By Russell Clark, author of Capital Flows and Asset Markets

I only read the Communist Manifesto last year. I was trying to understand how the Chinese planners think about economics, and I found it extremely illuminating. I had often heard people talking about Marx, without ever being interested enough to read it myself. All I knew was he was keen on collective ownership, which as everyone knows, doesn’t work. However, my favorite historian, Eric Hobsbawm, was socialist is his thinking and made the entirely valid point is that you cannot understand the 20th century without understanding Socialism. He also points out that many of things we take for granted, such as equal rights for all people regardless of gender, race or religion as well as anti-imperialism were all originally ideas originally championed by Socialism.

When I was very young, everything was about the Cold War and the Soviet Union. Every movie, (War Games, Red Dawn, Rocky 4, Rambo III etc) and every Olympics (1980 Western boycott of Moscow games, and USSR boycott of the 1984 LA Games) was an extension of the Cold War. Then suddenly in 1989, the Berlin Wall fell, and in a few short years Communism had disappeared. No one really studied Socialism or Marxism anymore, as its theories had been thoroughly discredited. My brother had also warned me off reading the Communist Manifesto with this warning, “Marx’s historical analysis is so perceptive, so you think his policy prescriptions must be right, but they were of course totally wrong.” In politics, as in finance, great historical analysis does not guarantee good future results.

Why did Socialism come to dominate the 20th century? Before the Great Depression, Marx argued that capitalism would destroy itself. His observation was that the pursuit of profits would drive capitalists to grow production, while looking to keep costs (and most importantly wages) as low as possible. Rising production, but falling demand from falling wages was unsustainable. At some point, this would lead to depression, as you would see prices fall across the board.

He also argued that greater and greater consolidation of capital, would yield higher and higher returns. This would lead to concentration of wealth in fewer and fewer hands. Politically, this could only continue as long as there was a bourgeoisie (I never really knew what this was, except as an insult. Apparently it means, someone that thinks they are wealthy and in control, but actually just doing the bidding of truly wealthy, a middle class apparatchik if you like). I was surprised to find that bourgeoisie is the source of the term “Boujee” - but makes sense. One important thing I took from the Communist Manifesto was that Marx assumes that at some point, the middle class (the bourgeoisie) also rise up against the capitalist class, particularly when they feel they are missing out on the gains.

Marx assumed the capitalist class was so powerful, only revolution could bring about change. Here Marx was very wrong. It is in fact possible for democratically elected governments to act against, or co-opt , the capitalist interests and enact pro-labour change. This is something that FDR did very successfully. FDR managed to get corporates to agree to raising prices and wages, in return for government protection from other producers threatening to undercut profits. In effect, FDR offered corporate America protection from competition in return for raising prices and wages. What FDR began was greatly expanded in the Post World War II period. With the threat of socialism everywhere, the US government also greatly increase spending on social services, and had aggressive taxation to reduce income inequality. Asset owners lost relatively speaking, while wage earners won handsomely. The leading industry of the time, the auto sector, was heavily unionised, and government owned business such as the US Postal Service offered a clear path to the middle class. These policies which were widely copied in the west, proved that socialism was not the only answer, and western liberalism could indeed prevail.

