As human civilization has evolved, one thing has remained constant; change...

During major shifts, the root desire for change is typically ignored. I believe that these generational shifts, our societal shifts, are tied to a mismatch in the speed with which people and money need to move. Let’s take a moment to look at our major revolutions.

- Agrarian Revolution: a move from hunter-gatherer to farmers.

- Industrial Revolution: a move from farmers to factory workers.

- Digital Revolution: a move from assembly lines to skilled/knowledge workers.

Each of these waves caused a drastic shift in how society operated. They disrupted every industry and old line of thinking. These periods experienced major shifts in lifestyle, access, and money.

Each major revolution was propelled by our ability to harness new technologies and resources. In turn, allowing us to apply and realize the potential of mathematical principles that had been understood, but not fully utilized, in previous eras. For example, the Industrial Revolution leveraged Newton’s laws of motion to develop machinery that transformed production processes. Calculations, known for decades and centuries, became the powering force behind modern tools.

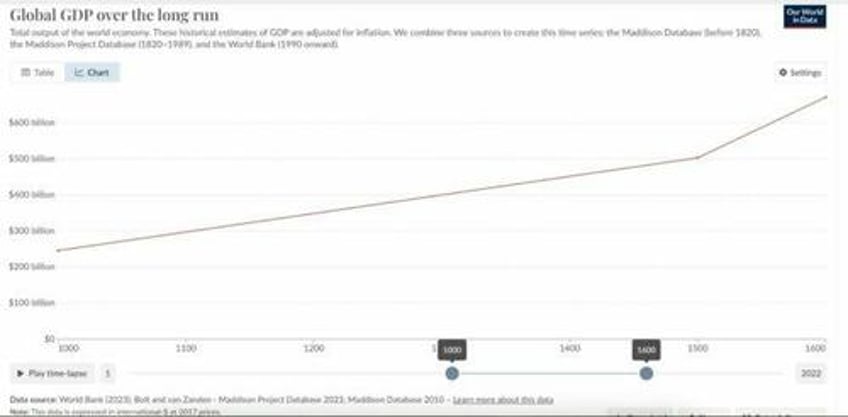

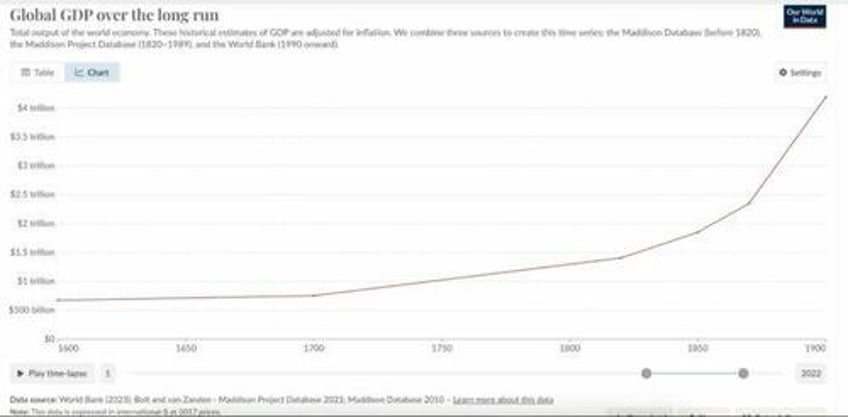

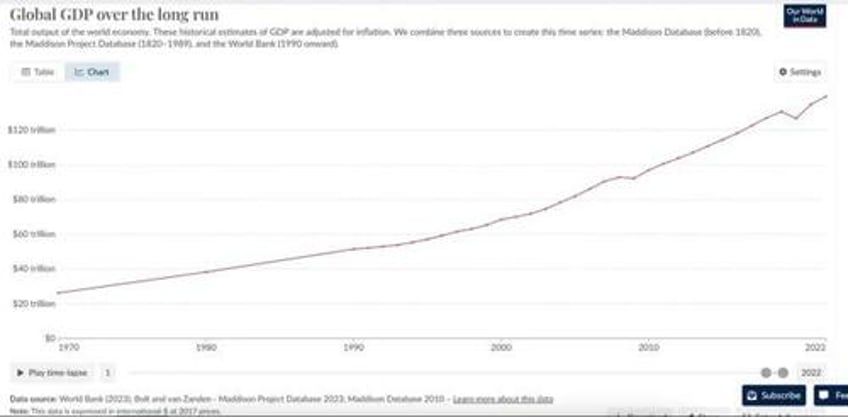

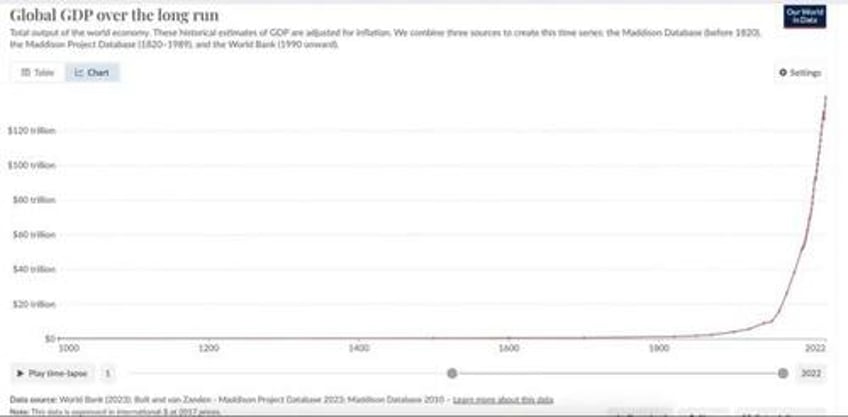

When we apply known calculations to new tools and technologies we typically see an unlocking of Gross Domestic Product (GDP) or “value” in a way never experienced before.

During each revolution, GDP trajectory seems unsustainable in the moment. Having a trajectory that resembles the path of a rocket ship. However, as time passes and we have the ability to zoom out, we find that the distant past looks much more normalized. Over long periods the chaos of the moment smooths, providing the continuous up and to the right movement for our economic systems.

