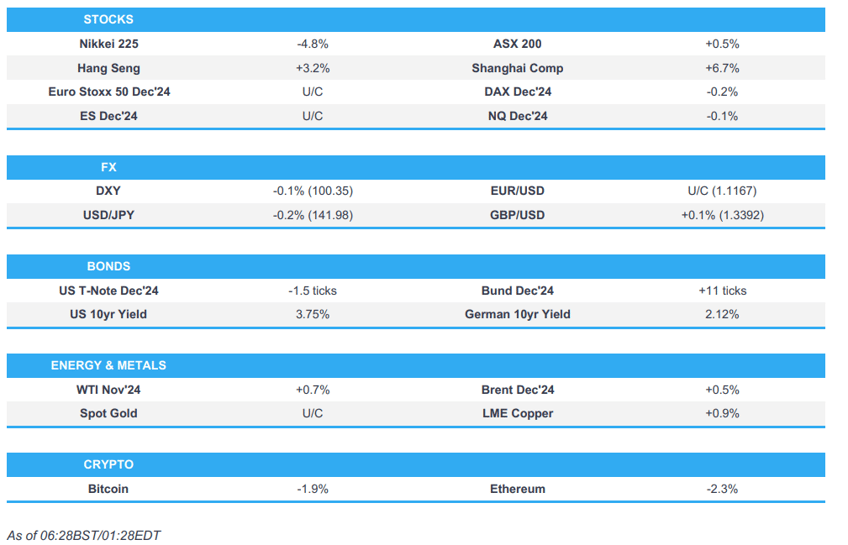

- APAC stocks were mixed heading into month-end amid the backdrop of recent geopolitical escalation and as participants digested a slew of data releases.

- Chinese PMI data was overall mixed but included a contraction in both official and Caixin Manufacturing PMIs.

- Reports suggest that Israeli forces are concentrated on the northern front and preparing for a ground invasion of Lebanon.

- European equity futures are indicative of a positive cash open with the Euro Stoxx 50 future +0.1% after the cash market closed higher by 0.7% on Friday.

- DXY is marginally softer, antipodeans lead across the majors, EUR/USD remains on a 1.11 handle, Cable is sub-1.34.

- Looking ahead, highlights include UK GDP, German Import Prices & Retail Sales, German State/Nationwide CPI, Italian CPI, Chicago PMI, Speakers including ECB President Lagarde, Fed Chair Powell, Bowman, BoE’s Greene.

SNAPSHOT

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks finished mixed on Friday following PCE data which printed either in-line or softer-than-expected with a slowdown seen in the PCE Y/Y figure but was accompanied by a slight acceleration in Core PCE Y/Y. In terms of the major indices, the Nasdaq 100 was the underperformer as the tech sector was pressured by losses in Nvidia (NVDA)(-2.1%) after China urged local companies to stay away from its AI chips, although sectors closed predominantly in the green with Energy leading the advances as the crude complex was underpinned by the geopolitical risk premium after Israel bombed Hezbollah's HQ in Beirut.

- SPX -0.13% at 5,738, NDX -0.53% at 20,009, DJIA +0.33% at 42,313, RUT +0.67% at 2,225.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Fed's Bowman (Voter) said on Friday that the data points to continued economic strength.

- Fed's Musalem (Non-voter) said on Friday that the Fed should lower interest rates 'gradually', while he added the US economy could react "very vigorously" to looser financial conditions, stoking demand and prolonging the Fed's mission to beat inflation back to 2%, according to FT.

APAC TRADE

EQUITIES

- APAC stocks were mixed heading into month-end amid the backdrop of recent geopolitical escalation and as participants digested a slew of data releases, as well as China's latest support efforts and Japan's leadership transition.

- ASX 200 was led by outperformance in the commodity-related sectors as oil and metal prices benefitted from geopolitics and China's policy announcements.

- Nikkei 225 suffered heavy losses amid a firmer JPY following Ishiba's victory against Abe protege Takaichi in the LDP leadership race, while the data releases from Japan were mixed with a steeper-than-expected drop in Industrial Production but Retail Sales topped forecasts.

