Markets are unprepared for price growth that is becoming entrenched.

But even though the risk-reward in shorting Treasuries or buying gold or Bitcoin is diminishing, we can instead pinpoint the assets that have the most potential to catch up to persistent inflation: the clothing and food equity sectors, TIPS and commodities.

At the other end of the scale, tech, retail and construction look the most overextended in an inflationary backdrop.

An investor who has spent the last five years marooned on a desert island would find the price action in current markets quite disorientating. After a several days of rising tensions in the Middle East, Treasury yields are higher, not lower. This is a potent sign the wind has changed, and we are firmly stuck in an inflationary regime.

Wars are inflationary as they typically lead to an increase in unfunded government spending, while also disrupting supply. In the low-and-stable price-growth regime of yesteryear, the longer-term inflationary implications of conflict would be overwhelmed in the shorter term by the typical haven demand for USTs.

But the market is taking no chances. Inflation risks are heightened, and event risk is increasingly being looked at through an inflation lens. Any aspirations that price growth in the US was swiftly going back toward 2% have been dispelled as CPI repeatedly came in above estimates.

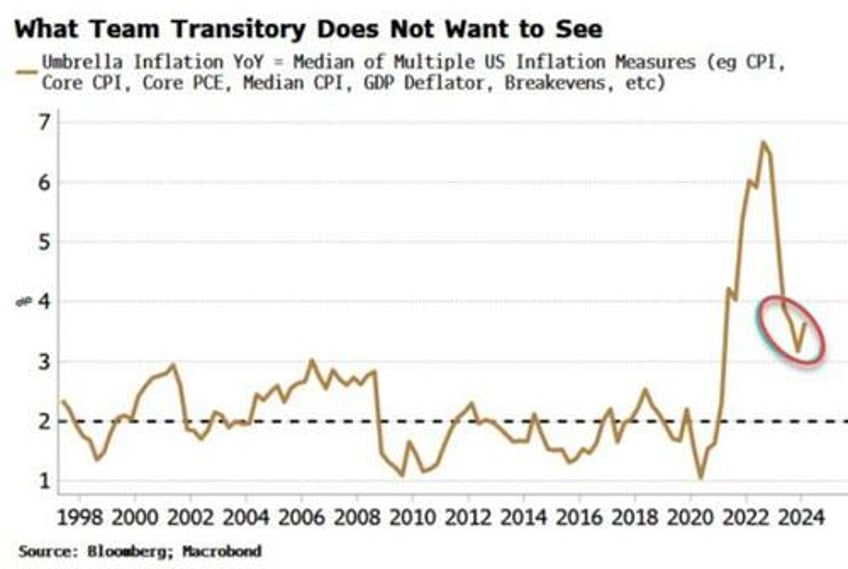

Indeed, inflation measures across the board are rising. This is not in Team Transitory’s playbook.

US yields have started to move higher, hitting their loftiest level since November after Monday’s strong retail sales report. Bitcoin and gold have been reaching new all-time peaks, while silver is beginning to rise in the head-spinning way only that market knows how to do.

While there may still be further juice from shorting Treasuries or buying gold or silver, the gains are likely to come less easily and with more volatility. By looking at previous inflation regimes and comparing how assets fared through them with their recent performance, we can identify those that may be lagging the inflationary cycle and thus have more catch-up potential.

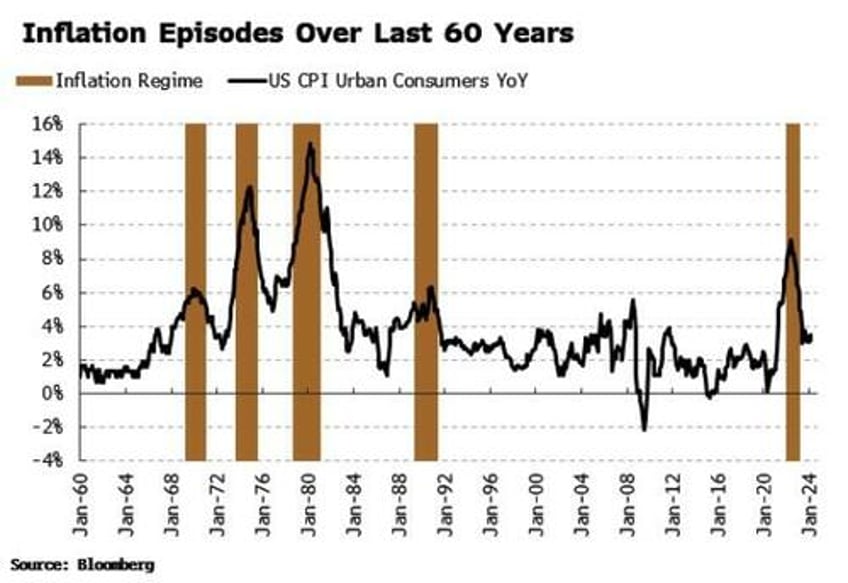

First, we need to put our finger on what we mean by an inflationary regime.

Qualitatively speaking, it is when inflation is significantly above trend on a persistent basis.