As we enter into the revolution of money, we should expect a surge similar to the impact of the internet in the 1990s.

For instance, the adoption of e-commerce, enabled by the internet, contributed to a substantial increase in GDP, with online retail sales in the U.S. growing from $27.6 billion in 2000 to $1.1 trillion in 2023.

Integration of digital currencies into the global economy is expected to reform banking and create new industries, reduce transaction costs, and open up previously inaccessible markets. This shift can be seen in dashboard data from Coinmetrics.io which shows the Stablecoin market having grown from roughly $0 prior to 2019 to about $160B+ today. Thus, Bitcoin and protocol innovations should continue to be big drivers of innovation for our next major wave of growth.

How Does This Relate to Today?

Much of the math that drove the industrial revolution was understood in 17th Century. In 1687, Isaac Newton published “The Principia“, laying the foundation for the laws of motion and gravitation. His work provided a mathematical framework for understanding force and motion in a way that led to the creation of mechanical systems which powered the industrial revolution of the 1800s.

Much of the math that drove probability theory and our understanding of the distribution of outcomes (Pareto’s Principle) was derived between 1500 and the late 1800s. The work of math mathematicians Gerolamo Cardano, Blaise Pascal, Christiaan Huygens, and Vilfredo Pareto powered much of our understanding and calculation of business margins in the 20th century. One could argue the genius of their work was not fully appreciated until post-1950 and again post-1980. A time when the American middle class was built. When sales and consumerism became the primary goal.

