"If I am not for myself, who will be for me? If I am not for others, what am I? And if not now, when?"-Rabbi Hillel

Authored by GoldFix ZH Edit

Good Morning:

Everybody seems to be very good at self-promotion these days. It’s almost as if you don’t brag about yourself, how can you be any good? Being a good self-promoter is more important than what you are promoting. Sadly, this is the new reality

The problem with that is the self-professed sizzle gets more attention than the steak, and promoters eventually use your trust to sell you a bag of bullshit. But all personality cults and identitarian marketing lead to bullshit content eventually. Content matters when it's important.

Still, recommending yourself is all the rage these days. So be it.

Anyway…here is our own awkward attempt at self-promotion. The things we are most proud of these past two years.

(Markets and reports continue below the italics font)

Gold and Silver: A Point of Pride

Three years ago the precious metals community was hanging on the words of lame copy/paste comments, metal hucksters, salesmen posing as experts on ad-click sites, and MSM pundits deriding less heterodox economists and markets non-stop.

Most of those people (both neo-keyneisan ideologues, and shameless side-show shills) are so infatuated with their own midwit insights, they think money was invented by the USA. Now, however, we all have a better understanding of just how important these markets are for a continually functioning globe.

The MSM Neo-keyneisans treat Gold and Silver people like dummies who worship pet rocks. But you have to understand far more about markets and economics to truly understand Gold and Silver. You have to understand bonds, geopolitics, commodity supply/demand, and truly understand how money functions. But, and this just angers the clever (midwit) Neo-Ks, you don't have to understand all that to know what sound money looks like.

And those detractors will not ever “see the light.” That is the nature of incumbent ideology; especially when your pay depends on it.

Geopolitically and precious-metals wise, Some are finally catching up to what was said here the last two years or so. Here are some of those topics off the top of our heads:

Geopolitics/ Macro Economics:

Mercantilism, The increasing importance of Fiscal over monetary policy, Bond term structure, collapsing global complexity, monetary multipolarity, geopolitical bifurcation, Secular Stagflation, Anti-Goldilocks, and Cold war. Domestically, the rise of corporatism, the need to rebuild infrastructure, CHIPS as the new money, the 1970s analog, Volcker/Burns, Gold’s new role, and so on…

Specifically about Gold and Silver:

How Gold would be remonetized, how contango works, why backwardation happens, MMT, CBDC, BRICS, YCC, the m-Trade platform explanation, Silver’s shrinking supply and stealth demand, China’s role in popularizing Gold ownership, and of course translating the labyrinthine prose of the now stratospherically priced (but still cheaper than a Bloomberg Terminal) Zoltan Pozsar (who,we are told, along with two bullion banks, one reputable politician we'd vote for if we voted, two "reputable" MSM persons and several prominent, [as well as not prominent] analysts- read and use GoldFix)

Continuing; The rising importance of Silver globally, actually predicting Gold would be put on the blockchain by the BRICS based on recon into China/Russia Oil for Gold deals, The GoldenYuan, what Basel 3 actually means, the JPM hidden derivatives trick, how market structure works for/against investors, the comparisons with and advantages of Bitcoin (who do you think wrote most of the questions/content for the "Broke the internet" Saylor Bitcoin debate 2 years ago?) …. and so on.

Let's not forget about manipulation... lol- as victims, perpetrators, and experts used in civil court cases tied to the recent criminal ones.... anyone who says it doesn't exist (on any terms, be they individual, systemic, cultural or other) is a minion for the manipulators. That is in addition to the hundreds of current reports on precious metals we’ve shown and written up. Reports and explanation few else can or are willing to give. Search for yourself here

We’re pretty proud of that track record.

Thank You.

There are also "Thank-yous" in order. First to ZH for seeing fit to give us access to its audience amplifying our work and trying to add value to their readers. Second to the ZH community and GF subscribers who made it worth while. Finally, a special thank you to the original Founders who saw the value before anyone else. Thank you for making this possible and subscribing.

Vincent (VBL)

**Find attached today’s Gold and Silver excerpts as curated and presented for subscribers.**

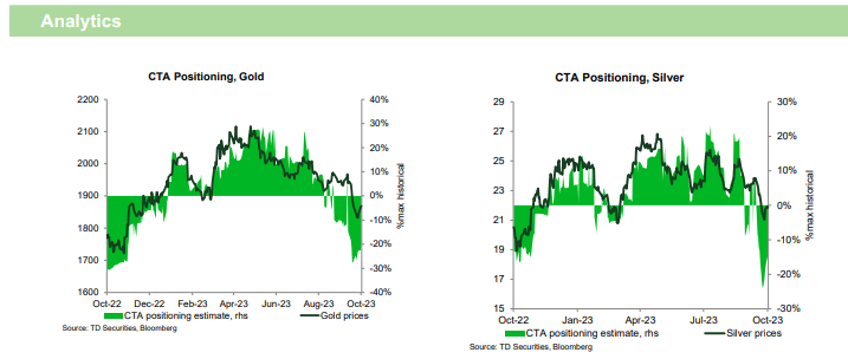

1- TD CTA Report

Shanghai traders are selling into the safe-haven bid in gold. As Chinese traders return to their seats following Golden Week holidays, our tracking of the largest participants in SHFE gold markets points to evidence that they have begun liquidating their bloated gold length, with 5.5k SHFE lots of net length sold over the last two trading sessions. Continues...

Comment: Note SHFE longs are selling while US CTAs are now covering. Whoever gets done first will dictate the next bias. But.. the longer this goes on, the higher we go. The US Government shutdown is in play now, even if the government isn't paying attention.

Recent ZeroHedge Posts:

Part 3: China Drops The Dollar, Goes Gold

Geopolitics: "Russia is going to Win the War"- John Mearsheimer

Uranium: Bank Makes Structural Bull Case

Bank Economist: Powell and Lagarde "Dithering" Lawyers, Not Economists.

How Gold and the Vix Became Broken

Podcast: The Battle for Gold-Pricing Power With Vince Lanci

Continues here ...

Free Posts To Your Mailbox