The European Central Bank may have reached a point of hesitancy in its fight against inflation, but real rates suggest that it won’t be able to put a full stop to its tightening just yet.

At the heart of the ECB’s efforts will be how much of a restraint its policy rate poses on the economy, with inflation-adjusted rates set by the markets providing the most direct read-out.

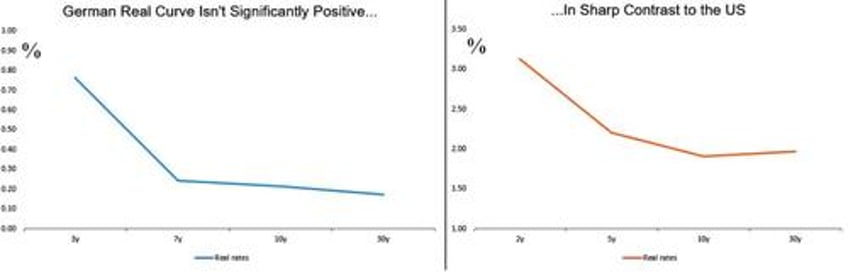

For instance, inflation-adjusted rates in Germany are only mildly positive as you go further out the curve, in sharp contrast to the US, where the rates are significantly positive.

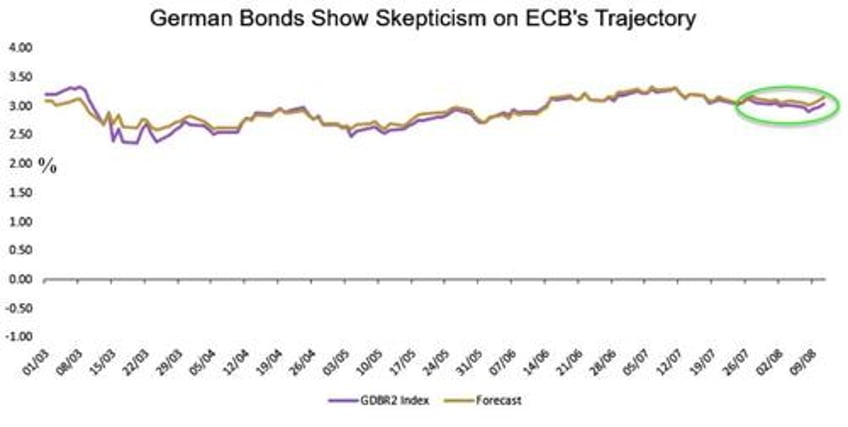

Germany’s two-year bonds are now trading at a premium to where they are indicated on my model, which reflects skepticism that the ECB will go the distance to quell inflation.

However, against a backdrop where core inflation is still holding above 5%, the ECB will find that terminating its hiking cycle when its policy rate is at 3.75% is predicated more on a prayer than on arithmetic.

Later this week we will know how inflation in the euro zone evolved in August. Economists forecast that core inflation slowed to 5.3% from 5.5%, though even an outcome as estimated won’t be enough to offer the ECB much comfort.

Which is why it wasn’t surprising that Governing Council member Robert Holzmann warned this week:

“We aren’t yet in the clear when it comes to inflation. If there aren’t any big surprises, I see a case for pushing on with rate increases without a pause.”

Should data on Thursday show that inflation is here to stay, real rates and German front-end bond yields may both tick higher.