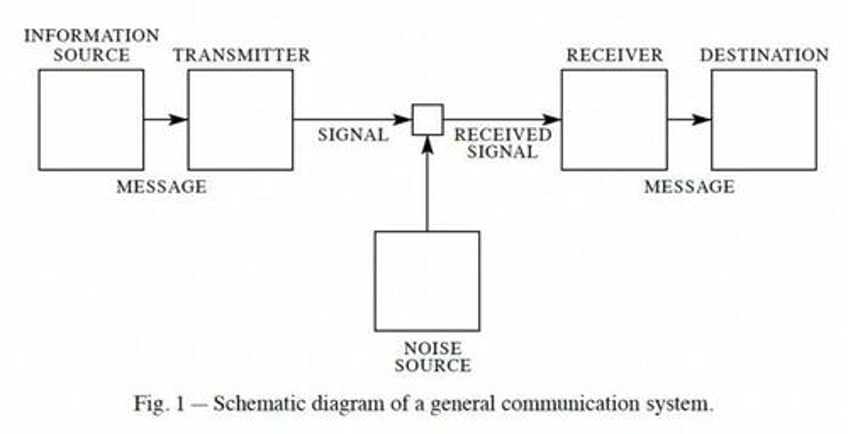

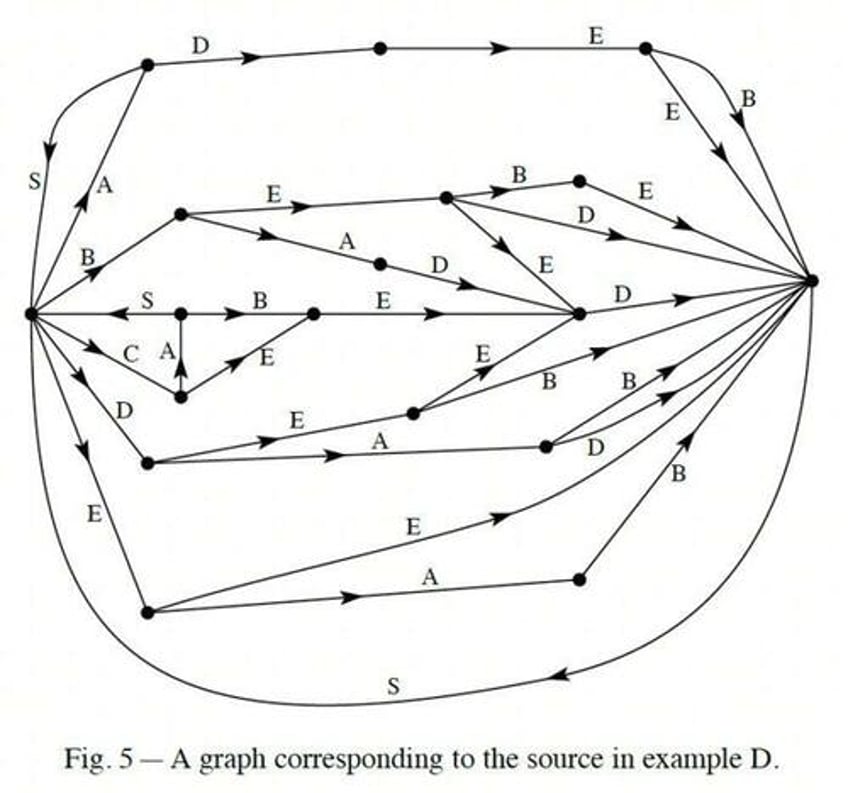

Much of the math that powers our digital and telecom networks was formulated between the mid-1800s and mid-1900s by mathematicians like George Boole, Harry Nyquist, Claude Shannon (the godfather of AI), Ralph Hartley, Alan Turing, and John von Neumann. Their foundational works were later expanded on by Paul Baran, Donald Davies, Richard Hamming, Vint Cerf, Bob Kahn, and Robert Metcalfe. These pioneers stood on the shoulders of giants before them and integrated our understanding of information (bits and bytes) with global business, enabling the digitization of industries and business models between 1970 and the early 2000s.

Source: A Mathematical Theory of Communication by Claude Shannon

While probability theory served us well in the analog and early digital eras, the complexities of today’s networked world demand a more sophisticated approach. This is where Information Theory offers a framework that can support exponential growth and the interconnectedness of our modern economy.

Previously, Information Theory was not widely understood, nor were the resources and compute power available to make it work at scale. Its math, formulated in the early to mid-1950s, gave us what we know today as Artificial Intelligence (AI), noded networks, social graphs, and graph-based database technologies.

Source: A Mathematical Theory of Communication by Claude Shannon

Why is this Important?

Each revolutionary moment brought major change to the world, creating a new state. During these major shifts, we often see confluence of human understanding of past fundamental laws (math), availability of resources (technology), and the ability to serve human needs (money/value). In short, today’s shift is because of a broader understanding of math derived by Claude Shannon, power laws, and the availability of new age chipsets and compute resources.

Today, we are transitioning from a digital/analog world, where systems operate independently or in linear sequences, to a ‘networked world’ where everything is interconnected through complex, node-based systems. In this new paradigm, relationships—both social and economic—are managed through decentralized networks, much like the structure of the internet.

However, our base money still operates off of probablistic principles rather than exponential laws. As our economic system evolves, it’s clear that traditional forms of money are not a good fit. Given the limitations of speed, scalability, and adaptability of fiat currency it makes sense that we commonly refer to our money as broken. Paper money no longer meets the need of our increasingly digital and interconnected world. We need to transition to a new form of currency that can grow and adapt at the pace of technological advancements. There is a critical need to shift from traditional monetary systems, which grow linearly or incrementally, to one that operates in an exponential nature. One we can refer to as ‘exponential money’—a form of currency that grows and scales at a much faster rate due to its integration with digital networks and information theory.

