In our FOMC preview, we said that the only thing that will matter today was the Fed's 2024 median dot...

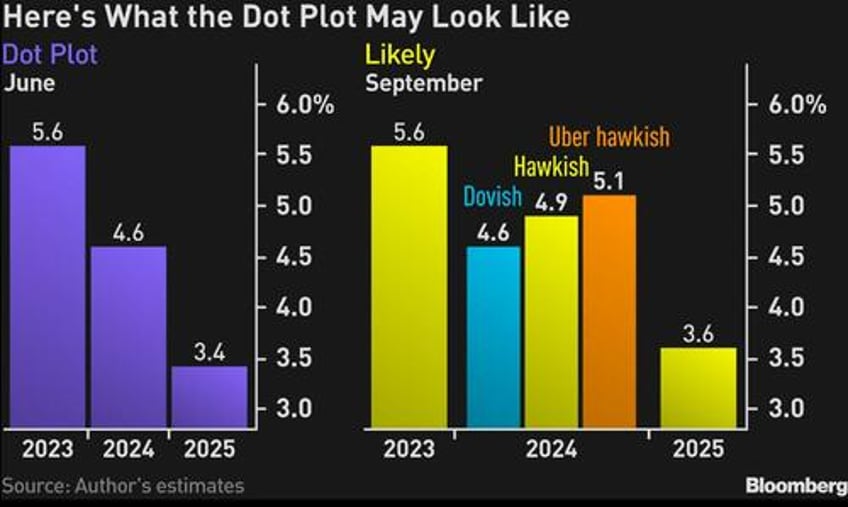

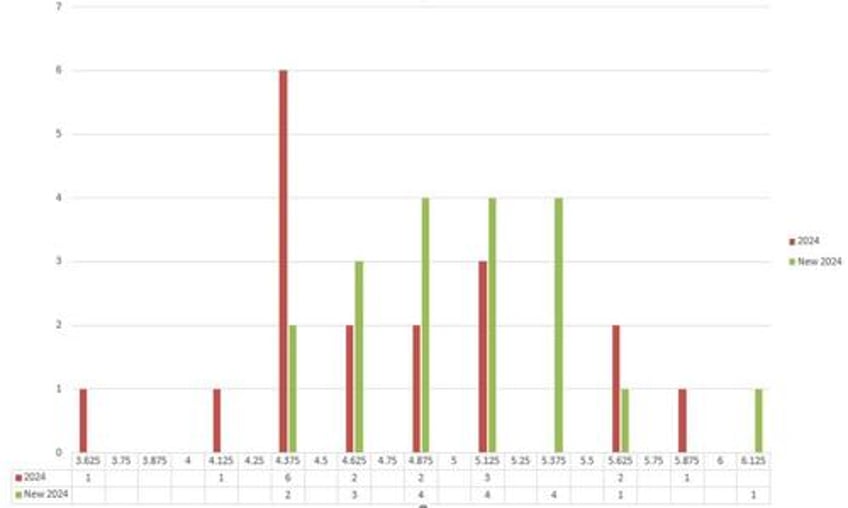

... and that's precisely what happened: with a statement that was a carbon copy of July, the real shocker today was the much more hawkish outlook for 2024. Indeed, as Bloomberg notes, when comparing the 2024 dots with the previous projection, one can clearly see a hawkish shift. The most frequent, (aka mode) projection from June was 4.375% (6 dots). Now, it’s between 4.875% and 5.375%. It’s a shift of as much as 100 bps.

And while the market swings around wildly, repricing trillions worth of assets based on a forecast which will be dead wrong months from today, let alone a year, here is what some Wall Street analysts, strategists and traders had to say in kneejerk response to the Fed statement and Powell presser.

Mohammed El-Erian

"I worry that the economic and policy signals coming out of this Federal Reserve press conference may come across to many as both confused and confusing. Some will deem this an inevitable consequence of this phase of the inflation and policy cycle; others will view it as further evidence of challenged Fed communication."

Ira Jersey, chief rates strategist at Bloomberg Intel

“A Fed that maintains short term rates well above 5% for most, if not all, of 2024 will keep the Treasury yield curve inverted for longer than many casual observers will be comfortable with. But in our view, even if the Fed doesn’t cut, the curve will continue to price for lower rates at some point in the future.”

Bloomberg Economics Team

“Even though the dot plot shows another hike this year, we see a number of potential adverse shocks to growth between now and end-year that could derail that plan. Economic uncertainty and disruptions from the UAW strikes and looming government shutdown may push the Fed to postpone a hike to 2024 — or even nix it completely. Still -- we do think the question of another hike this year is an increasingly close call.”

Zachary Hill, head of portfolio strategy at Horizon Investments.

"The Fed’s projections are compatible with a more resilient economy under higher interest rates, which implies a higher neutral rate. On its face, that is not a great reason to give up on equities, so I think that explains why we have had a muted selloff so far. Plenty of time left in the day though.”

