It's become a bit (or more than a bit) of a joke: Biden is doing everything in his power - and beyond that too now that Fed Chair Jerome Powell has admitted what we have been saying all along and that the White House has been "overstating" jobs - to prove to America just how great his "economic recovery" is, and the more he tries the more people hate it.

And the funny thing is, the responses themselves are prima facie evidence of precisely the propaganda embedded in this discussion.

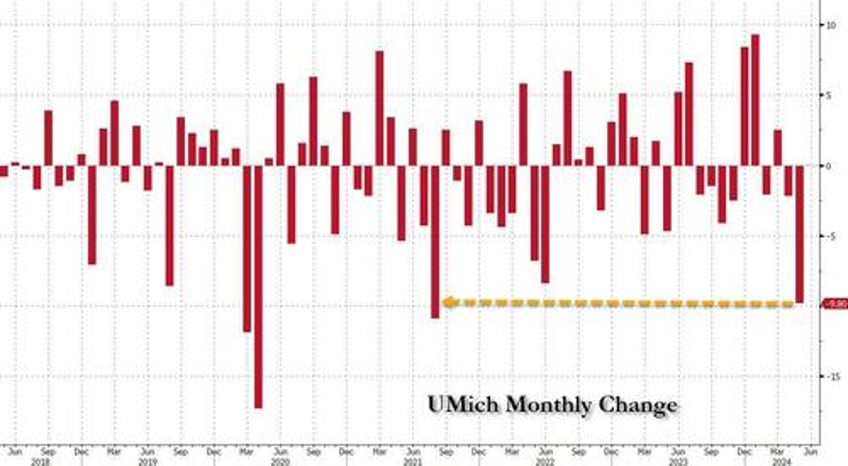

Consider that last October, the WSJ published an op-ed by the ultra liberal Alan Blinder titled "The Economy Is Great. Why Do Americans Blame Biden?" (his conclusion was "Inflation is lower, but some won’t be happy until prices come down too. That would be a disaster.") A few months later, in April, the even more liberal WSJ editorialist Greg Ip wrote "What’s Wrong With the Economy? It’s You, Not the Data." These desperate attempts to spark adoration for Bidenomics were a disaster, and in May the University of Michigan consumer confidence cratered the most since August 2021...

... forcing the WSJ to point out the painfully obvious: in an article from the editorial board titled "Why Biden Is Losing on the Economy", the WSJ capitulated and pointed out the glaringly obvious: "The average annual inflation rate during his Presidency is 5.5%. Under Trump it was 1.9%."

Alas, this moment of lucidity did not stop the propaganda express, and over the weekend Politico came up with what can only be described as pathetic pandering, writing that "Inside Biden’s orbit, the fear is that there’s little new the administration can do to change the perceptions of a stubborn electorate that’s living through an upswing — yet simply refusing to believe it." Translation: the deplorables are too stupid to appreciate just how great they have it.

such an ungrateful nation of deplorables does not deserve Biden https://t.co/dVdcSb68BI

— zerohedge (@zerohedge) June 10, 2024

It did not stop there, however, and the captured media pressed on, desperate to validate the Goebbels maxim that "if you repeat a lie often enough [even in rhetorical format] it becomes the truth." It culminated yesterday during Fed Chair Powell's presser, when he faced a question from a CBS reporter who asked "what's your message to Americans who are seeing encouraging economic data, but don't feel good about this economy?"

Powell's response was actually brutally accurate, and evaded the attempt to trap him into praising Biden:

You know, I don't think anyone knows, has a definitive answer why people are not as happy about the economy as they might be. And we don't tell people how they should think or feel about the economy. That's not our job. We, you know, people experience what they experience.

Instead, Powell - who has previously taken pot shots at Biden's overheating fiscal policy, i.e. out of control debt, which to many inside the Fed is the primary reason why inflation remains as hot as it is - was quick to point out that if he fails to do his job right this time and curb inflation (unlike the devastating easing episode of 2020-2022 which ended with the worst inflation in decades), it would be a disaster and would lead to even more pain for the majority of American people.

... it's going to be painful for people but the ultimate pain would be a period of, a long period of high inflation. It is people who, lower income people who are at the margins of the economy who have the worst experience, who experience the most pain from inflation. So, you know, it's for those people, for all Americans, but particularly for those people that we're doing everything we can to bring inflation back down under control.

The fact that it is the "lower income people" that are hurt the most by Powell's economy may have something to do with why liberal economists and pundits, living in their upper-middle class enclaves and buying their groceries with their corporate charge card, are so confused about why the Biden recovery is so hated by most.