We are transitioning from relying primarily on probability theory—which deals with predicting the likelihood of different outcomes—to leveraging information theory, which focuses on quantifying, transmitting, reducing noise in communication and processing information. Particularly in complex and interconnected digital systems.

During the digital era from 1980 to 2009, probability theory played a central role in business and decision-making, as it was well-suited for predicting and optimizing likely outcomes in a relatively stable, linear environment. Businesses relied on algebraic models to maximize profit margins and manage risks based on historical data and statistical analysis. With money that’s lightly integrated into the system and conditioned to handle probabilities this works. However, in the cloud era our lifestyles became integrated and the connectivity to our money fell behind in it’s ability to compute.

Post 2000 as the world shifted to exponential systems that were increasingly connected, the money no longer moved at the pace of human need. More importantly the heart of the modern economic system shited from oil to Data. “Data is the new oil”, or rather, information is the new oil and money is information.

As digital data became integral to our economy, the limitations of traditional currencies, which were not designed for rapid scalability, became increasingly clear. The introduction of Bitcoin in 2009 provides a solution to this problem. By utilizing principles of Information Theory and Power Laws we have a currency that can scale for the digital age. For instance, Bitcoin’s decentralized network relies on the exponential increase in network participants, as described by Metcalfe’s Law, which helps explain its growing value and adoption. This is evident in Bitcoin’s market capitalization growth, which surged from nearly zero in 2009 to over $1 trillion in 2024, reflecting the currency’s ability to scale alongside the digital economy.

Prior to now, these scaling behaviors and distributions were only common in nature, viruses, physics, and network theory. Though this type of scaling was also common in economic theory, it was foreign to our money.

Money Powered By Networks

Moving forward, all our people, business, and money will operate off the same math that powers our networks. As AI and Bitcoin become integral to our financial systems, we can expect a dramatic increase in economic growth and efficiency, similar to the productivity gains seen during previous technological revolutions. Bitcoin and stablecoins’ ability to facilitate near-instantaneous cross-border transactions at lower costs than traditional financial systems offers a glimpse into the future of more efficient global trade. A 2020 report by PwC estimates that AI alone could contribute up to $15.7 trillion to the global economy by 2030, demonstrating the potential scale of these technologies.

This is the crux of the chaos and geopolitical battle we see. Multiple parties are jocking for power and control of the joystick of the new world order. Log of time and price will bring forth another revolution. A revolution of money.

For us to progress as economies and to unlock the full GDP value of the future, we will need money that operates at its core on mathematics that is conducive with principles rooted in network theory. Dollars, fiat money in general, cannot by nature of the math basis do this. Bitcoin and cryptocurrencies, which operate at their core using digital information (bits and bytes), are built on the principles of Information Theory.

With the internet, in the 1980s, we broke the barrier to information. Exploding the world with new growth and business opportunities. As we enter into the revolution of money. We will do the same. As we break the barrier to money, with these technologies, we will witness another explosive round of growth and business opportunities that will power the next wave of GDP. For the first time, we will see value, information, and energy integrated seamlessly within our networked systems, creating the conditions for rapid economic expansion. A precedent for this can be seen in the rapid adoption of the internet, which led to the dot-com boom in the late 1990s and early 2000s. Companies like Amazon and Google, which harnessed the power of digital networks, grew exponentially and reshaped entire industries. Similarly, the combination of blockchain technology and AI is expected to unlock new levels of economic productivity by enabling secure, real-time data exchanges and automated decision-making across global markets.

Our relationships are now deeply interconnected, both socially and financially. Yet, our monetary systems still rely on outdated probabilistic principles and human subjectivity rather than embracing the exponential laws that drive modern communication technology. It’s time to transition from a flawed, morally bankrupt currency to a new form of ‘exponential money’ - one rooted in the same mathematical principles that govern nature.

As we stand on the brink of another revolution, it’s clear we must move beyond the limits of probability theory to something far more profound.

* * *

Get on the Bombthrower mailing list here and receive a free copy of The Crypto Capitalist Manifesto and The CBDC Survival Guide when it drops. Subscribe to Kane McGukin’s Substack here.