- Hang Seng and Shanghai Comp rallied ahead of National Day Golden Week holiday closures despite mixed PMI data from China with advances led by strength in property developers after the PBoC instructed banks to lower interest rates on existing mortgages and lower downpayments, while some Chinese cities also eased home purchase restrictions. Furthermore, the mainland index is on course for its largest gain since 2015 and is set for a bull market after China's latest policy announcements and the PBoC's Monetary Policy Committee quarterly meeting where it pledged several supportive efforts.

- US equity futures (ES U/C) were contained and largely ignored the various moving parts driving the mixed price action in Asia.

- European equity futures are indicative of a positive cash open with the Euro Stoxx 50 future +0.1% after the cash market closed higher by 0.7% on Friday.

FX

- DXY traded sideways amid a lack of pertinent catalysts from the US to start the week and as participants awaited the upcoming Fed speakers due later including Fed Chair Powell and dissenter Bowman, while ISM data and the latest NFP jobs report are also scheduled this week.

- EUR/USD lacked direction ahead of several inflation data releases from across the bloc, while there was some political uncertainty following the Austrian elections after the far-right FPO was projected to have finished first with 29.1% of the votes.

- GBP/USD conformed to the uneventful picture across the FX space amid light relevant newsflow and as final UK GDP data for Q2 looms.

- USD/JPY struggled to find composure after slumping on Friday in the aftermath of the LDP leadership election result but with the recovery severely limited after mixed Japanese Industrial Production and Retail Sales data.

- Antipodeans saw early upward momentum on the back of China's latest policy support announcements and easing of home purchase restrictions, but then briefly faded some of the gains following the mixed Chinese PMI data which showed a contraction in factory activity.

FIXED INCOME

- 10yr UST futures traded lacklustre and took a breather after gaining on Friday alongside the ultimately mixed PCE data.

- Bund futures remained afloat but with the upside capped by resistance around the 135.00 level and as German inflation data looms.

- 10yr JGB futures languished near Friday's worst levels after slumping in reaction to the LDP leadership result with prices also not helped by weaker results at the latest 2yr JGB auction.

COMMODITIES

- Crude futures were mildly underpinned amid the heightened geopolitical tensions after Israel's strikes on Beirut which killed Hezbollah leader Nasrallah, while it also widened its assault on Iran-backed militants and struck targets in Yemen. However, the upside was capped after WTI stalled at resistance at the USD 69.00/bbl level and amid mixed Chinese PMI data including the contraction in both official and Caixin Manufacturing PMIs.

- BSEE estimated about 3% (prev. 12%) of oil production and 1% (prev. 6%) of natural gas production in the Gulf of Mexico was shut-in on Sunday. It was also reported that the death toll from Helene reached 89 and North Carolina’s Governor said that almost 464k customers in the state remain without power.

- Spot gold failed to sustain early gains with price action jittery but contained within Friday's parameters.

- Copper futures were underpinned and iron ore futures in both China and Singapore saw early double-digit gains after China's continued support efforts and the easing of homebuying restrictions by some key cities.

CRYPTO

- Bitcoin was gradually pressured overnight and retreated to beneath the USD 65,000 level.

NOTABLE ASIA-PAC HEADLINES

- PBoC’s Monetary Policy Committee held its third-quarter meeting and stated that China’s economy still faces challenges such as insufficient demand and weak social expectations, while it added that it must accurately and effectively implement prudent monetary policy, as well as pay more attention to counter-cyclical adjustments. PBoC said it must focus on expanding domestic demand, boosting confidence and promoting a sustained recovery in the economy. Furthermore, it is to maintain a reasonable abundance in liquidity, guide reasonable credit growth, support banks to supplement capital, support the reduction of interest rates on existing mortgages and promote the stable and healthy development of the real estate market, according to Reuters,

- PBoC said all commercial banks must in batches lower interest rates on all existing mortgages by October 31st to no less than 30bps below the PBoC’s Loan Prime Rate, while it said the adjusted mortgage rates in some Chinese cities including Beijing, Shanghai and Shenzhen must not be less than the floor of their existing rates. Furthermore, Guangzhou city announced to lift all restrictions on home purchases, while Shanghai and Shenzhen announced to ease restrictions on home purchases by non-local buyers and cut the minimum downpayment ratio to no less than 15%, according to Reuters.