So to answer the question once and for all (of course, it will never stop the propaganda but we can try), we direct readers to a recent note from TS Lombard's Dario Perkins titled "Why everyone hates this economy (except economists)" who has done a good job of not only explaining why "economists are baffled" (even more than usual), but how they can get unbaffled.

According to Perkins, "the data say the economic situation couldn’t really have evolved any better over the past two years. There was no recession (not a “proper” one, anyway), inflation has come down a long way, and unemployment is at generational lows. Wages are growing briskly." But, he also notes, "the general public clearly don’t like this economy, which is a big deal if you are a politician seeking reelection. So why is everyone so grumpy? Are economists out of touch with reality?"

Here are the key points Perkins makes to answer these rhetorical questions, and to explain why :

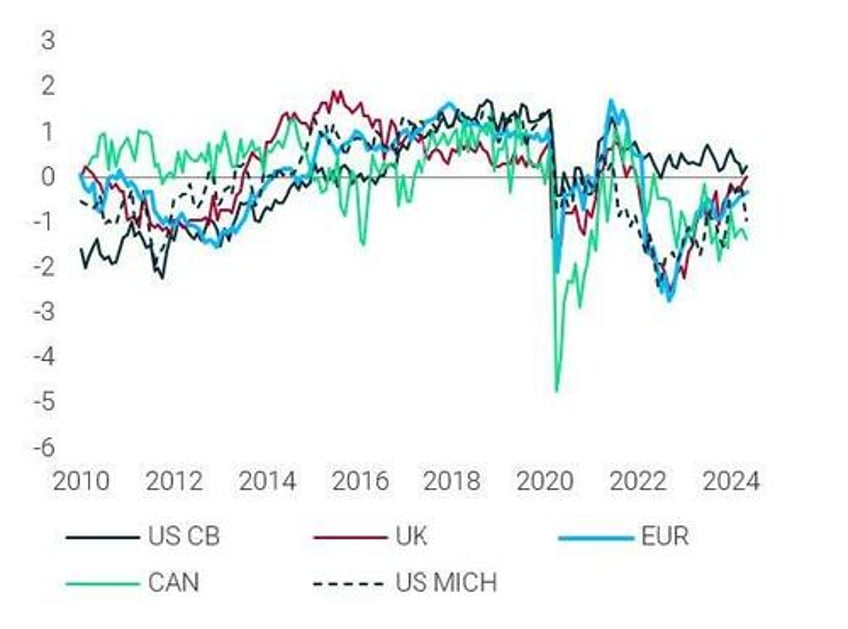

While the debate about consumer grumpiness has been focused on the US, it is not just a US story. Confidence plunged everywhere during the pandemic and has never fully recovered. If anything, the US data are a bit mixed – with a notable divergence between the two main readings – and people outside the US are even grumpier than Americans. That is probably because the US enjoyed a post-pandemic boom that was absent elsewhere. The US had the party, but the whole world has had the hangover.

