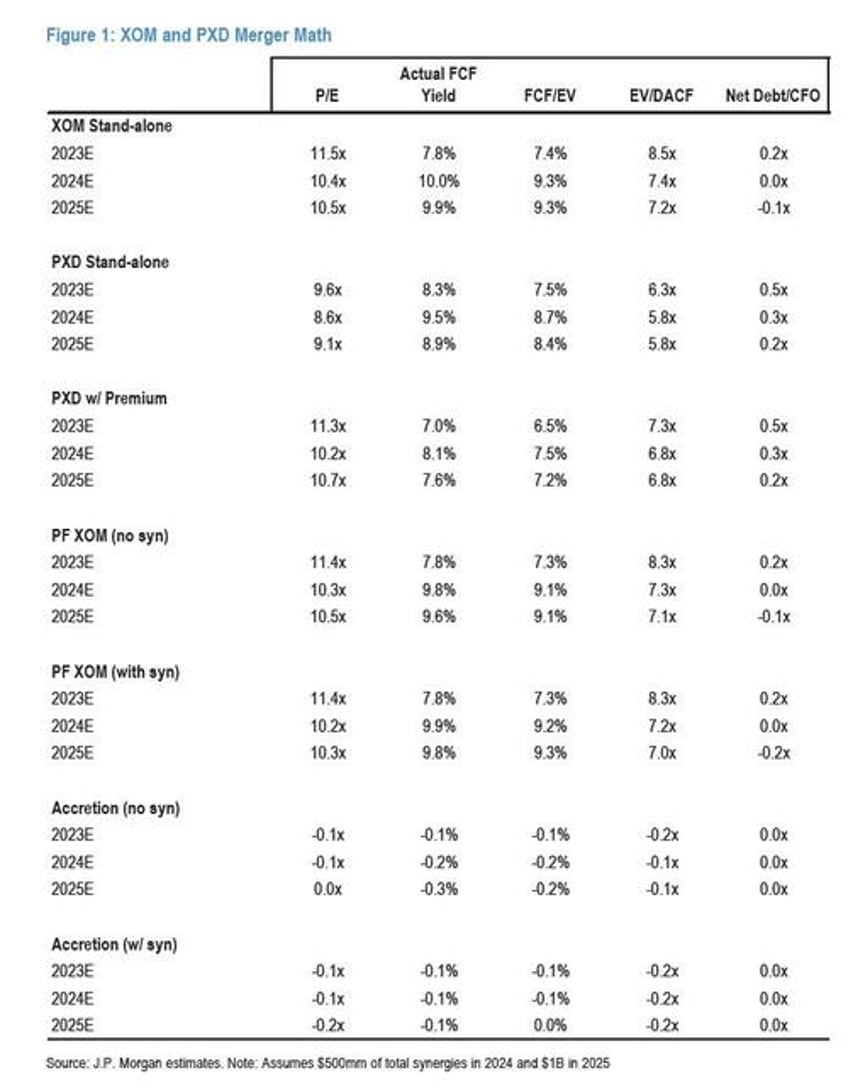

Following last Thursday’s WSJ article suggesting late stage deal talks between XOM and PXD (see our initial takeaways here), XOM announced a $59.5B all stock merger that values PXD at $253 per share using the exchange ratio of 2.3234 shares of XOM (~18% premium to PXD’s unaffected price). Strategically, this looks to be a pivot towards a higher mix of short cycle barrels (~40%+ from 28% today) and the U.S. (~45% from 31% today), which looks to have positive implications for NAM levered service stocks. We are not surprised to see XOM use all stock for the transaction given the timing of the transaction at well above mid-cycle conditions (~$87/bbl Brent), as all-stock deals have often been a preferred method of de-risking the potential for oil price volatility for the buyer. In PXD’s case, the all-stock deal provides its investors with portfolio diversification and potentially higher resource recovery from XOM’s technology toolkit. Figure 1 shows our refreshed accretion/dilution math on the final deal values. We expect the transaction to be relatively neutral on FCF metrics, assuming $1B of total synergies and modestly accretive (-0.2x) on both P/E and EV/DACF in 2025. XOM has identified $1.0B of synergy capture in year 2 and $2B per annum over the next decade. Interestingly, XOM expects two-thirds of the synergy capture from higher recovery factors and one-third from capex/opex synergies (we assume a 50/50 split of the one-third between capex/opex in our analysis). Surprisingly, lower G&A was not a key driver of expected cost synergies.