Jake Schurmeier, PM at Harbor Capital Advisors

"It seems that the Fed is quite optimistic about a soft-landing. And it’s clearly leading them to revise up their estimates of the neutral rate despite the stickiness of the long-run dot.”

Omair Sharif, president of Inflation Insights LLC

“It’s very hard to explain a 3.7% core PCE forecast for this year. That figure, along with lower unemployment and higher growth, explains why the Fed took out two hikes for next year, but it’s very, very hard to justify. It implies a much higher monthly core PCE than most are expecting (especially given the 0.1% August core PCE that most are forecasting). It’s also odd to think the unemployment rate will just stick at 3.8% this year. It seems like officials have more confidence that we’ll just see lower demand via job openings and no pickup in layoffs. It’s oddly optimistic on the labor market and equally oddly pessimistic on core inflation this year.”

Andrew Patterson, senior economist at Vanguard

“It means (combined with the increase in growth expectations and cut in unemployment rate for that year) that the Fed is increasingly confident that they can pull off a soft landing and that the economy can withstand higher rates for longer.”

Derek Tang, economist with LH Meyer/Monetary Policy Analytics

“Contours of dot plot were largely as expected though the 2024 dots moving up to 5.1%, not just 4.9%, raised my eyebrows. I found the new absence of any 2023 dots above 5.6%, which means even the most hawkish no longer see hiking twice more as necessary, as imparting a dovish tone in the near term. The number who don’t project any more hiking this year was seven, which is a comfortable margin for Powell.”

Anna Wong, chief economist at Bloomberg Economics

“Conditional on very optimistic SEP forecasts on unemployment and inflation, Bloomberg Economics’ rule would indeed match the dot-plot projection of only two 25-bp rate cuts next year, and 120 bps of cuts in 2025. Our view is that the risks tilt toward a weaker economic outlook than the SEP has penciled in -- and we think the Fed ultimately will end up cutting more than the dot plot indicates.”

Bryce Doty of Sit Investment Associates

"The large real fed funds rate means the Fed does not need to raise rates any further. Odd how Powell points out STRONG growth of working age labor force as earnings growth subsides (more supply = less cost) and yet concludes the Fed is looking for WEAK employment before saying they are done raising rates.”

Audrey Childe-Freeman, chief G-10 FX strategist at Bloomberg Intelligence:

“There is not much in today’s Fed policy decision or policy statement likely to deter dollar bulls near-term when considering that the high for long interest rate message holds strongly, so that means that US dollar yield appeal for now. “In addition and arguably more surprisingly for 2024, the adjustment higher in the GDP growth profile for this year and next year puts dollar bulls in a strong position too, for now. Whether this can be sustained will obviously be a function of whether this soft landing scenario unfolds. All eyes on the press conference next but a first take at the statement and forecasts gives fresh ammunition to dollar bulls.”

David Powell, head of market strategy at TradeStation

“Today’s slightly hawkish Fed statement reflects the strength we’ve seen in the economy since their last meeting. Policymakers have zero incentive to get dovish now, especially with oil on the rise and the auto strike threatening to push up wages and potentially car prices... This announcement keeps them data dependent, which could be a positive if shelter costs continue to ease. Jerome Powell isn’t ready to back down yet, but markets might look past the rhetoric. Investors know he’s wary of declaring victory against inflation after his infamous transitory call two years ago.”

Peter Tchir of Academy Securities

"They do not want to cut. They want to hold rates higher for longer. End of 2024 and end of 2025 both 50 bps higher on recent SEP than the June SEP. A significant move but one that seems in line with our "extremely high hurdle" to cut. Between them barely mustering the dots to get one more 25 bp hike this year, and a press conference that seemed like he had to contain himself from sounding dovish (he did not come across hawkish) we may have moved from "high hurdle to hike" to "extremely high hurdle to hike". Yes, they are data dependent, and maybe it is wishful thinking on my part, but they seem to be looking to the data for reasons to do nothing! The Fed is always "data dependent" but they often seem to have had a bias. Until early this summer, they seemed to be looking for excuses to hike. I just don't see that in his language or their actions (remember, he comes into this with an objective of not coming across as dovish, so anything less than brutally hawkish is probably an admission of neutrality). So far, treasury yields are getting more inverted across the curve as the front end sells off a bit (pricing in higher for longer) but the back end is rallying a bit (given it is an FOMC day and we are near the high yields of the year (depending on where you look on the curve) the movements are quite muted.

Finally, to summarize the market moves: Initially we saw rates higher and equities lower. But both reversed during the press conference, before re-reversing again with yields back to session highs and stocks at session lows.

“Those moves are loosely consistent with a better growth outlook,” said Stuart Kaiser of Citi. “Higher rates are a tactical risk for equities but medium-term the SEP changes are positive for stock markets, in our view. It’s important to note that the FOMC is implying fewer cuts rather than additional hikes.”

Source: Bloomberg, primary sources.