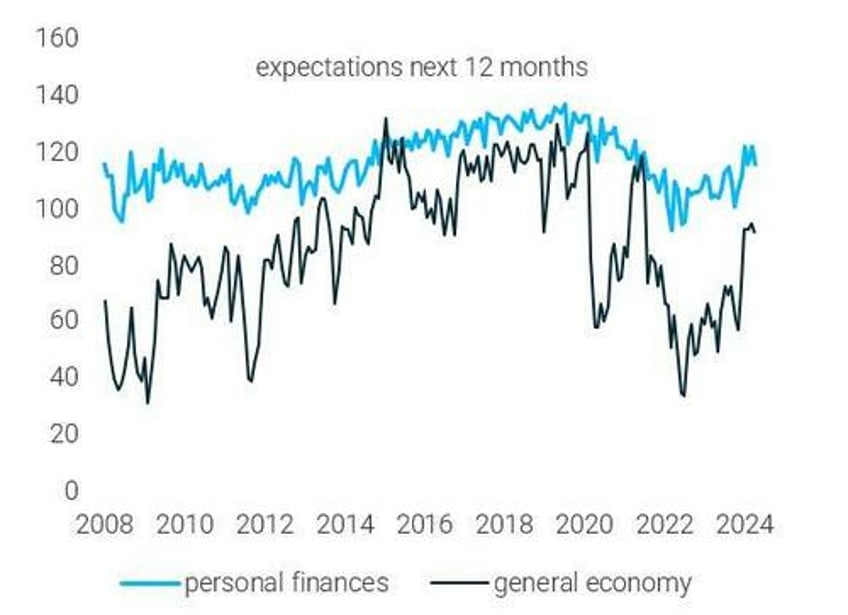

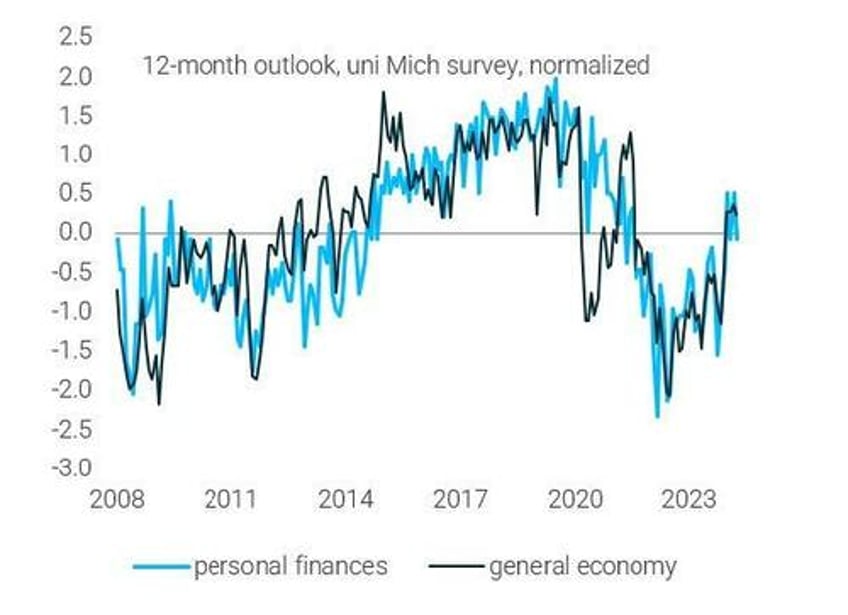

One popular explanation for low consumer confidence is that people are just fibbing, perhaps out of political bias. They don’t like the way their economies are being run, but their own situation is actually pretty good. A recent poll in the US seemed to back this up. According to KPMG, 54% of Americans were optimistic about their own financial situation, while only 37% thought the economy would do well. We see the same divergence in consumer confidence, both in the US and elsewhere.

But this theory is note right. Where we have historical data on this divergence we see that (i) people are ALWAYS more optimistic about their own situation and (ii) those expectations don’t change very much over time. To correct for this, we need to normalize confidence readings. When we do that, the gap in sentiment disappears. Even if people are fibbing, they are not doing fibbing more than usual.