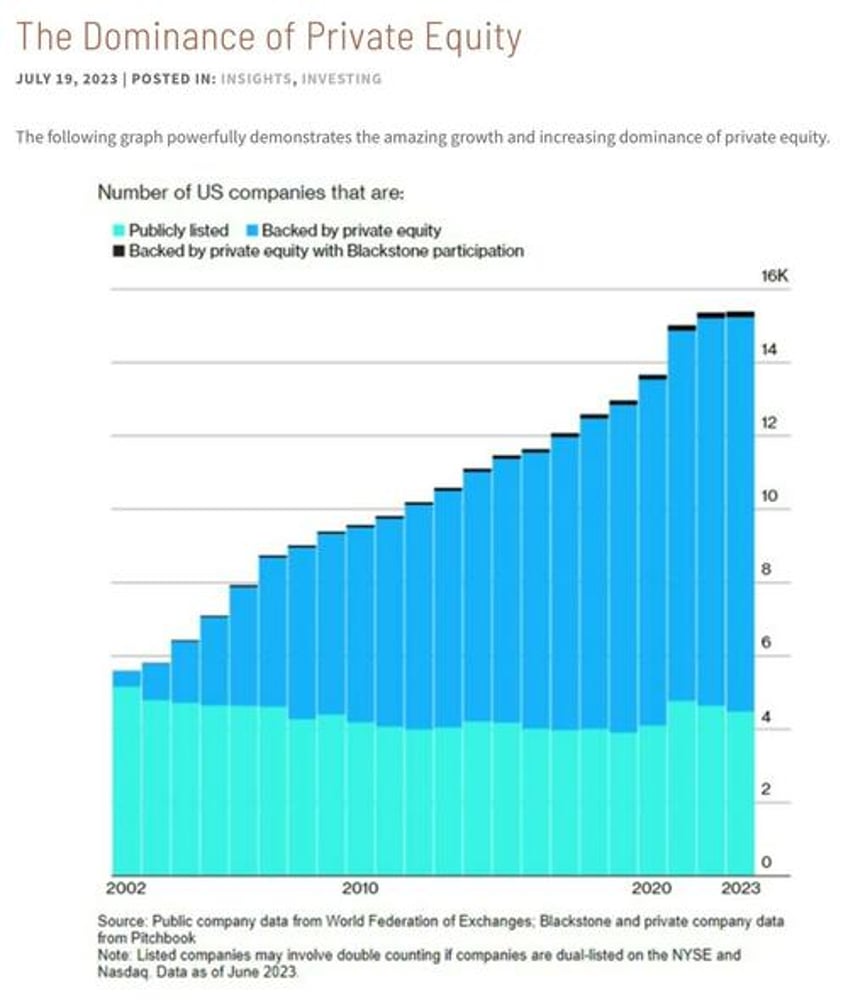

If Marx was alive today, what would he think of this world? Many of the policies that the west adopted to counteract the rise of Socialism have been rolled back. Effective tax rates faced by American billionaires are lower than wage earners, and with work arounds on inheritance tax, capital accumulation has probably accelerated. Capital concentration has definitely increased. Not only do we have a record share of the S&P 500 concentrated into relatively few companies, as a share of capex and R&D they are also dominating. Private equity control and coordinate a vast number of industries.

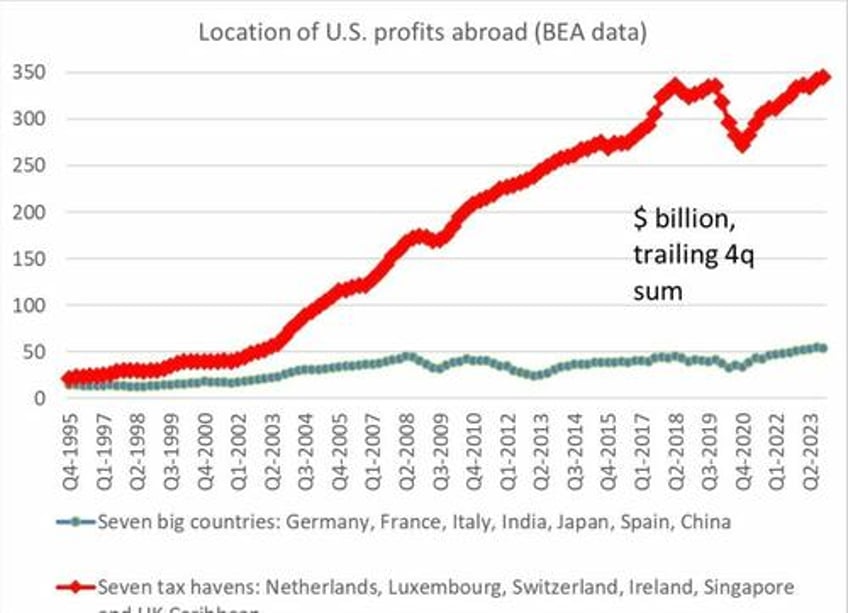

Marx observation was that capitalism’s constant search to lower costs would destroy wages and hence demand at some point. If I look at modern capitalism (ie 2024), my observation is that corporates go to extraordinary efforts to shield income from tax (another cost). Converting income stream to capital gains is the underlying organising principal of private equity, and much of large cap share buybacks. Hence, the risk to capitalism is not collapsing wages and a deflationary spiral, but the collapse in government credit worthiness driven by capitalism’s urge to minimise taxes. As Brad Setser recently posted, US corporates have been shifting an ever large amount of profits to tax havens.

The seven big countries represent over 3 billion people, and a USD 30 trillion GDP than the US. The seven tax havens have a combined population of less than 50 million, and a GDP of maybe USD 3 or 4 trillion.