More concretely, we can define regimes in this way:

The 1-year moving average of year-on-year headline CPI > the 2-year moving average

1-year moving average of YoY CPI > 4.5%

Inflation volatility is above trend on a persistent basis

Excluding the most recent occurrence which ended in February last year, this gives us four inflation regimes: three in the Great Inflation of the 1970s, and one in the late 1980s, an inflation aftershock at the beginning of the Greenspan era at the Federal Reserve.

The latest instance ended as the shorter-term moving average of CPI went back below its longer-term counterpart. But as the 1970s show, during an inflationary backdrop multiple episodes of elevated inflation can occur close together. There is a good chance the US will soon enter another such episode soon, as leading indicators continue to point ever more convincingly in that direction.

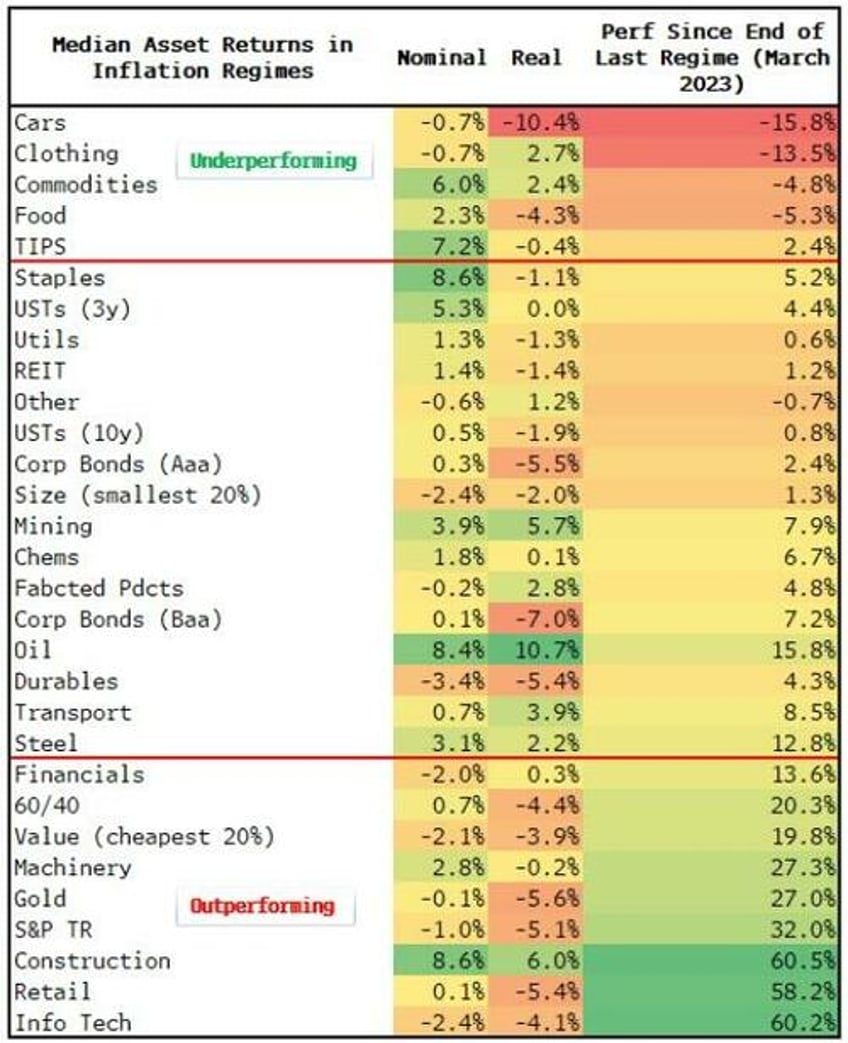

Which assets stand out as potentially being most behind the inflation curve? The table below shows various equity sectors, bonds, corporate bonds, commodities, etc. ordered in terms of assets whose nominal return since the end of the last inflation regime is most below its median nominal return through the previous five inflation episodes:

Top of the list is the autos, textiles and clothing, and food equity sectors, as well as commodities and TIPS. Those assets tend to perform relatively well through inflation regimes, but are lagging at the moment. You might want to take autos with a pinch of salt, however, as that sector has in recent years been — excuse the pun — driven by Tesla.

Those assets in the middle of the table — corporate bonds, small caps and USTs — are most in line with their median inflationary performance. Take them or leave them from an inflation-trade perspective.

At the bottom we have the tech, retail and construction sectors. The first two tend to perform quite poorly when inflation is elevated, yet both sectors have been on the rampage, returning ~60% since March 2023. All three sectors are liable for some giveback with inflation resurfacing, especially the high-duration retail and tech sectors.

Other underperformance candidates include financials, 60/40 portfolios and gold. The latter might be counter-intuitive, but gold is historically a poor (consumer) inflation hedge, and it’s not inconceivable its recent gains will soon peter out or reverse as central-bank demand becomes sated.

Chasing trades is rarely a good idea. The market can still move in your direction, but with the trend already underway, the risk-reward is less in your favor and painful drawdowns are more likely.

Yet as silver’s recent wild rallies show, inflation catch-up trades can move aggressively, especially in smaller markets or stocks unable to cope with the demand. With the inflation toothpaste out of the tube, it will not be last asset with catching up to do.