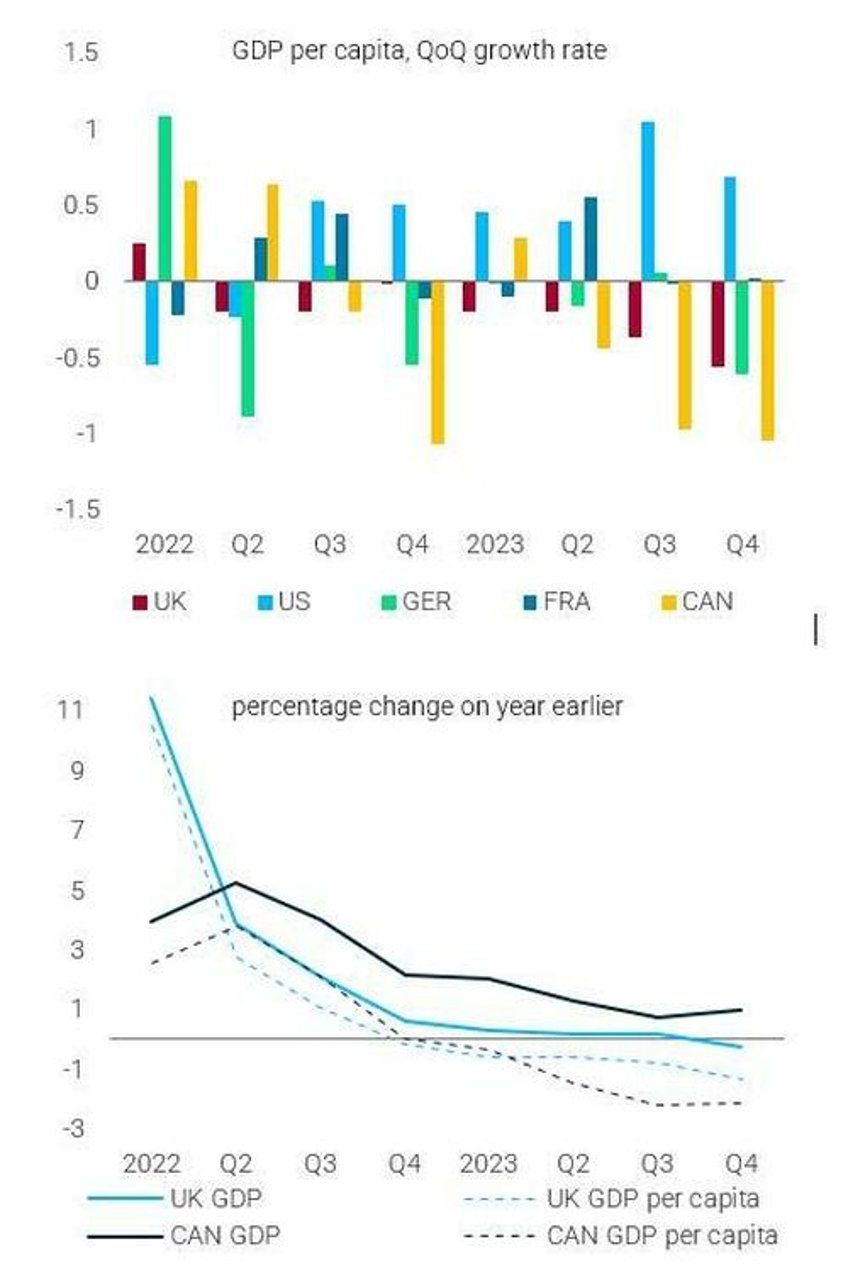

We need a better explanation. Another possibility is that aggregate data on GDP and employment are exaggerating how well the economy is doing. We know, for example, that there has been a lot of immigration since 2022. This has raised overall spending, but per capita GDP has often gone down. Canada and the UK, for example, have been suffering a per capita recession for 18 months. But this thesis doesn’t really work for the US, where there is no big gap between GDP and GDP per capita.

