- APAC stocks began the week on the front foot following last Friday's gains on Wall St owing to the blockbuster jobs report.

- European equity futures are indicative of a positive cash open with Euro Stoxx 50 futures +0.3% after the cash market closed higher by 0.7% on Friday.

- DXY has held onto most of Friday's post-NFP gains, EUR/USD is on a 1.09 handle, USD/JPY briefly traded above the 149 mark overnight.

- Israel continued its wave of airstrikes on Lebanon on Sunday in what was the heaviest 24 hours of bombing since it stepped up its campaign against Hezbollah, FT

- Looking ahead, highlights include German Industrial Orders, EZ Sentix Index & Retail Sales, US Employment Trends & Consumer Credit, Speakers including ECB’s Cipollone, Lane & Escriva, Fed’s Kashkari, Bostic & Musalem.

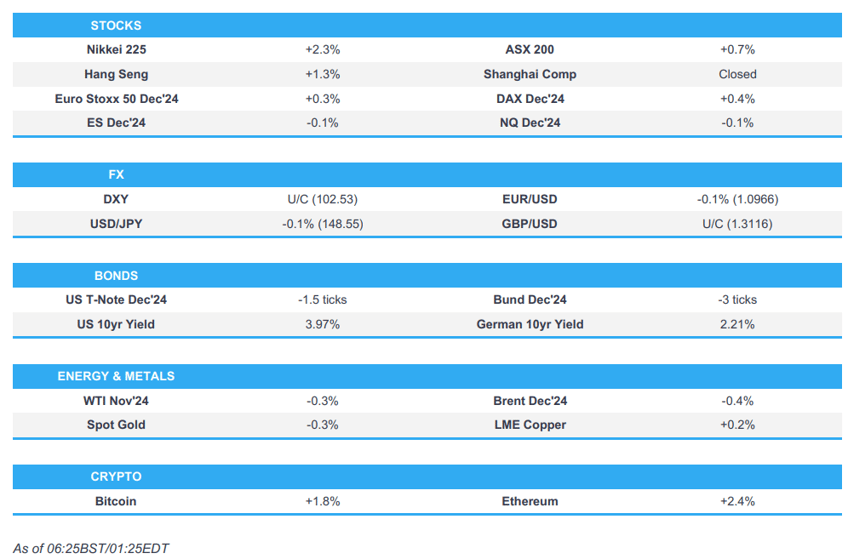

SNAPSHOT

More Newsquawk in 3 steps:

More Newsquawk in 3 steps:1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks gained on Friday with outperformance in the Russell 2k on the prospects of a strong US economy following the stellar September NFP report and sectors closed predominantly in the green in which Financials, Consumer Discretionary and Communication led the gains, while defensive sectors such as Real Estate, Utilities and Health Care underperformed. All attention was on the September jobs report in which the headline NFP printed at 252k to top all analyst forecasts (consensus 140k, max estimate 220k), while the unemployment rate dipped and wages accelerated. This spurred a bid in stocks and the dollar while Treasuries tumbled with the curve bear flattening as 50bps bets were fully unwound with money markets currently pricing a 99% probability for a 25bps cut for November.

- SPX +0.90% at 5,751, NDX +1.22% at 20,035, DJIA +0.81% at 42,353, RUT +1.50% at 2,213.

- Click here for a detailed summary.

APAC TRADE

EQUITIES

- APAC stocks began the week on the front foot following last Friday's gains on Wall St owing to the blockbuster jobs report, while Japanese stocks led the advances on the back of recent currency weakness.

- ASX 200 shrugged off early indecision as strength in tech, financials and miners picked up the slack from weakness in defensives.

- Nikkei 225 gapped above the 39,000 level with the rally facilitated by recent JPY weakness, while a Reuters analysis report suggested that a preference by Japan's new leadership for loose monetary policy raises the hurdle for rate hikes.

- Hang Seng climbed at the open ahead of tomorrow's resumption of trade in the mainland and the NDRC's news conference to discuss implementing a package of policies to promote economic growth, although the gains were initially capped by weakness in some property stocks and China-EU tariff frictions.

- US equity futures (ES -0.1%) were little changed in the absence of any pertinent macro catalysts from over the weekend.

- European equity futures are indicative of a positive cash open with Euro Stoxx 50 futures +0.3% after the cash market closed higher by 0.7% on Friday.

FX

- DXY slightly softened but retained most of Friday's spoils after rallying on the blockbuster jobs data which wiped out the prospects of a 50bps move at the November meeting with money markets pricing a 99% chance of a 25bps cut, while the attention this week for the dollar turns to the FOMC Minutes due on Wednesday followed by the latest US CPI data on Thursday.

- EUR/USD languished beneath the 1.1000 handle after giving way to last week's dollar strength, while there were comments from ECB's Villeroy that they will quite probably cut rates in October due to a rising risk of inflation undershooting the 2% target.

- GBP/USD partially nursed losses following a recent brief dip beneath the 1.3100 handle but with the rebound lacking any strength.