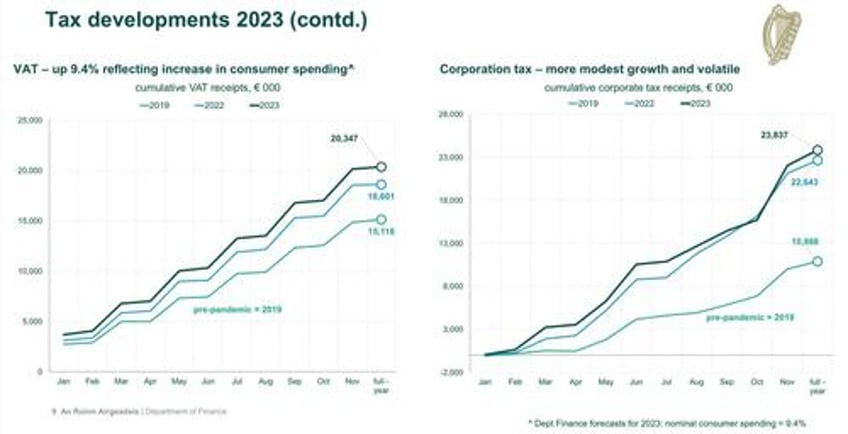

Collapsing employment and wages of the 1930s, eventually gave way to the rise of socialism to counteract the political power of corporates. As governments are committed to full employment and rising wages (or more correctly austerity is a certain vote loser), and corporates are determined to maintain a system that shields income from tax, a political crisis seems inevitable. However, the problem is that there is a huge disincentive to cooperate from the winners of this system. The EU closed down the Apple tax avoidance scheme, only for Ireland to open up a new more legally robust system. Ireland has seen tax revenue surge. Corporate tax take has double in Ireland since 2019.

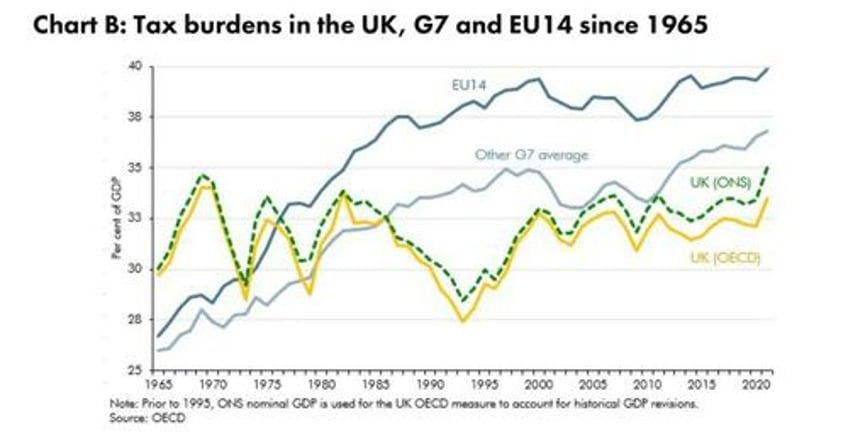

In non-tax haven nations, this is leading to the extraordinary situation that tax take is high, while government debt increases. The UK tax take is back at levels seen in 1970s.

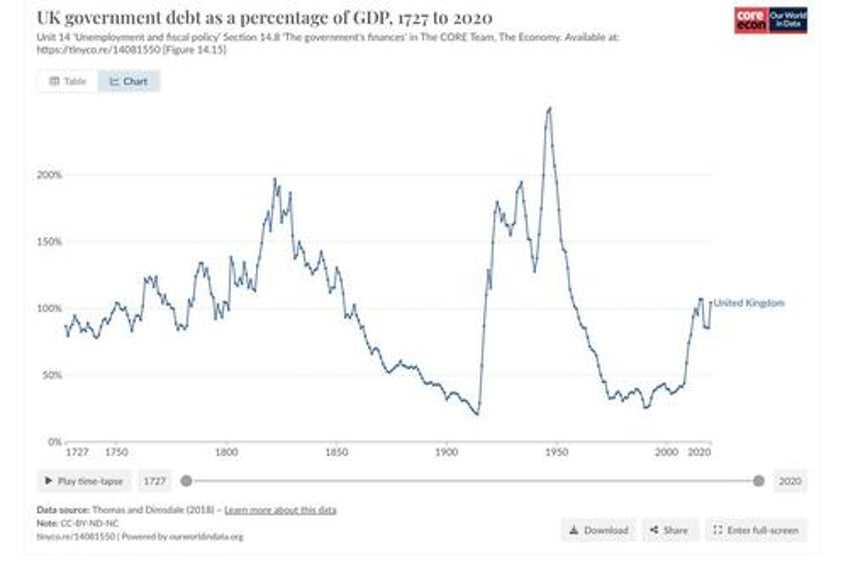

Last time UK take rates were this high in the 1960s and 70s, debt to GDP was rapidly declining. Despite this high level of taxation, debt to GDP is not falling today.

The one nation that could probably change this dynamic is the US. US corporates are the overwhelming beneficiary of this tax avoidance. The principal reason (and greatly simplified) is that the US operates on a worldwide taxation system. If US corporates pay tax overseas, then it would receive a rebate from the US government. This encourages US politicians to turn a blind eye to US corporate tax practices in relation to overseas earnings. That is US tax policy, makes sense for US politicians and US corporates, but not for any one else. In contrast, inversions, where a US company relocated to the UK to reduce tax, was quickly stopped by the Obama administration.