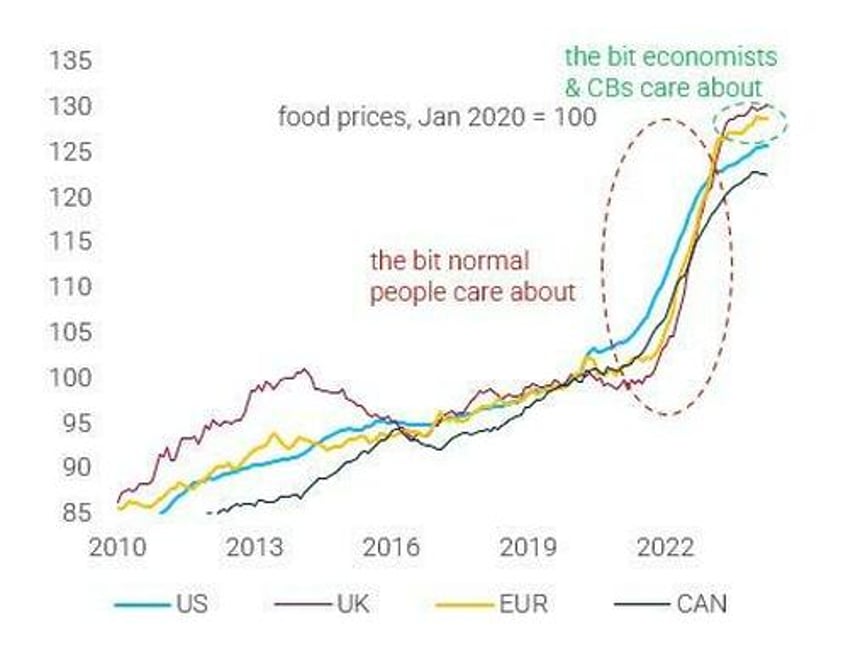

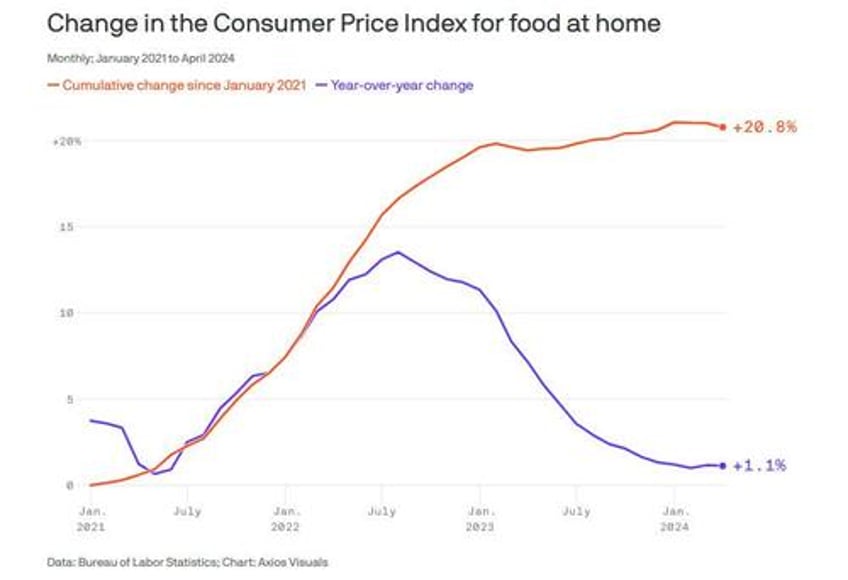

The best explanation is simpler. Normal people have a different way of looking at inflation compared to economists/ central bankers. Even if prices are no longer rising fast, they are still a lot higher than three years ago. Food prices are up a whopping 30% everywhere, and you need a mortgage to take a family of four to a restaurant. People don’t like paying more for the same things, even if wages have increased. You could call this reverse money illusion, but in many cases real wages are down.

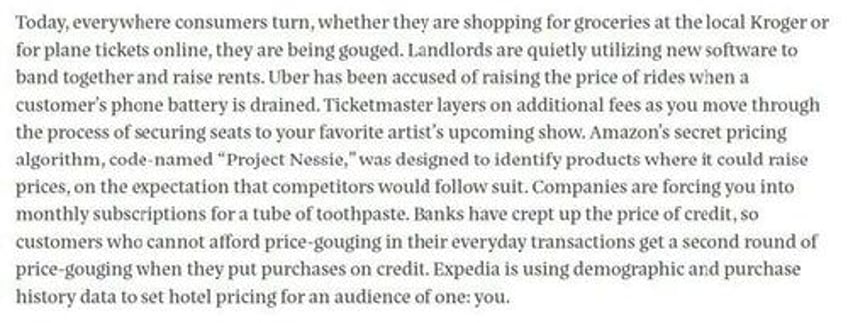

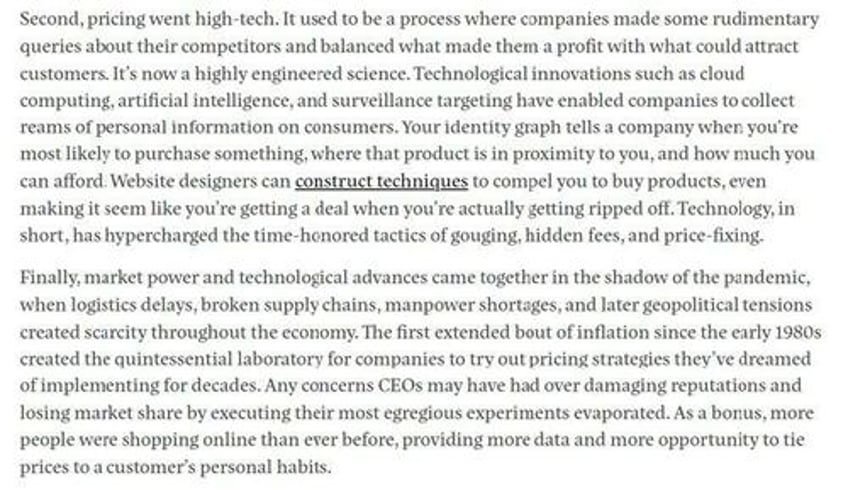

And its not just the price level that is irritating. People also have the feeling they are being ripped off. This isn’t just a vibe. I urge you to listen to the Oddlots podcast (or read this issue of American Prospect) on “digital price gauging”, about the explosion in digital surveillance since COVID-19. For decades, tech enhanced price transparency and reduced companies’ ability to raise their prices. Today, those dynamics are being turned on their head – to the detriment of consumer welfare.

There's more: shrinkflation and drip pricing (only revealing part of the price upfront) are not new. But we are also seeing an explosion in:

- personalized pricing: using big data, often collected covertly via apps, to reveal the maximum price people will pay:

- algorithmic price fixing: companies using the same software to coordinate pricing and prevent undercutting

- dynamic pricing: raising prices when supply is low, or consumers desperate.

As Perkins concludes, "these are issues macro economists have ignored. That needs to change" and in some circles, we are seeing the change: even that ultra liberal media bastion of ex-Politico pundits, Axios, recently experienced a lightbulb moment, that it is not the declining year-over-year inflation that matters, which is what the White House touts at every opportunity, but the cumulative inflation since 2021...

... that matters, and - paradoxically - absent a bone-crushing recession or worse, that sky high cumulative inflation from the past three years is never going down again.