- USD/JPY pared some of last week's firm advances with a pullback seen after failing to sustain a brief foray into the 149.00 territory.

- Antipodeans traded sideways after last week's selling pressure and with little pertinent catalysts to drive price action, while participants now await the RBA Minutes on Tuesday and the RBNZ rate decision on Wednesday with the NZIER Shadow Board evenly split between a 25bps and 50bps cut.

FIXED INCOME

- 10yr UST futures got some slight reprieve after slumping on Friday owing to the blowout US jobs report.

- Bund futures attempted to regain composure following last week's selling and briefly reclaimed the 134.00 level.

- 10yr JGB futures tracked the post-NFP declines in global counterparts with demand also not helped by the rally in Japanese stocks.

COMMODITIES

- Crude futures took a breather following last week's 9.1% surge which was the biggest weekly gain in over a year, while the downside was cushioned amid geopolitical tensions and after Saudi raised the OSP to Asia, with support also seen in WTI and Brent around USD 74/bbl and USD 77/bbl, respectively.

- Saudi Arabia set the November Arab Light Crude Official Selling Price to Asia at a premium of USD 2.20 vs Oman/Dubai and to NW Europe at minus USD 0.45/bbl vs ICE Brent, while it set the OSP to the US at plus USD 3.90/bbl vs ASCI.

- Qatar set the November Marine Crude Official Selling Price at a premium of USD 1.00/bbl vs Oman/Dubai and Land Crude OSP at a premium of USD 0.85/bbl vs Oman/Dubai.

- Iraq’s Kerala refinery is undergoing extensive maintenance which started on September 25th and is currently non-operational with the maintenance expected to last for around a month, according to a source with direct knowledge cited by Reuters.

- Italy’s ENI (ENI IM) is in talks with Japan on supplying LNG to the country.

- Goldman Sachs sees Brent to trade in the USD 70-85/bbl range and forecasts an average price of USD 77/bbl in Q4 2024 and USD 76/bbl for 2025. Goldman Sachs added that assuming a 2mln bpd 6-month disruption to Iranian supply, it estimates that Brent could temporarily rise to a peak of USD 90/bbl if OPEC rapidly offsets the shortfall.

- NHC said tropical storm Milton is about 845 miles west-southwest of Tampa Florida and that the risk of life-threatening impacts is increasing for portions of Florida's west coast, while NHC said Milton is expected to become a major hurricane in the next day or so.

- BP (BP/ LN) said it is monitoring Milton to protect its people and operations in the Deepwater Gulf of Mexico but does not expect major impacts to its offshore facilities in the Gulf of Mexico.

- Spot gold was contained following quiet weekend macro newsflow and with key releases from the US due from mid-week.

- Copper futures were rangebound despite the mostly positive risk tone, as its largest buyer remained absent from the market.

- TotalEnergies (TTE FP) is considering a foray into copper trading, according to a top executive.

CRYPTO

- Bitcoin strengthened overnight after climbing back above the USD 63,000 level.

NOTABLE ASIA-PAC HEADLINES

- Chinese officials will brief on economic policy implementation with the state planner to conduct a news conference on Tuesday at 10:00 local time (03:00BST/22:00EDT).

- Chief China correspondent at the WSJ posted on X "Source in Beijing told me there are lots of 'misunderstandings in the market' about what China will do next to support growth. Yes, some fiscal measures “in the pipeline” but nothing as big as some had speculated".

- Japanese Finance Minister Kato said a weak yen has both merits and demerits, while he added that they will need to monitor how excessive forex moves will affect corporate activities and households.

DATA RECAP

- Chinese FX Reserves (USD)(Sep) 3.316tln vs. Exp. 3.304tln (Prev. 3.288tln)

- China Gold Reserves (Oz)(Sep) 72.8mln (prev. 72.8mln)

GEOPOLITICS

MIDDLE EAST

- IDF said on Monday that it is targeting Hamas sites and rocket launchers throughout the Gaza Strip and it attacked a Hamas command and control post at the Al-Aqsa Martyrs Hospital. It was also reported that four projectiles were fired from Gaza as Israel began October 7 commemorations, according to AFP. Furthermore, Israeli media reported sirens sounded in Tel Aviv for fear of infiltration of drones and the Israeli military also announced that sirens sounded in Rishon Letsiyon in central Israel.

- Israel conducted a strike on a mosque in Deir Al-Balah in the central Gaza Strip over the weekend which killed at least five people and wounded 20, according to Reuters.

- Israel continued its wave of airstrikes on Lebanon in what was the heaviest 24 hours of bombing since it stepped up its campaign against Hezbollah, according to a report on Sunday by FT.

- Lebanese media reported rocket barrages fired from Lebanon towards the Galilee and the Haifa area in Israel, according to Asharq News. Furthermore, sources reported a direct hit on a restaurant in Haifa, Israel after rockets were fired by Hezbollah from southern Lebanon and Israel's ambulance service separately announced 10 were wounded after Hezbollah fired rockets at Haifa, including one in serious condition.