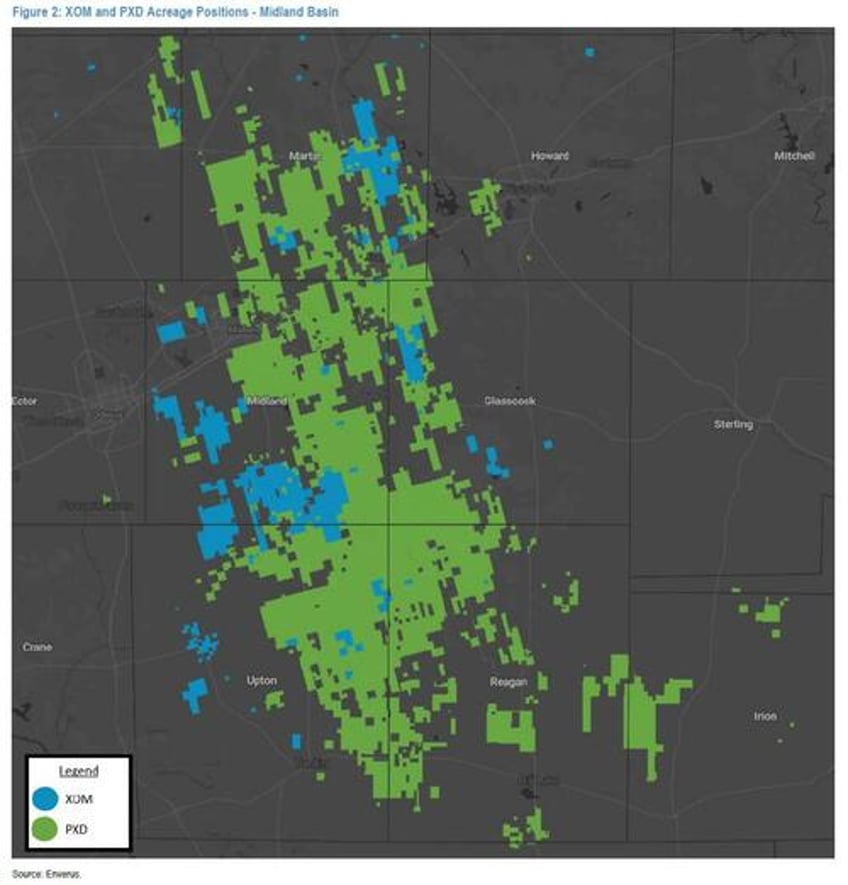

XOM now expects ~1.3mmboepd of PF volumes in the Permian in 2023 (stand-alone: ~600kboepd), with its 2027 target now ~2mmboepd (standalone: ~800kboepd). This implies a >11% growth CAGR vs. PXD’s standalone long-term oil growth forecast of up to 5% per annum. XOM’s total Permian acreage would go from 570k net to 1.42mm net, and combined resource is 16B boe. XOM expects <$35/boe cost of supply for PXD’s assets and is targeting double-digit returns on the transaction. XOM expects to generate $5B of FCF from the deal in year 1, growing to $6B in year 2, and $10B by 2030. XOM described the deal as immediately accretive to EPS and FCF and discussed upside opportunity to returns of capital to shareholders. Overall, we think the deal makes strategic sense, as it grows XOM’s Permian footprint, which had been smaller than that of peers CVX and COP, and allows the company to high-grade and apply its own production techniques to PXD’s acreage, which has a strong overlap with XOM’s legacy acreage (Figure 2).

XOM and PXD Acreage Positions - Midland Basin

More in the full note available to pro subs