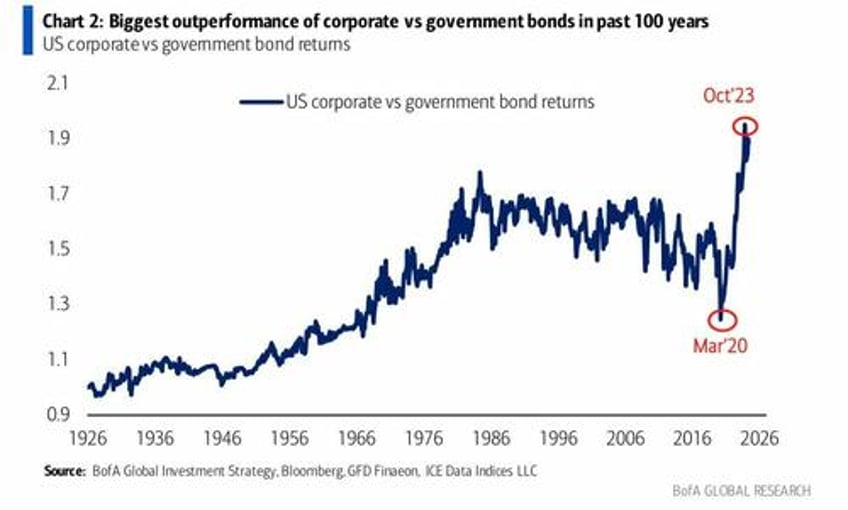

The problem is that the current situation is so good for large corporates, and government finances are so parlous, and voters are so disenchanted, it’s hard to see what governments could offer to bring corporates to the table. The markets pretty much see it the same way, with corporate debt outperforming sovereign debt, reversing the trend seen since the 1980s. Credit markets prefer corporate debt to sovereign debt since 2020.

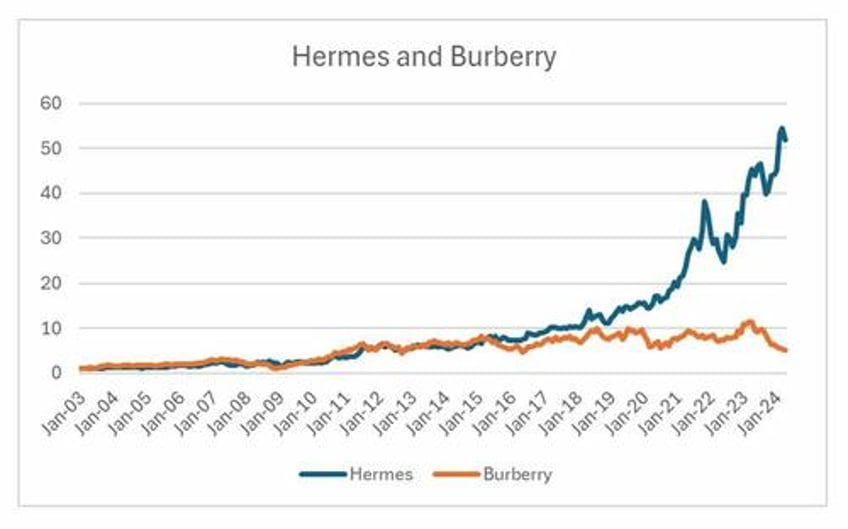

Coming back to Marx, he predicted crisis in the capitalist system when the middle classes, the bourgeoisie, started to realise that the system was not working for them either. Curiously, the market has been pointing out that middle class demand is collapsing, while very high end demand is robust. Hermes and Burberry use to have very similar performance, but from 2018 onwards, they may as well live in alternative universes. Similar breakdown has been seen in almost all luxury names - with middle classes, or lower upper class brands being destroyed, while ultra high net worth names holding up.

There is a large number of Americans who associate a soaring stock market with all that is good and great about America. For true patriots, and true believers in the American dream, a bear market would be better confirmation of the inherent goodness of the USA. A bear market would show that the checks and balances that the founders of America were so careful to add to the constitution to ensure power never became too concentrated were working as they should. A soaring Nasdaq is a sign of US failure, not success. US corporate power needs to be curbed. If it is not curbed, either a financial or currency crisis looms. This is what GLD/TLT tells you.

Crisis is coming, and while it won’t be exactly like the wave of socialism seen post World War II, capitalism will still be the bad guy. Just at the failure of socialism turned former heroes to villains (Marx, Mao, Stalin were all lauded at one point), it is easy to see current heroes turning to villains (Warren Buffett freely admits to the tax system being broken, and has probably used it “better” than anyone else). A government debt crisis would be incredibly bad outcome. The question is whether we can find a FDR first, before a more unpalatable leader turns up. Perhaps its too late already.