Last week, analysts from Piper Sandler and Barclays downgraded Apple, citing sagging iPhone demand in China. Furthermore, a report from Jefferies released on Sunday sheds even more light on sliding iPhone demand in the world's second-largest economy.

Jeffries analyst Edison Lee told clients that iPhone sales in China plunged 30% in the first week of 2024 compared to the same week last year. The US tech giant faces rising competitive pressures from domestic brands, such as Huawei, spurred by "patriotic fervor" amid the tech war with the US.

"Our industry checks show Android+HW managed to stay flat YoY recently against a high base, while iPhone is down YoY > 30%," Lee said.

While full-year iPhone sales for 2023 were down 3%, Huawei and other domestic brands were flat but increased market share. Market share for Apple fell .4%.

"We est iPhone in China exited 2023 at ~3% decline, and ~0.4ppt lower market share. HW [Huawei] gained the most share in 2023, followed by "others" and Xiaomi, but we est HW's shipment at ~35m is still below cons of 40m, likely due to supply constraint," the analyst said.

Lee noted that Apple's downturn is primarily due to the competitive pressures from Huawei and other local brands. This was highlighted by the launch of Huawei's Mate 60 series in August last year, which coincided near with the release of the iPhone 15.

We suspect the made-in-China Mate 60 Pro, which defied Western sanctions and has a top-of-the-line processor, has spurred patriotic fervor among Mainland consumers for domestic handsets.

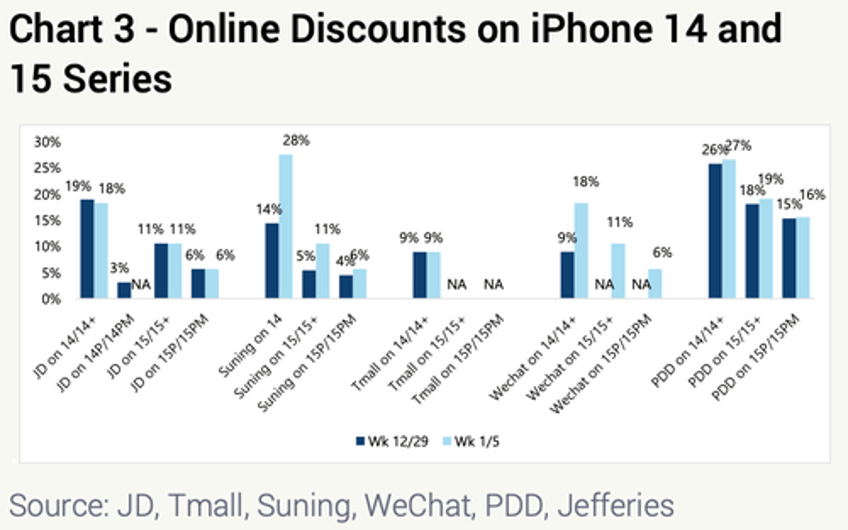

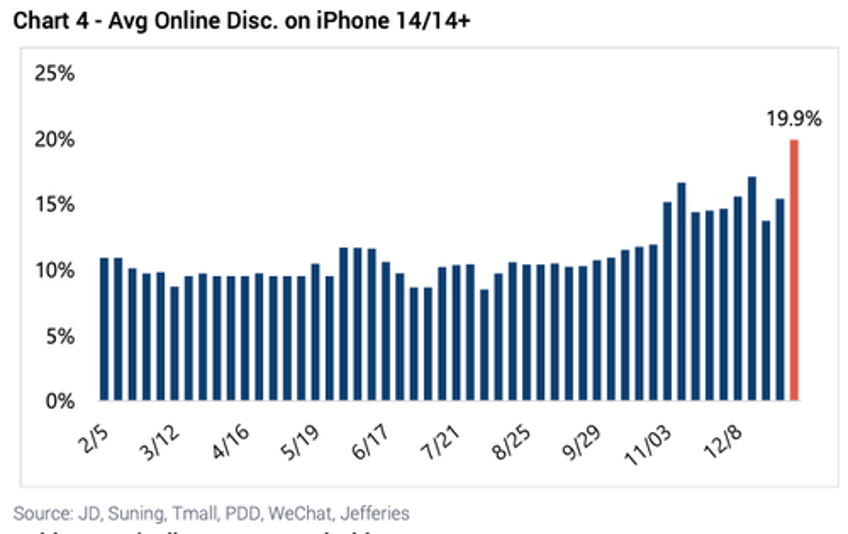

According to the Jefferies analyst, iPhone sales declined even with Chinese shopping platforms, such as Suning and WeChat, offering sizeable discounts.

iPhone discounts have soared.

Perhaps a slump in iPhone sales indicates the chip war is now patriotic.

This will be very telling when the years-long handset downturn reverses, which research firm IDC predicts later this year.