- PBoC injected CNY 182bln via 7-day reverse repos on Sunday with the rate lowered to 1.50% (prev. 1.70%) and injected CNY 212.1bln via 7-day reverse repos on Monday with the rate kept at 1.50%.

- China's MOFCOM said it will further improve policy targetedness and effectiveness, as well as improve the consumption structure and focus on fostering new consumption business, while it will promote the steady growth of foreign trade business.

- China’s Finance Ministry said state-owned firms’ August YTD profits fell 2.1% Y/Y.

- Japan’s Finance Minister post is likely to go to former Chief Cabinet Secretary Kato and the Foreign Minister position is likely to go to former Defence Minister Iwaya, while the Defence Minister post in the new cabinet is likely to go to former Defence Minister General Nakatani, according to Japanese press. It was also reported that newly elected ruling LDP leader Ishiba is considering a plan to conduct a Lower House election on October 27th.

DATA RECAP

- Chinese NBS Manufacturing PMI (Sep) 49.8 vs. Exp. 49.5 (Prev. 49.1)

- Chinese NBS Non-Manufacturing PMI (Sep) 50.0 vs. Exp. 50.4 (Prev. 50.3)

- Chinese NBS Composite PMI (Sep) 50.4 (Prev. 50.1)

- Chinese Caixin Manufacturing PMI (Sep) 49.3 vs. Exp. 50.5 (Prev. 50.4)

- Chinese Caixin Services PMI (Sep) 50.3 vs. Exp. 51.6 (Prev. 51.6)

- Chinese Caixin Composite PMI (Sep) 50.3 (Prev. 51.2)

- Japanese Industrial Production MM (Aug P) -3.3% vs. Exp. -0.9% (Prev. 3.1%)

- Japanese Retail Sales YY (Aug) 2.8% vs. Exp. 2.3% (Prev. 2.6%, Rev. 2.7%)

- New Zealand ANZ Business Confidence (Sep) 60.9% (Prev. 50.6%)

- New Zealand ANZ Activity Outlook (Sep) 45.3% (Prev. 37.1%)

GEOPOLITICS

MIDDLE EAST

- Israel conducted strikes on Lebanon’s capital of Beirut on Friday and targeted the headquarters of Hezbollah which killed Hezbollah leader Nasrallah.

- Israeli military said it struck dozens of Hezbollah terror targets in Lebanon including launchers that were aimed at Israeli territory, while it also announced that it killed senior Hezbollah figure Nabil Kaouk and the commander of Hezbollah’s southern front Ali Karaki.

- Israeli Walla website reports that Israeli forces are concentrated on the northern front and preparing for a ground invasion of Lebanon.

- Israeli military said sirens sounded in an area of Jerusalem following a launch from Lebanon towards Israeli territory on Saturday and reports noted that Hezbollah launched a new rocket attack on Israel after announcing the death of its leader and said the group is to continue its battle against Israel.

- Israeli military announced sirens sounded after a missile was fired from Yemen which was intercepted and Yemen’s Houthis said they fired a ballistic missile at Israel’s Ben Gurion Airport upon Israeli PM Netanyahu’s arrival, while it was also reported that the Israeli military conducted strikes on Houthi targets in Yemen on Sunday including a power plant and sea import used to import oil.

- Israeli army said it bombed dozens of rocket launchers and Hezbollah weapons storage buildings in eastern Bekaa, while the Popular Front for the Liberation of Palestine said three of its leaders were killed in an Israeli strike on Beirut.

- Israeli PM Netanyahu said on Saturday that Hezbollah’s Nasrallah was the main engine of Iran’s axis of evil and Nasrallah’s elimination was a necessary step towards changing the balance of power in the Middle East, while he added that their work is not done and there are challenging days ahead.

- Israel’s Defence Minister was reported to be holding talks on the expansion of IDF activities in the northern arena.

- Israel warned Lebanese air control that it would use force if an Iranian plane landed at Beirut Airport, while the Lebanese Transport Ministry asked the Iranian plane to stay away from Lebanese airspace and the plane obliged.

- Lebanon’s caretaker PM said that they have no option but the diplomatic option, while the Lebanese Information Minister said following a cabinet meeting that diplomatic efforts for a ceasefire are continuing. It was also reported that the head of the Lebanese government crisis cell said around 1mln Lebanese people have been displaced by Israel attacks.