- Israel’s military issued new evacuation alerts on Sunday for areas in southern Lebanon, while it separately announced that areas of Manara, Yiftah and Malkia in northern Israel declared a closed military zone, according to Reuters.

- Israel’s military announced changes to the Home Front defensive guidelines which apply to several areas including communities near the Gaza Strip in which gatherings of up to 2,000 participants will be permitted and the activity scale will be changed to partial activity in a number of central Galilee communities, while the rest of the country’s guidelines remain unchanged, according to Reuters.

- Israeli military spokesperson said their response to Iran’s missile attack will come at the timing that Israel decides is best, while the spokesperson confirmed that two Israeli airbases were hit in Iran’s attack on Tuesday but noted its air force and the bases remain fully operational, according to Reuters.

- Israel’s military said Hamas official Muhammad Hussein Ali Al-Mahmoud who served as Hamas’s executive authority in Lebanon and Hamas military wing in Lebanon member Said Alaa Naif Ali were killed by an Israeli air strike and operation on Saturday. It was also reported that a Lebanese security source said Hezbollah leader Hashem Safieddine was ‘unreachable’ since Israeli air strikes on Friday.

- Hamas official said Israel is blocking a ceasefire agreement despite Hamas’s flexibility and urged world countries to stop the double-standards policy over Gaza and Lebanon, according to Reuters.

- Hezbollah political official Qmati said Hezbollah is now being jointly led internally and picking a new Secretary-General will take some time, while he responded that Israel is not allowing a search to progress when asked about the fate of Hezbollah’s senior official Hashem Safieddine.

- Iranian security officials said Quds Force commander Esmail Qaani, who travelled to Lebanon, has not been heard from since Israeli strikes on Beirut last week, according to Reuters.

- Iran’s Oil Minister said he was not worried about the crisis amid reports of Israeli threats to strike Iran’s oil facilities, according to Reuters.

- Iran’s Mehr news agency cited an official who stated all flights were cancelled in Iran’s airports from Sunday at 21:00 (18:30BST/13:30EDT) to Monday at 06:00 (03:30BST/22:30EDT). However, it was later reported that all flight restrictions were lifted after ensuring favourable and safe conditions.

- Syria confronted hostile targets in the central region, according to state TV.

- US Defense Secretary Austin spoke with Israel's Defence Minister Gallant on Sunday to discuss Iran's destabilising actions in the Middle East and the current situation with Lebanon and Gaza, while they reiterated commitment to deterring Iran and Iranian-backed partners and proxies from taking advantage of the situation, according to the Pentagon.

- US Secretary of Defense Austin will host Israeli Defence Minister Gallant at the Pentagon on October 9th to discuss the ongoing Middle East security developments.

- US State Department commented regarding the latest Israeli bombing of Lebanon in which it stated that military pressure at times can enable diplomacy but could also lead to miscalculation and that Israel has a right to pursue extremist targets but civilian infrastructure should not be targeted. Furthermore, it stated that the US is continuing discussions with Israel and that the US goal is to reach a ceasefire to provide space for diplomacy, according to Reuters.

OTHER

- Ukraine’s air forces said on Sunday morning that Russia launched 87 drones and 3 missiles at Ukraine.

- Russia took control of the settlement of Zhelanne Druhe in Ukraine, according to IFX.

- Netherlands’s Defence Minister pledged EUR 400mln for a drone action plan with Ukraine.

- Chinese hackers reportedly breached US court wiretap systems, according to WSJ.

- Philippine President Marcos said the Philippines and South Korea elevated relations to strategic partnership and he exchanged views with South Korea's President on regional and international issues including the South China Sea and the Korean Peninsula. Furthermore, South Korean President Yoon said South Korea concurred with the Philippines a strategic partnership on the security front and will actively take part in Philippine military modernisation.

EU/UK

NOTABLE HEADLINES

- UK Chancellor Reeves seeks to reassure investors that guardrails will be placed around extra borrowing for investment and confirmed she was looking to revise her fiscal debt rule to take account of the benefits of investment and not just the costs, according to FT. It was also reported that Chancellor Reeves is to spare private equity bosses from the top 45p tax rate in the upcoming Budget as she looks for a compromise agreement to close tax loopholes that won't drive investors out of Britain.

- UK PM Starmer's Chief of Staff Sue Gray resigned on Sunday citing concerns about increasing news reports regarding her salary and role risk becoming a distraction to the government, according to AP.

- UK ministers were warned that power market reforms pose a danger to the industry and investment with trade groups warning proposals for regional pricing could risk deindustrialisation and higher costs, according to FT.

- UK's job market continued to show more cooling in September as a survey by REC and KPMG showed growth in starting pay for people hired in permanent roles was at the slowest since February 2021.

- ECB's Villeroy said the ECB will quite probably cut rates in October due to the rising risk of inflation undershooting the 2% target, according to a La Repubblica interview.