- Lebanon’s top Christian cleric said Lebanon’s patriarch calls for diplomacy because war means all sides lose, while the top Christian cleric added that Nasrallah’s killing opened a wound in the hearts of the Lebanese and that the international community must work to stop the cycle of war, killing and destruction.

- Iran’s Supreme Leader Khamenei announced five days of mourning over the death of Hezbollah leader Nasrallah and said that Nasrallah’s blood will not go unavenged.

- Iran's President Pezeshkian said Lebanese fighters should not be left alone so that Israel does not attack countries of the axis of resistance one after the other.

- Iran’s Foreign Minister Araqchi said the killing of the IRGC deputy commander Nilforoushan in Lebanon will not go unanswered, according to a statement.

- Iran called for a UN Security Council meeting on Israel’s actions in Lebanon and across the region, while it warned against any attack on its diplomatic premises and representatives. Furthermore, it was stated that Iran will not hesitate to exercise its inherent rights under international law to take every measure in the defence of its vital national and security interests, according to Iran’s UN mission.

- Iran’s parliament speaker Qalibaf said the resistance will continue confronting Israel with the help of Iran, according to state media.

- US President Biden said it is time for a ceasefire now and replied that they are responding when asked if the US would respond to missile attacks on US warships in the Red Sea. It was also reported that President Biden is reviewing the status of the US military force posture in the region and directed continued diplomatic efforts to coordinate with allies and partners and de-escalate the ongoing conflicts.

- US Defense Secretary Austin spoke with Israeli Defence Minister Gallant and expressed support for Israel’s right to defend itself against Iranian-backed terrorist groups, while Austin stressed the US is determined to prevent Iran and Iranian-backed partners and proxies from exploiting the situation or expanding conflict.

- US is to reinforce defensive air support capabilities in the coming days in the Middle East and Defense Secretary Austin has put other US forces on a heightened readiness to deploy. US also ordered the departure of certain US Embassy direct hire employees and their eligible family members from Lebanon.

- US Central Command said it conducted targeted strikes in Syria which killed 37 terrorist operatives including senior leaders of ISIS and Hurras Al-Din.

- China’s Foreign Ministry said China opposes any violation of Lebanon’s sovereignty and urges the parties concerned, especially Israel, to immediately cool the situation.

OTHER

- UAE condemned a 'heinous attack' on UAE's mission in Sudan's Khartoum and said the attack was carried out by a Sudanese military aircraft.

- Russian forces took control over the settlement of Makiivka in eastern Ukraine’s Luhansk region, according to IFX.

- Russia’s Kremlin said amendments to Russia’s nuclear doctrine have been prepared and will now be formalised, according to RIA.

- Russian PM Mishustin will visit Iran on Monday and will meet with the Iranian President.

- China’s Foreign Minister Wang told the UN General Assembly that China is not throwing oil on fire or exploiting the situation for selfish gain by promoting Ukraine peace talks, while he also stated that the complete reunification of China will be achieved and that Taiwan will eventually return to the embrace of the motherland.

- North Korea said the US’s USD 8bln military aid to Ukraine is an incredible mistake, while it added that Ukrainian President Zelensky who called Pyongyang an accomplice in the Ukraine war is waging reckless political provocation, according to KCNA.

- South Korea’s Foreign Minister Cho said Russia is engaging in illegal arms trade with North Korea.

EU/UK

NOTABLE HEADLINES

- Former UK PM Sunak urged for the Tories to unite behind who succeeds him as party leader and warned that the party risks marginalisation if divisions persist, according to FT.

- Far-right Freedom Party of Austria was projected to be first in the Austrian parliamentary election with 29.3%, while the ruling conservatives are seen at 25.3% and social democrats at 20%. Furthermore, Austria’s Chancellor and conservative leader Nehammer conceded that his party failed to catch up with the far-right freedom party in the election and said talks between the parties are important once the final election result is in, while the far-right party leader Kickl said they are ready to lead a government.

- ECB's Stournaras said that based on the most recent data for inflation and the real economy, he finds it reasonable to proceed with a 25bps cut in October, or risk inflation falling below target, according to an FT interview.